Stablecoins: An Extension of Ant Group's Payment Empire?

In mainland China, Ant Group's Alipay has captured a significant share of the payment market. This time, leveraging Ant's digital technology, it is venturing into the stablecoin sector with the aim of creating "Alipay on the blockchain."

As the main force supporting Ant's accumulation in the payment and blockchain fields, Ant Digital Technology not only provides digital solutions for global enterprises but is also actively applying for stablecoin issuance licenses in Hong Kong and Singapore.

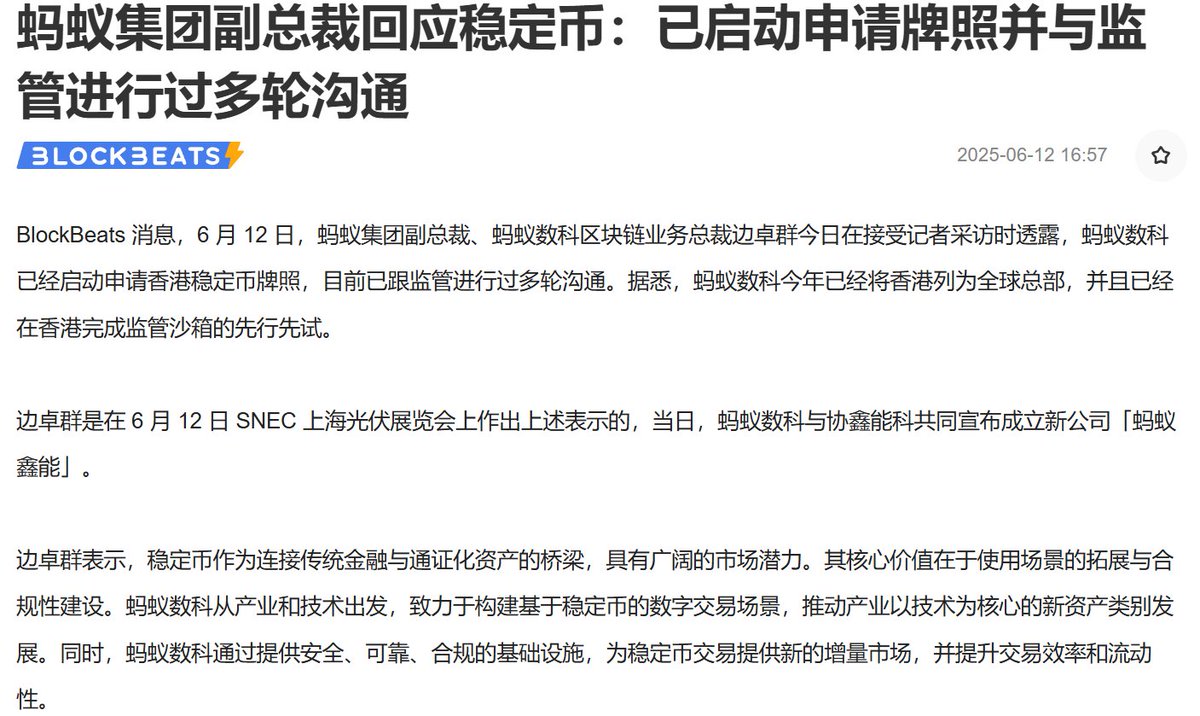

1⃣ In June this year, Bian Zhuoqun, President of Ant Digital Technology's blockchain business, publicly stated that the application for a stablecoin license in Hong Kong has been initiated, and there have been multiple communications with regulatory authorities. At the same time, Ant has designated Hong Kong as its global headquarters and completed regulatory sandbox testing. Hong Kong's position in its RWA, Web3, and stablecoin strategy is increasingly rising.

2⃣ The "Green Energy Exchange" RWA project launched by Ant Digital Technology in collaboration with Conflux and dForce uses USDT as a settlement tool, highlighting the application potential of stablecoins in industrial scenarios.

Ant Digital Technology has established a joint venture called "Ant Xinneng" with Xiexin Energy, focusing on the integration of green energy and blockchain scenarios.

