However, from a broader perspective of the DeFi space, Aave V4 is not the only player in the concept of a unified liquidity layer. The Spark liquidity layer within the Sky (MakerDAO) ecosystem has already taken a step ahead in technical practice, achieving some success in the use of stablecoins and integration with other DeFi protocols. Additionally, some smaller projects are also exploring and practicing in the field of cross-chain liquidity layers. From a longer-term perspective, the competition between Aave, which is based on the lending sector, and Sky, which is based on the stablecoin sector, may truly determine who the ultimate winner in the future DeFi space will be.

At present, Aave is the leader in the Ethereum lending field.

Aave focused on the demand for DeFi leveraged arbitrage in the bull market that began in late 2023, and the lending business data showed significant growth, turning losses into profits in 2024, and maintaining the momentum into the first half of 2025. In addition, Aave has also achieved great results in multi-chain liquidity deployment relying on Portals, becoming the DeFi project with the highest lock-up volume on multiple chains, such as Arbitrum, Polygon, Avalanche, and Optimism.

Now that Aave V4 is expected to be launched within the year, the throne is going to sit more securely?!

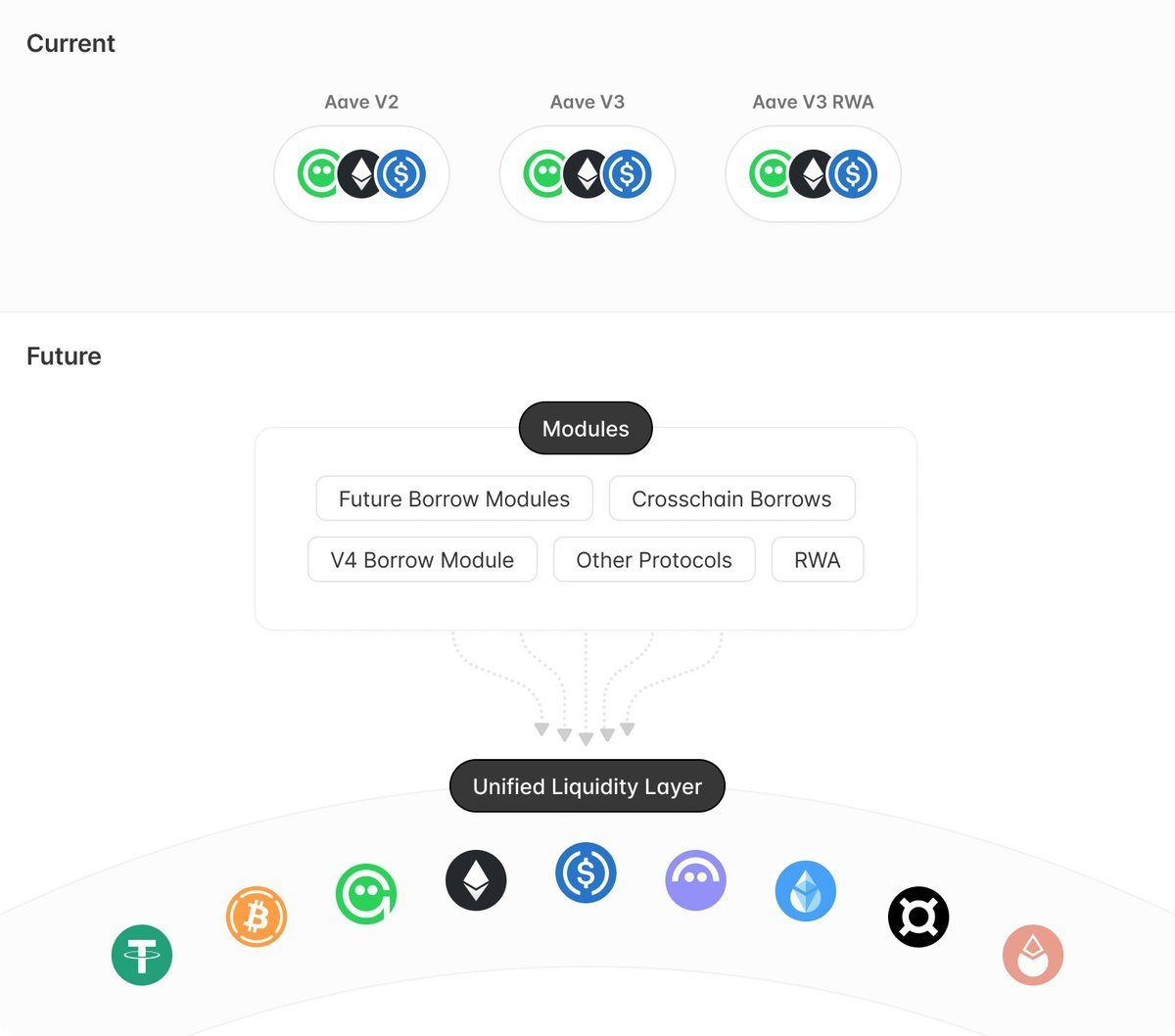

Aave basically maintains a large-scale product iteration cycle of 2~3 years, and the main version running now is still V3, but from the proposal of the development team in 2024, we have glimpsed the prototype of Aave V4, that is, a unified modular liquidity layer.

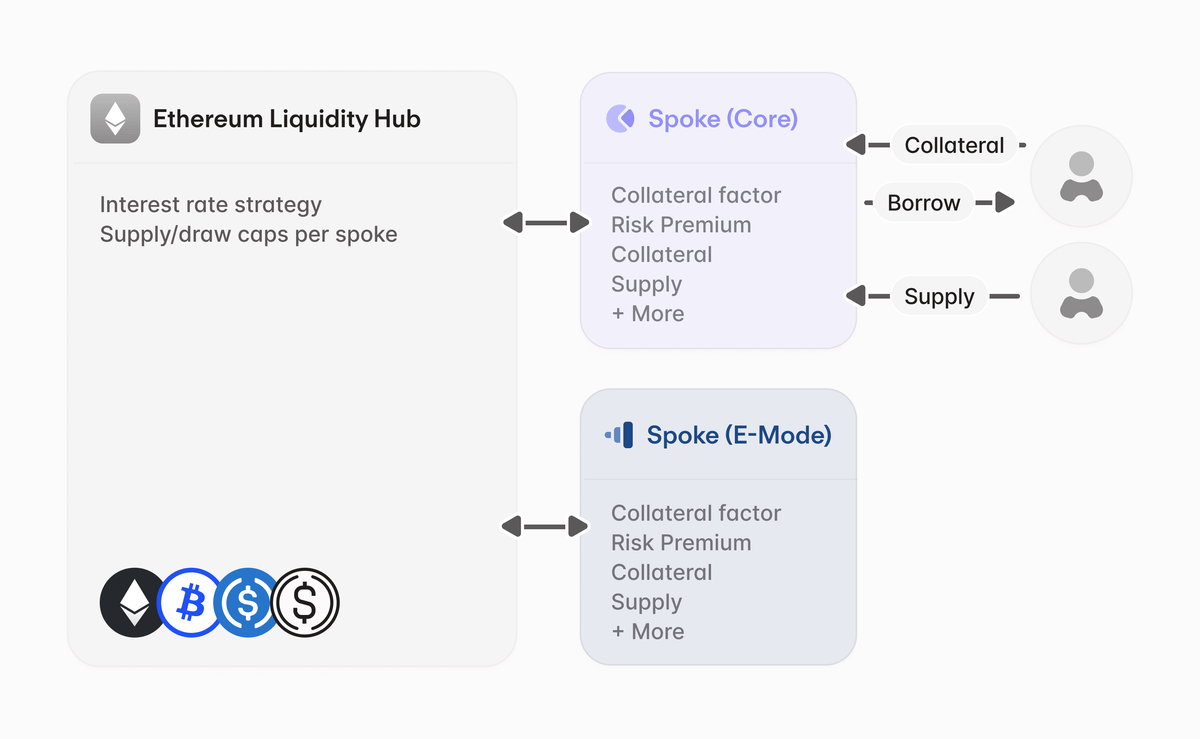

Aave V4 adopts a new architecture of hub & spoke, which enhances modularity, reduces governance overhead, and optimizes capital efficiency. Aave V4 will rely more on the automatic dynamic adjustment of on-chain smart contracts according to the market environment (interest rates, risk parameters, asset lists, financial management, etc. are no longer adjusted by governance), introduce chain abstraction concepts to improve user experience, integrate GHO stablecoins more deeply into the ecosystem, and will also introduce new risk management tools and a more efficient clearing engine.

In the long run, once the design of Aave V4 is actually implemented, it is possible that various parameters that dynamically and automatically adapt to the market environment and open up multi-chain liquidity will once again help Aave to gain a technical and liquidity advantage with other lending protocols.

18.13K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.