1/ Case Study: @dYdX Staking Programme

In 9 months, dYdX deployed 79M DYDX through a structured treasury programme.

➖ Secured the chain

➖ Coordinated 42 validators

➖ Generated 7-figure yield

➖ Demonstrated the Fat App Thesis

This is how it was built 👇

2/ Context

dYdX launched its own chain in 2023, committing to full-stack control.

In 2024, it needed a way to utilize the DAO treasury to secure the network, create sustainable on-chain yield while growing its ecosystem, and align long-term validator incentives.

That’s where the Treasury SubDAO, managed by kpk, came in.

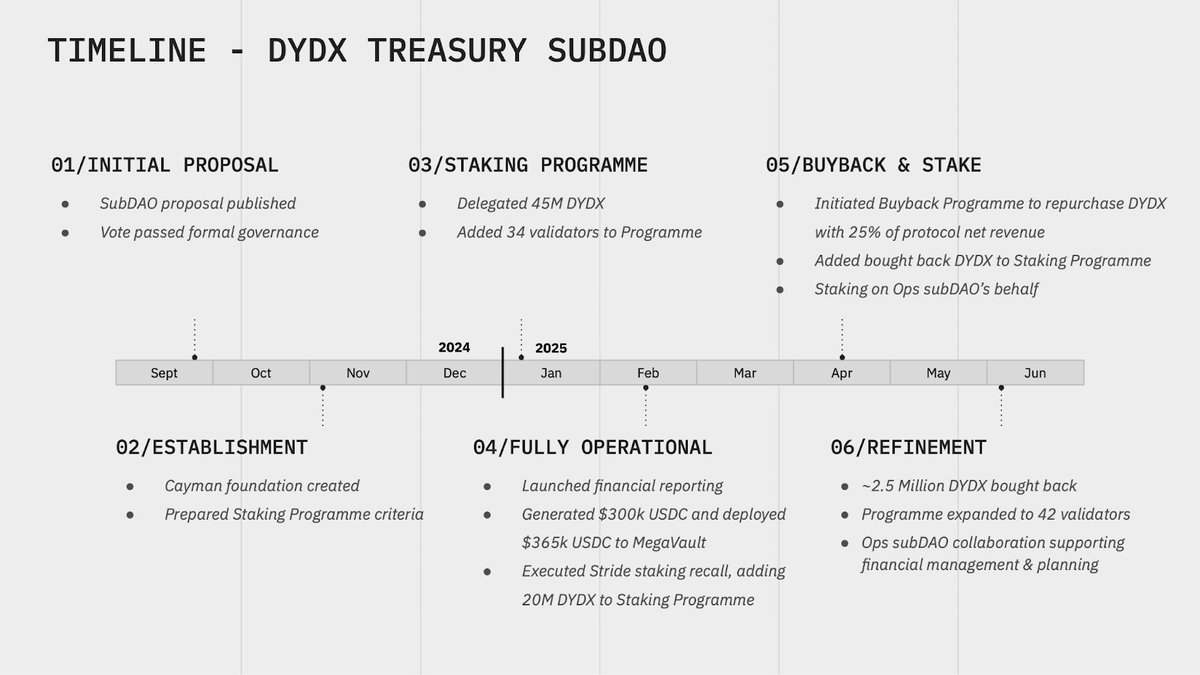

3/ Establishment

➖ Cayman Foundation created

➖ Validator criteria defined to align incentives

➖ Staking Programme launched

➖ 45M DYDX delegated to 34 validators

➖ ~$365K in revenue generated in the first month

4/ Expansion

➖ Recalled 20M DYDX from Stride to consolidate staking under Treasury SubDAO

➖ Validator set expanded to 42

➖ Redelegations optimized based on performance & feedback

➖ Enabled USDC yield deployment via MegaVault

5/ Value Accrual

➖ Launched a Buyback & Stake program

➖ 25% of net protocol revenue used to buy DYDX

➖ Staked repurchased tokens in the Staking Program

➖ Tightens token supply while boosting chain security

6/ The impact was clear: 2.5M DYDX was bought back on the open market (~$1.2M in value), helping drive staking participation from 29% to 36% of total supply between April and June.

By the end of May, ~270M DYDX was staked, alongside a noticeable improvement in validator activity and performance.

7/ On-the-ground impact

The feedback from validators like @CosmostationVD has been extremely positive.

The programme didn’t just deploy capital — it set standards, aligned incentives, and raised the bar for securing the dYdX Chain.

5.74K

63

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.