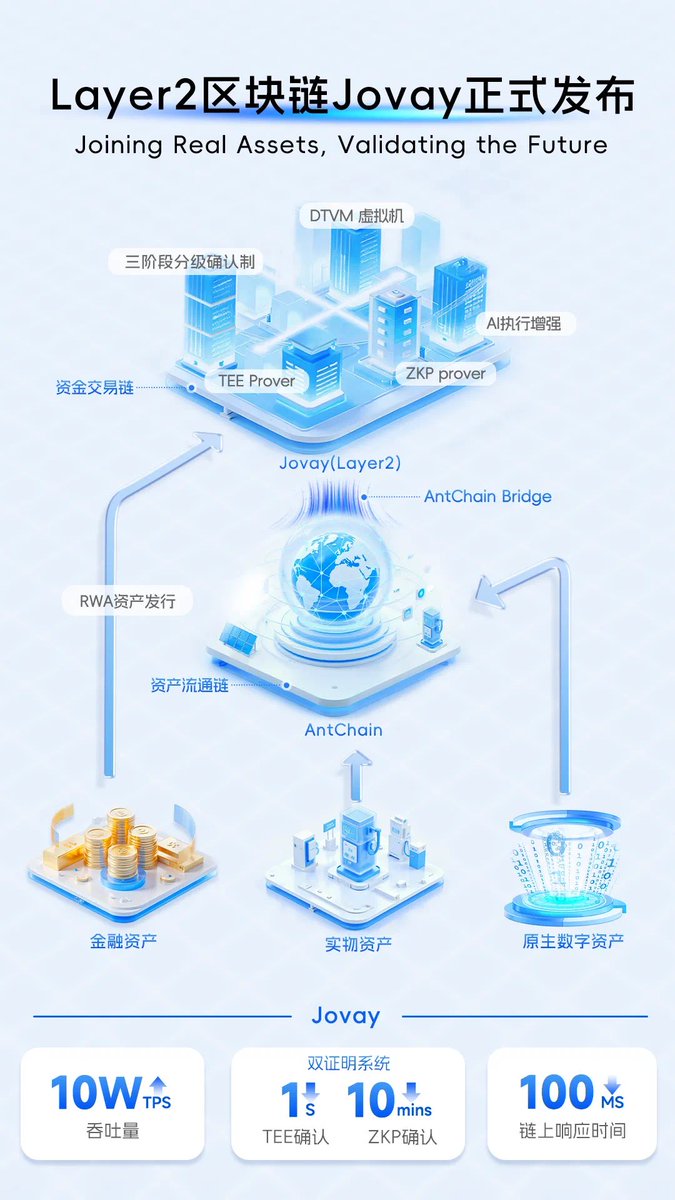

Additionally, Ant Digital Technology has launched a Layer 2 blockchain called Jovay, specifically designed for RWA transactions, supporting 100,000 TPS and 100 milliseconds response time, integrating the open-source virtual machine DTVM, and compatible with the Ethereum ecosystem, reducing cross-platform barriers for developers.

3⃣ From the "Green Energy Exchange" RWA pilot to the establishment of "Ant Xinneng" with Xiexin, and then to the launch of the high-performance blockchain Layer 2 platform "Jovay" aimed at overseas markets in Dubai, Ant Digital Technology's strategic layout is very clear: building practical use cases around stablecoins and providing compliant and secure infrastructure to support industrial-level applications.

4⃣ It is worth noting that Jovay not only achieves 100,000 TPS and 100ms response speed but also features the open-source virtual machine DTVM, is compatible with Ethereum, and supports the large model development framework SmartCogent, specifically designed for RWA scenarios. Against the backdrop of increasing global demand for high-performance chains and trusted asset trading infrastructure, this move by Ant is undoubtedly a step towards "positioning for the future."

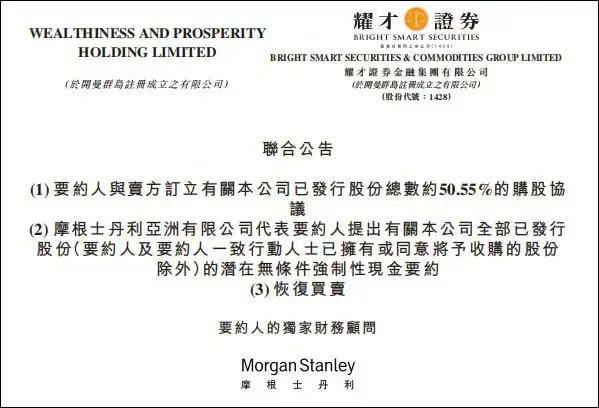

5⃣ Furthermore, in April 2025, Ant invested 2.8 billion HKD to acquire a 50.55% stake in Yao Cai Securities, indirectly obtaining a Hong Kong brokerage license. If Yao Cai obtains the first license in the future, it may become one of the main distribution channels for Ant's stablecoins. It is noteworthy for the crypto community that this could signify the formation of a "stablecoin ecological closed loop" encompassing the entire chain of issuance, compliance, trading, and scenarios.

Conclusion:

From the national-level success of Alipay to the global ambitions of stablecoins, Ant Group is leveraging the momentum of blockchain to seek a new round of upgrades for its payment empire. Relying on Hong Kong's compliant environment, the technical performance of the Jovay chain, and the support of financial resources like Yao Cai Securities, Ant Group is accelerating the implementation of the "stablecoin + RWA" ecosystem.

Can it achieve a technological breakthrough on this new track and become a key player connecting traditional finance and the crypto world? It is worth our attention.

“稳定币”怎么又上热搜了?

近段时间,股票和币圈的热门词非“稳定币”莫属。两大头部玩家表现抢眼:昨晚稳定币第一股Circle(CRCL)股价继续大涨收盘,盘中总市值一度超过其发行的稳定币USDC的总市值;Tether靠USDT在2024年赚了近140亿美元,2025年“印钱”的速度丝毫没有减慢,仅6月22日当天就在Tron网络铸造了 20 亿枚USDT。

1⃣美国发牌,美元稳定币全球称王

6月18日,美国参议院《GENIUS法案》通过,明确稳定币必须须1:1绑定美元资产,承诺随时兑付,禁止投资及收益,稳定币需真实美元背书,非纯算法币,需具价值支撑。Circle迎来监管红利,股价暴涨。

2⃣香港出手,港币等稳定币将上线

8月1日生效的《稳定币条例》支持机构发行港币、离岸人民币等稳定币,吸引IDA、域塔物流科技、Nano Labs公司争抢牌照。渣打、RD InnoTech Limited等之前也参加了沙盒测试。港股相关概念股暴涨,市场看好香港成为亚洲Web3金融中心。

3⃣内地谨慎,转向“离岸布局”

虽然内地仍禁稳定币交易,但通过香港设子公司布局跨境支付。蚂蚁、京东、小米、Conflux等动作频频。陆家嘴论坛上,央行高层频提“稳定币+人民币国际化”,释放战略信号。

结语:稳定币正从灰色地带走向合规正轨,一步步变成全球金融的新基建,资本市场已经嗅到机会,动作频频、讨论不断。

85.66K

120

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.