The "real annualized" Ethena LP pool on Pendle 👀

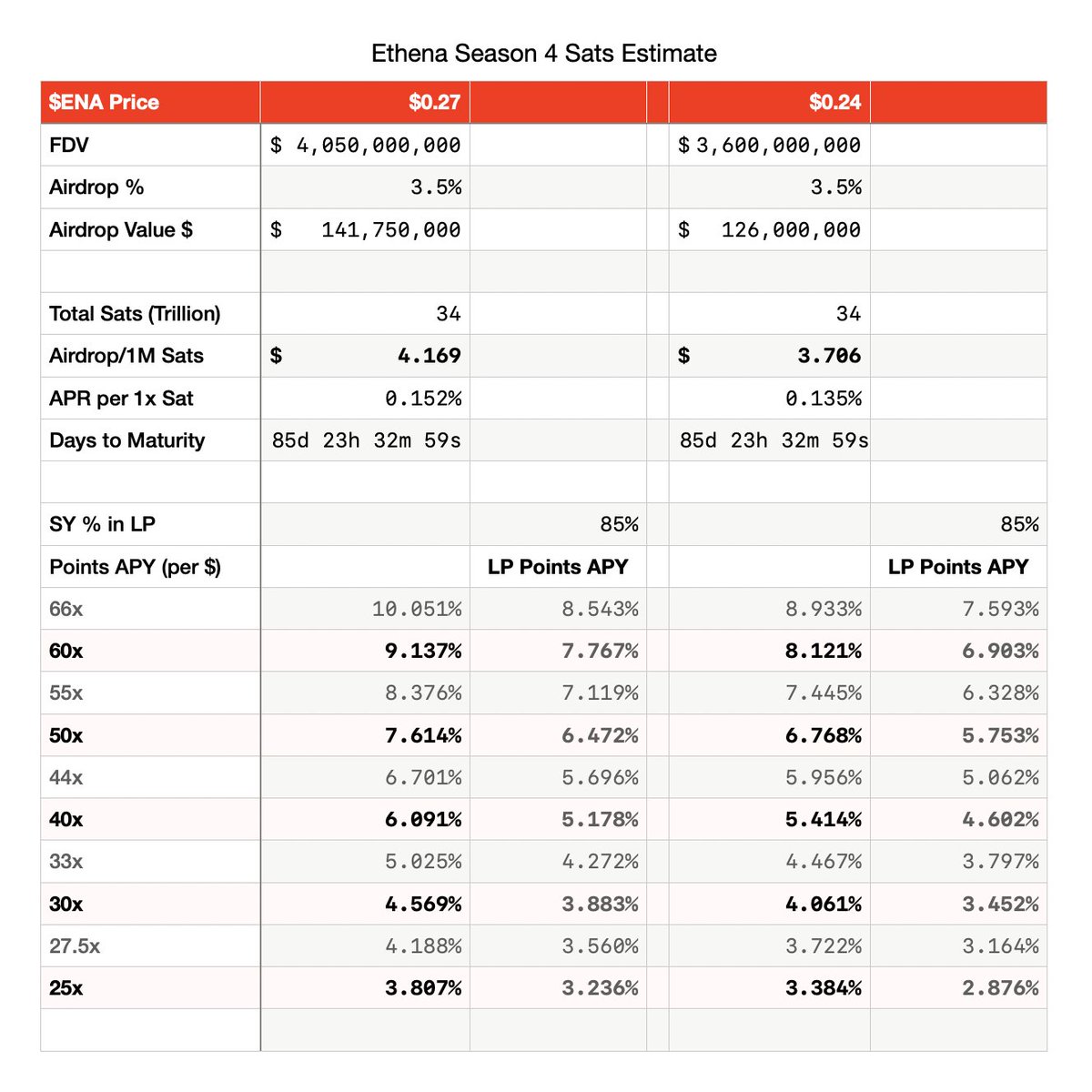

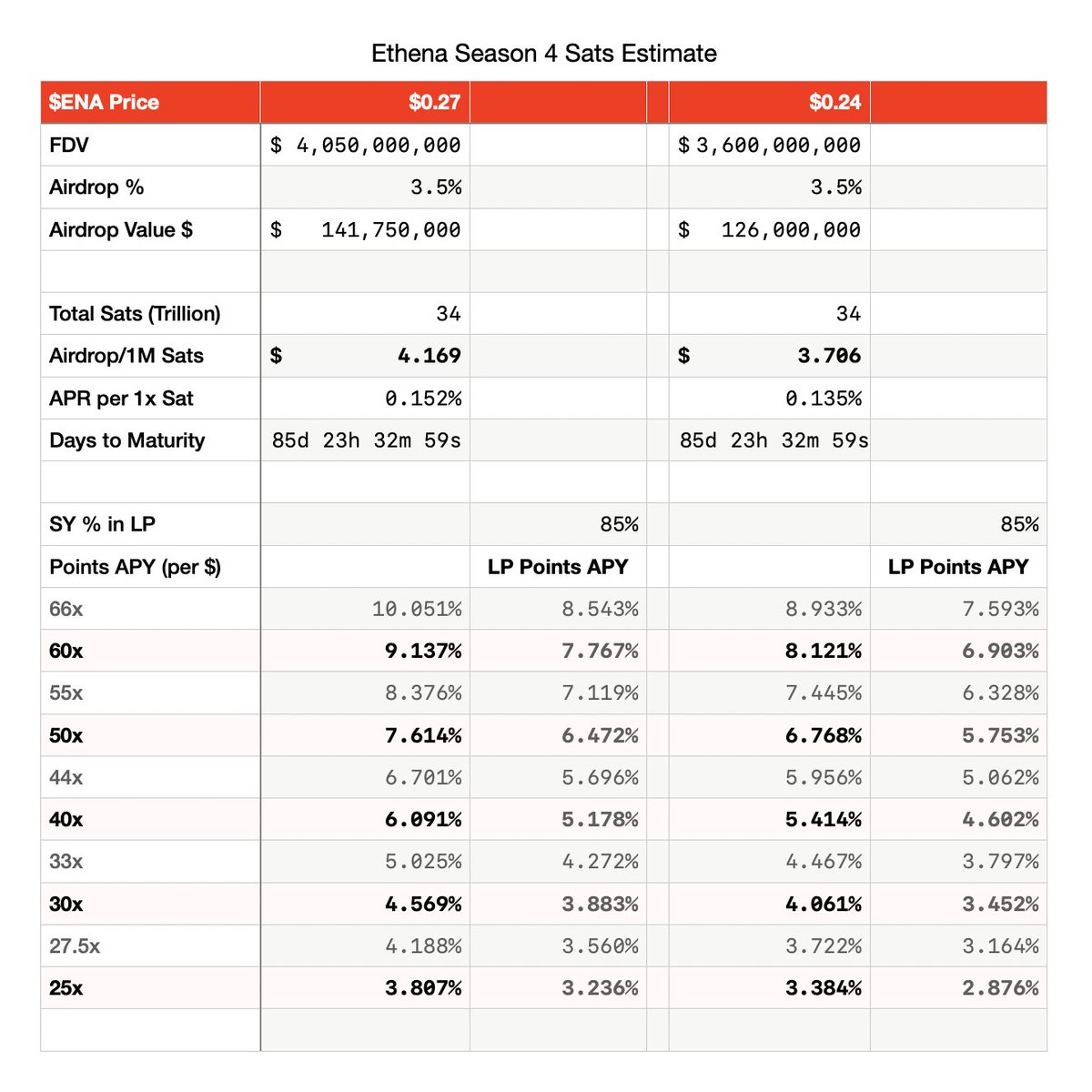

Visualizing the expected annualized points from @ethena_labs S4 Sats added to the LP annualized from @pendle_fi (based on $ENA = $0.27 / 34T Sats / 3.5% distribution, detailed estimation in the original post below)

For example, the total annualized return considering point earnings for the $USDe July pool is currently max ~19.7%

Not very exciting, but still quite appealing.

Expected points earnings for Ethena Season 4, along with the annualized points table.

@ethena_labs airdrop point rules and gameplay have matured significantly, with very few uncontrollable factors: S4 is confirmed until September 24, with a minimum allocation of 3.5% tokens, and the minimum holding requirement that existed since S3 has been canceled. The only special rule left is that the top 2000 addresses have a 33% reward that needs to be unlocked (Sats mined from the USDe pool on Pendle can be exempted)... The emission of Sats points is also quite stable (currently estimating the final total points amount to be around ~34T), so the value of points can be roughly estimated from the $ENA coin price.

