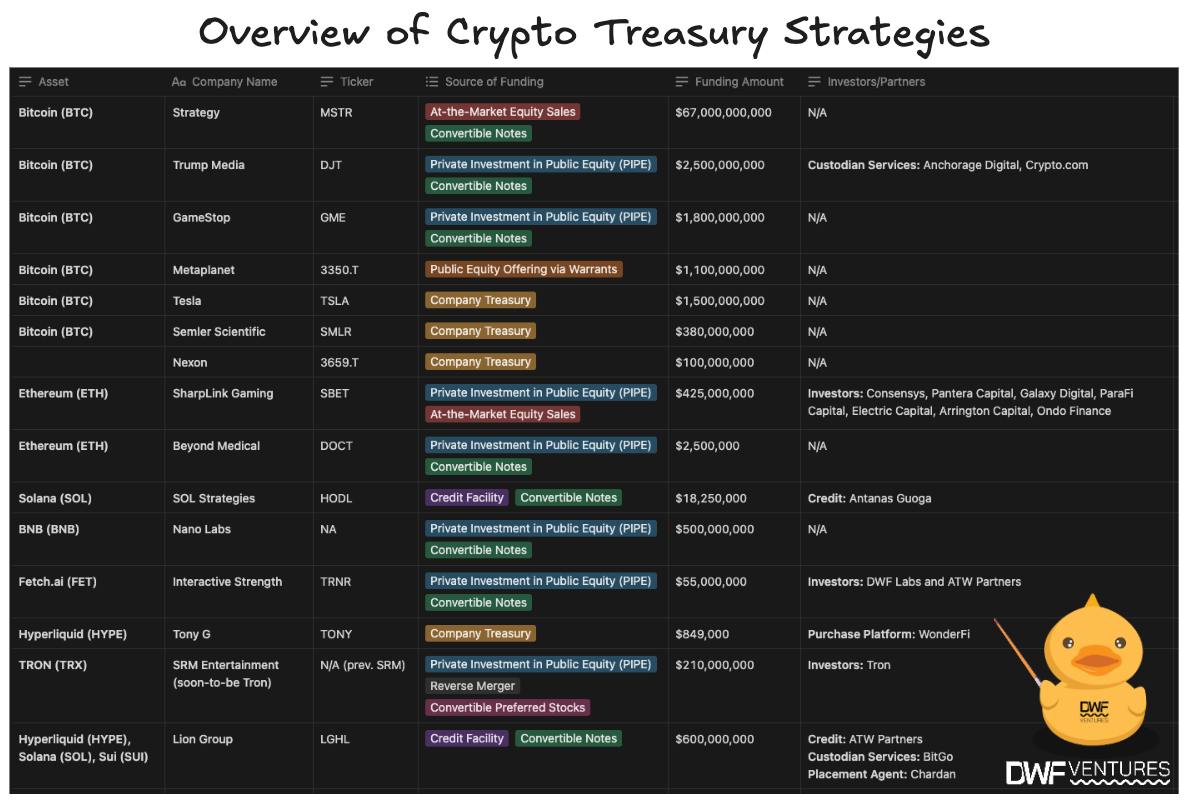

Over $40bn capital has been injected into crypto treasury strategy this year:

> Apart from OG @MicroStrategy, companies like Metaplanet, Trump Media, @SharpLinkGaming, @LionGroupLGHL have been acquiring crypto assets as part of their corporate holdings

> Many companies fundraised for their crypto treasuries through PIPE, ATM Equity Sales, and Credit Facility - instead of using company balance sheet like @Tesla

> @trondao is going public in the US via reverse merger on SRM Entertainment, setting a good case study for crypto protocols that are interested in US equity listing

> Not only BTC, but mainstream altcoins are also getting institutional interests, such as SOL, BNB, HYPE, FETCH, etc.

Public companies are increasingly embracing crypto treasury strategies, injecting over $40 billion into digital assets in the past year alone. This trend highlights a significant shift in how corporations are managing their capital.

We've identified 14 companies that have publicly adopted these strategies, with their combined crypto holdings now surpassing $76 billion.

9.88K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.