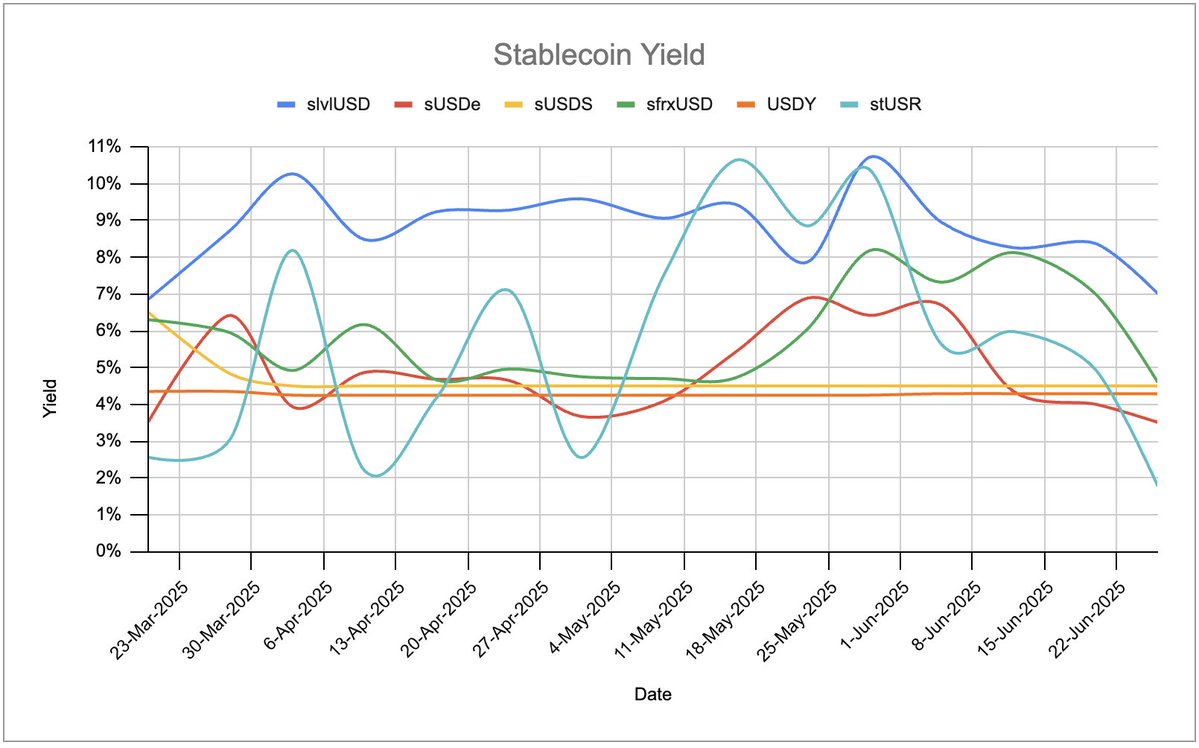

Yield-bearing stablecoins saw a slight dip in returns across the board, but slvlUSD continues to outperform the rest

• slvlUSD: 7.01% 🥇

• sfrxUSD: 4.60%

• sUSDS: 4.50%

• USDY: 4.29%

• sUSDe: 3.51%.

• stUSR: 1.78%.

Stablecoin yields historical performance

A few comments:

• Stablecoin lending rates declined overall due to a sharp increase in USDC/USDT lending TVL on Aave, which has impacted the yield of lending-based stablecoins

Aave USDC TVL (Ethereum V3)

• Overall, funding rates also declined during the period, even turning negative at times, which compressed yields related to basis trade strategies

ETH funding rates in June 2025

This trend reflects last week’s bearish sentiment, which seemed to ease slightly over the weekend, as we see funding rates and lending yields recovering already.

Level 🆙

Sources

slvlUSD: update of June 26th 2025 from

sUSDe: update of June 25th 2025 from

sUSDS: Sky Savings Rate's 7D average

sfrxUSD: @DefiLlama's last 7D average of SFRXUSD (Frax - Ethereum)

USDY:

stUSR: 7D Staking APR from

Disclaimer: This post is not financial advice. Do your own research.

Weekly APY Update 🚨

1️⃣ slvlUSD delivered a weekly APY of 7.01% this week.

2️⃣ Reserve Composition

Current allocation across lending strategies:

→ $91.9M in aUSDC

→ $61k in aUSDT

→ $33.18M in steakUSDC (Morpho)

Total Reserves: $125.12M

Diversified, onchain and fully auditable on our website.

3️⃣ Total Yield Distributed: $102.55k

4️⃣ XP Yield Highlights

→ Curve LP: 60x XP

→ Pendle (Sep expiry):

• lvlUSD PTs: 40x XP

• slvlUSD PTs: 20x XP

→ Morpho M11 Credit Vault (lvlUSD): 40x XP

5️⃣ Bits of the Week

→ We've reduced unstaking cooldown period from 7 to 3 days.

→ @MorphoLabs introduced Morpho Loans in collaboration with @gelatonetwork

→ @turtleclubhouse released their @KaitoAI Leaderboard

→ The GENIUS Act was passed by the Senate on June 17 and is now en route to the House of Representatives.

→ Hong Kong has unveiled an expanded digital asset policy framework

6️⃣ Transparency Note

APY is calculated as protocol revenue distributed to slvlUSD holders, divided by daily average slvlUSD supply since last distribution, annualized with compounding.

Past performance does not guarantee future results.

How to earn:

🔹 Mint lvlUSD →

🔹 Stake for yield → Convert to slvlUSD + track rewards

🔹 Unstake anytime → Redeem after 3-day cooldown

Not available in the U.S.

7.04K

33

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.