💡 Therefore, the current Ethena series on @pendle_fi YT is basically "a kind of PT" = buying $ENA at a discount three months later.

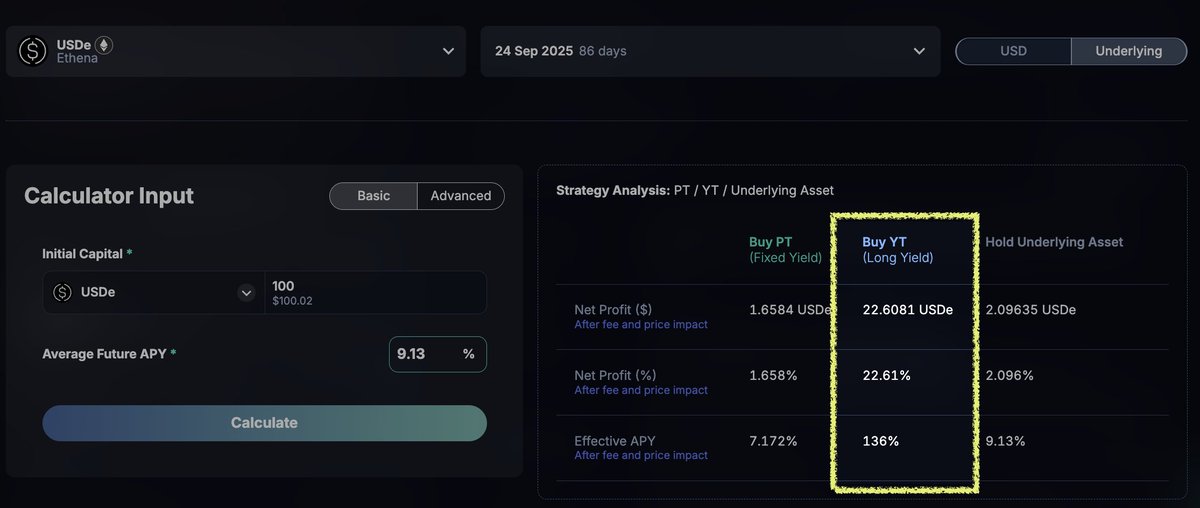

For example, referring to the column with a points multiplier of 60x in the table below, if we value $ENA at $0.27, the points earnings (three-month APY) would be around 9.13%. By entering 9.13% into the calculator on the Pendle interface (see attached image two), it can be calculated that the September USDe YT bought at about 7.5% cost can yield a profit (ROI) of 22% - or approximately equivalent to buying $ENA at an 18.5% discount three months later.

Note: Most people actually have at least a 10% points multiplier (for example, loyalty multiplier), so the table also includes an annualized reference for a 10% increase in points multiplier. (In the previous example, if 60x is increased to 66x, the points earnings would be about 10.05%, equivalent to a 35% ROI / 26% discount on buying coins).

In other words, currently participating in the 7.5% cost YT-USDe, the coin price has a "room for decline" of ~18.5-26%, which is certainly better the more there is, so it depends on your entry point. For example, with a 7% YT cost, similarly valuing $ENA at $0.27, the ROI will rise to 33-46%, or equivalent to a 25-31% discount on buying coins.

Currently, my operation is to set limit orders and wait for a drop to buy cheap YT.

〔LP〕 If you're not interested in buying YT, the Ethena stablecoin LP earnings on Pendle are also quite good: since 85% of the content in the LP currently has points as "SY", when we look at the annualized LP, we should add the expected LP points annualized to the numbers displayed on the Pendle interface. The table also includes LP points earnings, for example, the max annualized UI for the USDe LP pool in July shows 13%, and with the expected points added, it becomes ~20.8%.

Pendle LP guarantees the minimum capital preservation (USDe-based) as long as you hold it until maturity, and all annualized / emissions / points are essentially free earnings.

Finally, the above is just a personal analysis of Ethena points sharing, NFA & DYOR.

If you want me to regularly update this table, please like, comment, and share. Thank you!

8.22K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.