I'd say risk curators like @gauntlet_xyz can do more in the agents space, specifically by providing quantitative risk analysis on target products. This would allow @gizatechxyz to offer the optionality to parametrize users' agents with their preferred risk framework.

3/ What is the role of curators like Gauntlet in the AI yield process?

AI Agents rely on permissionless vaults to deploy capital. The more vaults they support, the more options they have. But that also introduces more risk, including liquidation, depeg, and smart contract exploits.

Curators manage risk, optimize liquidity, and design vaults for risk-adjusted yield. These vaults are accessible to any user or AI agent.

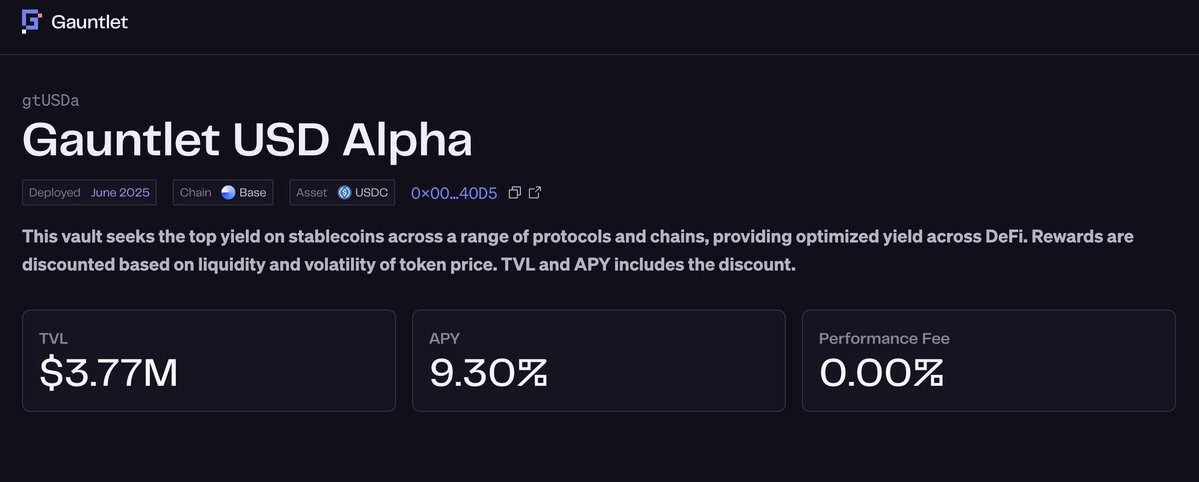

Gauntlet USD Alpha, our latest product, is well-suited for agents seeking robust cross-chain, risk-adjusted yield starting from Base USDC.

Here are 3 AI Agent protocols allocating to Gauntlet-curated vaults 👇

@tarunchitra

3.95K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.