<CLOBs on Blobs 🦣 and Celestia’s Comeback>

In the second half of 2023, modular blockchains and rollups were at the center of crypto’s dominant narrative. However, as time passed, the narrative lost momentum due to a lack of users and decreasing transaction activity. Celestia’s blobspace also remained underutilized for a period. But things are changing again.

A new narrative, “CLOBs on Blobs,” is driving real demand for Celestia’s data availability (DA) layer—not just hype, but actual on-chain traffic. I sat down with Nick White from @celestia, to discuss their long-term vision, technical philosophy, and the structural changes behind this renewed momentum.

1. Celestia’s Core Principle: Verifiability

Throughout the interview, @nickwh8te emphasized that “the essence of blockchain is verifiability.” DA is not just about storing data—it's a foundational component that ensures blockchain security. Celestia was designed so that anyone can independently verify data, relying not on centralized structures like DACs (Data Availability Committees), but instead on Data Availability Sampling (DAS).

To clarify: DACs rely on a small group of servers to store off-chain data and sign off on its availability. In contrast, DAS allows data to be verified via random sampling, without requiring high bandwidth or powerful hardware. This concept was introduced in a 2018 paper co-authored by Celestia co-founder Mustafa Al-Bassam and Ethereum’s Vitalik Buterin—and Celestia is the first project to bring it to mainnet.

2. Rollups Aren’t Dead—Real Demand Is Emerging

Interest in rollups faded by late 2023. As blob usage on Celestia declined, many began to question whether the rollup thesis was over. Nick countered this sentiment by referencing the Gartner Hype Cycle: "Every technology goes through a phase of disillusionment." Celestia, he said, is now entering the early stage of actual adoption.

He pointed to a growing trend. Traditional financial institutions and crypto exchanges are expanding into on-chain trading. Robinhood launched tokenized stock trading on @arbitrum, Coinbase introduced its L2 chain Base, Kraken unveiled Ink, and Worldcoin launched World Chain—all of them rollup-based. As these platforms scale, demand for a robust DA layer like Celestia becomes increasingly critical.

Nick noted that rollups offer what general-purpose L1s cannot: low latency, customizable execution environments, and independent economic models. These advantages require strong DA infrastructure to maintain performance and trust—which is precisely where Celestia fits in.

Nick also shared a compelling vision for Celestia’s long-term revenue model. While it currently generates income through DA fees, he emphasized that future value will come from shared revenue with rollup execution layers. As native rollups on Celestia proliferate and build their own execution environments, a portion of the economic activity they generate could be shared with the DA layer itself—similar to how Solana captures value from its execution layer.

This approach positions Celestia not just as infrastructure, but as a platform that captures value across the entire rollup ecosystem. Nick highlighted this structural design as a key reason to be optimistic about Celestia’s long-term future—beyond short-term market cycles.

As a prime example, Nick mentioned Robinhood’s tokenized stock rollout as “just the beginning.” While Ethereum DA may be sufficient at first, growing user activity will eventually strain its capacity—opening the door for Celestia to become the go-to alternative. Several TradFi firms are exploring decentralized infrastructure for stocks, options, and derivatives, all of which demand low latency, high throughput, and verifiability. According to Nick, Celestia is best positioned to meet all three.

