xStocks: A more liquid and flexible tokenized US stock channel

Since the launch of the new xStocks section on Gate in early July, the first batch of 8 tokenized US stocks, including: COINX, NVDAX, CRCLX, AAPLX, METAX, HOODX, TSLAX, and GOOGLX, has accumulated a considerable trading volume in a short period, allowing us to easily invest in global leading companies using USDT.

Currently, xStocks supports both spot trading and 1-10x perpetual contracts, enabling market makers to hedge across markets and enhance their quoting willingness. Tokenized stocks naturally inherit the 24/7 trading mechanism of the crypto market, with a minimum trading unit as low as 0.01 shares, allowing more small orders to gather on the order book, thus maintaining relatively continuous liquidity even during after-hours trading, avoiding significant price gaps and sudden drops in depth.

According to the official announcement, all tokens are collateralized and held at a 1:1 ratio with the underlying stocks, and all are settled in USDT, reducing cross-currency arbitrage friction. As of July 8, the cumulative spot trading volume in the xStocks section has exceeded $200 million; according to data from Dune's on-chain dashboard on July 7, the total number of token transfer events on-chain (on-chain transfer count ≠ matched transaction count) was 17,013; this data is relatively suitable for measuring token activity.

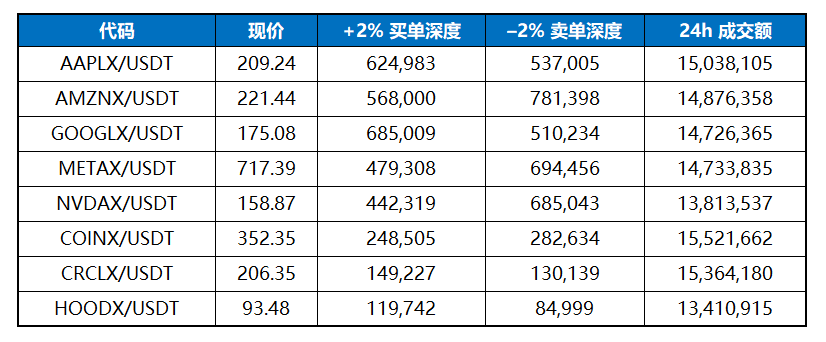

Based on the snapshot from CoinMarketCap on July 8, I compiled the order book depth and the trading volume (in USDT) for all 8 trading pairs in the xStocks section over the past 24 hours as follows:

Note: The snapshot only represents a single point in time. Since market makers typically refresh quotes around the pre-market and post-market hours of US stocks, the depth during the Asian time zone when US stocks are closed may be relatively thin, and slippage may increase. It is recommended to pay attention to the trend of ±1% depth changes; when the +1% depth continues to grow and exceeds 500,000 USDT, it indicates that liquidity is gradually improving.

🚩 Necessary risk warnings:

1. Due to market maker inventory and cross-time zone quoting, token prices may temporarily deviate from the underlying stocks; be aware of basis fluctuations and avoid high leverage overnight positions;

2. During US stock market closure periods (UTC +0 early morning hours), market maker inventory updates are slow, and depth may be slightly thinner than during US stock market opening times;

🚩 How to verify slippage / price difference yourself:

1. API order book, pull depth at 0.01% to 1% levels through the API interface to calculate impact costs.

2. Small test orders, observe the deviation between the actual transaction average price and mid price using the same amount of market orders at different times (before and after US stock market opening, weekends).

The above data indicates that the market depth and 24h trading volume of the first batch of tokenized US stocks in xStocks have already surpassed the early levels of most similar platforms. However, for large operations, it is still advisable to split orders or use limit orders and pay attention to the impact of US stock trading hours on order book thickness.

xStocks provides a new bridge for investors who wish to allocate global stocks within their crypto accounts while valuing liquidity; however, friends still need to fully understand the accompanying risks such as basis and leverage, reasonably control their positions, and avoid viewing it as a simple substitute for traditional stocks.

Show original

15.72K

48

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.