Don't worry, next week I'll share the July auctions for 1-year, 10-year, and 30-year U.S. Treasuries. Let's see if there's a significant increase in the issuance of U.S. Treasuries!

我跟肉桂平时沟通交流比较多,其实大家都非常知道对方在说啥。这次我觉得是头部形态除了前面说的利好出尽那些原因。还有一个非常核心的论点是美债流动性问题。大漂亮法案通过之后最重要的一个点就是提高了5万亿美债上限,按照之前每年增加2万多亿的速度看这些钱够花两年,债也会陆续发出来。

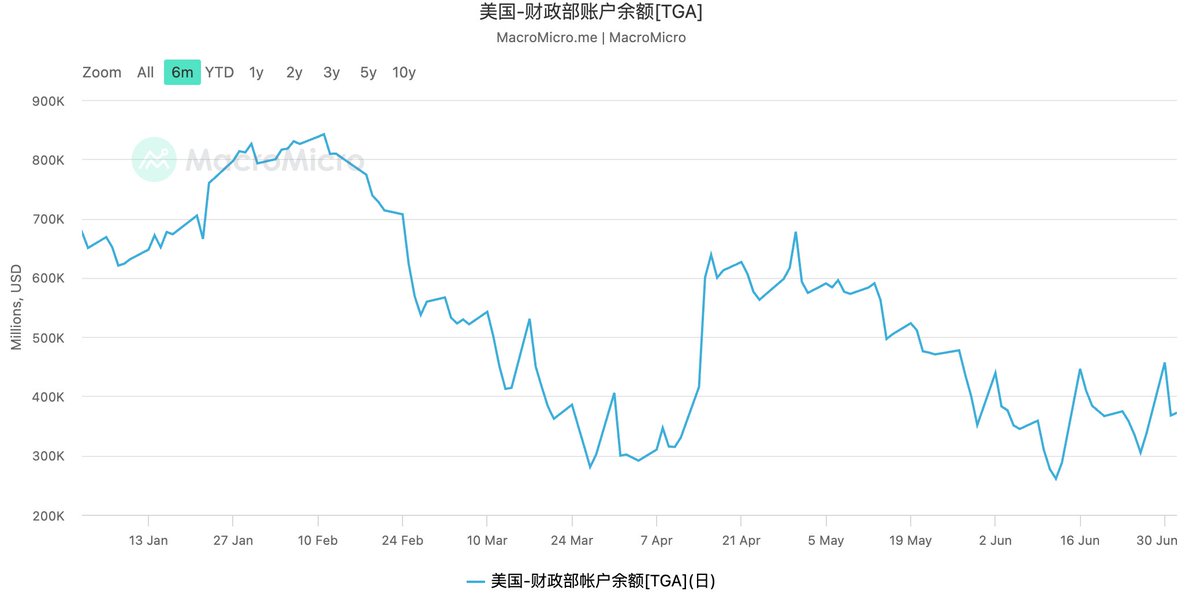

那么在TGA账户余额不断减少,美联储还没有放水的当下,新的美债一旦发行并推向市场必然会导致流动性匮乏,原有的市场蓄水池(币圈也是这个蓄水池的一部分)会被不停地抽水直到美联储降息放水。市场在这个间隔期就非常脆弱,很容易因为一些突发事件短期快速闪崩。

所以在价格相对比较高的位置,我觉得低倍做空更有性价比,等到市场风险彻底出清再低价反手多进来岂不美哉。

看看这TGA账户不断减少的余额,后续卖债回补是必然。天下水共一石,美债独占八斗,美股占一斗,币圈跟别的标的物共分一斗还尚且时不时被黑山老妖拿去吸血,所以说现在币圈哪有自己脱离基本面独涨的客观条件呢?

美债收益率随着大漂亮法案的推动也开始反弹,后续美债侵占流动性的信号非常明显了

近期市场需消化额外的 数千亿美元的短期票据,虽然景顺固定收益(Invesco Fixed Income)的北美投资级信贷主管Matt Brill认为市场上高达7万亿美元的货币市场基金正在提供支撑,但这7万亿里面有多少是币圈的钱,又有多少原本可能是准备买大饼的钱呢?如果这些钱被抽去买美债,币圈还有钱上涨吗?

9.6K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.