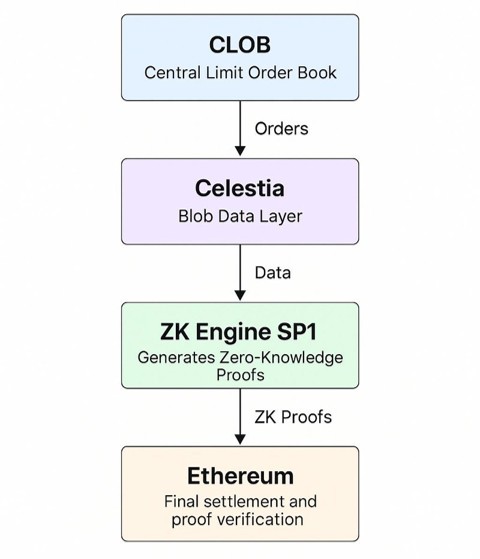

3. CLOB on Blobs: The Next Wave of Blob Demand

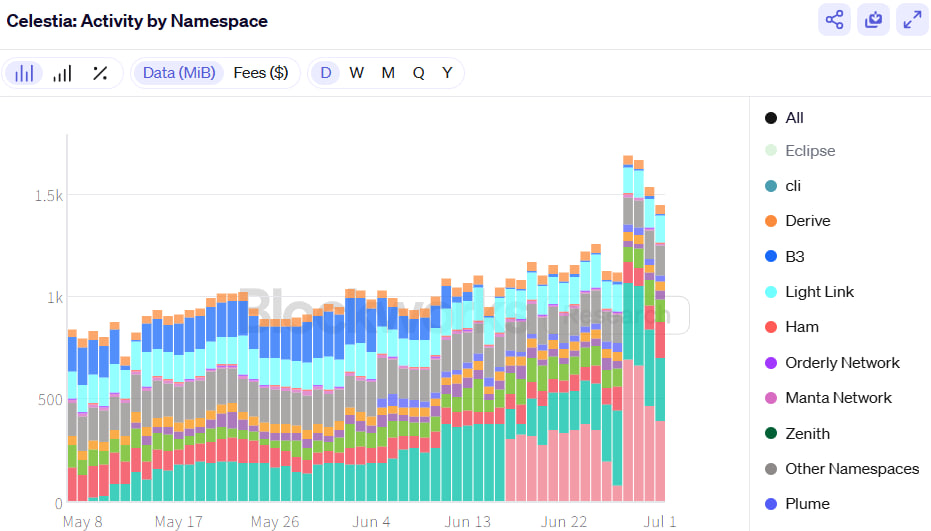

Blob usage on Celestia has surged recently, driven by the emergence of CLOB-based on-chain exchanges. Platforms like Hyperliquid and Hibachi are building decentralized exchanges with performance comparable to centralized ones—including fine-tuned price discovery, low-latency order matching, and complex fee models. These require massive data throughput and can only operate on rollup infrastructure.

Celestia currently offers 1.33 MB/s of DA throughput (roughly equivalent to 10,000 TPS) and is targeting scalability of up to 200,000 TPS through future upgrades. As a result, blob demand has tripled in the past three months. Beyond Hibachi, other CLOB or options-focused rollups like Rise and Derive are also integrating—or actively evaluating—Celestia.

4. Expanding $TIA Utility and Controlling Inflation

Celestia’s native token, $TIA, was initially used solely for paying blob fees. But the upcoming Lotus upgrade (expected in July) will significantly expand its utility. With Hyperlane bridging support, $TIA will become transferable across other chains like Ethereum and Solana, enabling its use as a yield-bearing asset within DeFi.

Celestia is also addressing concerns around token inflation. The current 7% annual inflation rate is set to drop to 5%, then eventually 4%, with a long-term target of 2.5% under a proposed “Proof of Governance” model. Additionally, most VC tokens will be fully unlocked by November 2025, which should ease long-term supply pressure.

5. From Technology to Demand-Driven Proof

What became clear through this interview is that Celestia is no longer just a technology story—it’s now about real demand. As on-chain exchanges scale, blob usage rises. If revenue-sharing from execution layers materializes, Celestia’s REV (Real Economy Value) will grow significantly. In short, the project is approaching a point where its tech and vision may soon be validated by numbers.

While some near-term supply concerns remain due to upcoming token unlocks, the broader picture is becoming more favorable. With inflation being adjusted and $TIA entering DeFi, it’s becoming easier to imagine a more robust and sustainable Celestia ecosystem on the horizon.

Show original

28.2K

112

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.