Celestia is great tech. Unfortunately, $TIA is one of the worst / most predatory VC tokens out there.

Here is why ↓

First off, @celestia (the chain) is great tech. It was Celestia that first made cheap blobspace abundant, overcoming the main scaling bottleneck that rollups have suffered under for years.

The team also put in a huge effort on the marketing front, basically coining the entire modular narrative single-handedly, and attracting an entire ecosystem of talented builders, both across (adjacent) infrastructure layer or the app layer.

But what about the token?

This is where things take a dark turn.

Why?

The venture capital rounds tell a stark story of insider privilege.

Let me explain:

Series A investors paid just $0.0955 per token while Series B investors paid $1.00.

When TIA launched to the public at $2.29-$2.50, retail investors were already paying >20x what the earliest VCs paid.

Even with TIA’s catastrophic 95% decline from its peak, Series A investors remain up 14-17x on their initial investment, having seen returns as high as 218x at the February 2024 peak of $20.

This pricing structure means that while retail investors who bought at launch are underwater by 40-60%, every single institutional investor still remains deeply profitable.

The asymmetry is by design, not accident.

That’s supported by a token distribution that heavily favors insiders with 80% allocated to team, investors, and foundation versus just 20% for public participants.

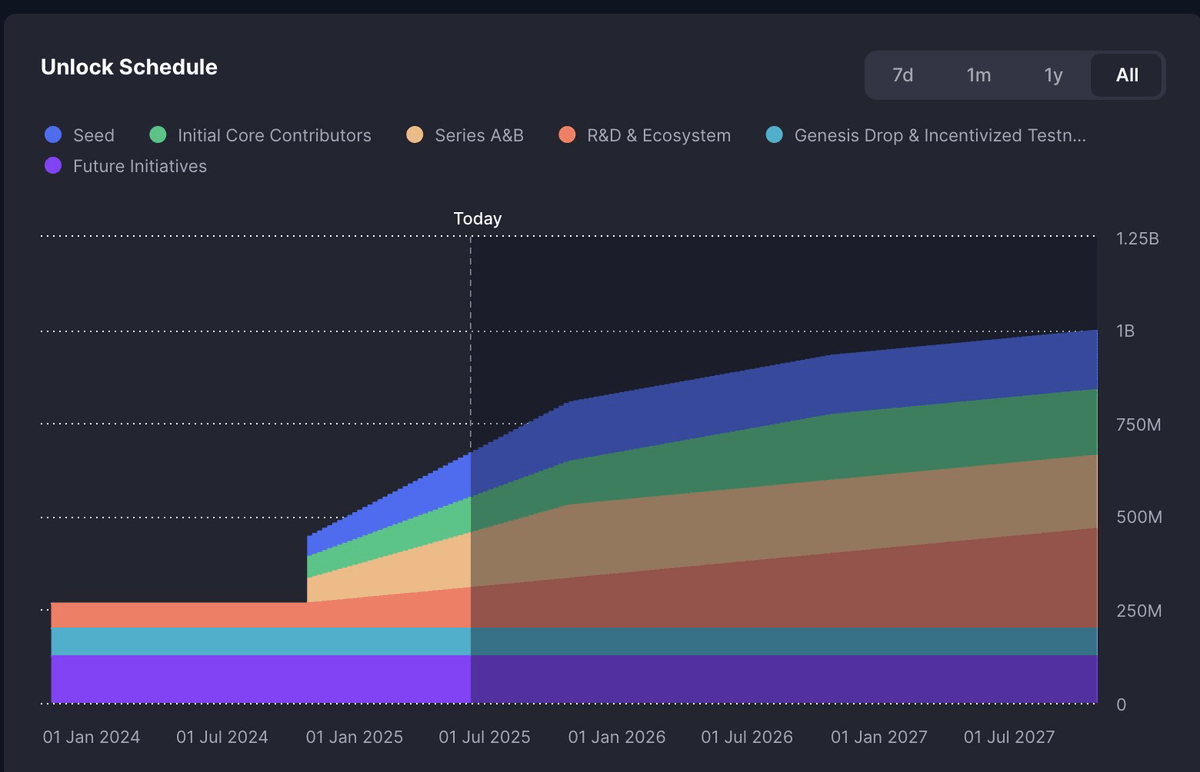

The unlock schedule on these allocations creates predictable selling events:

- October 30, 2024: A massive unlock of 175.59 million TIA tokens represented 80% of the then-circulating supply

- Monthly unlocks continue through 2027, with 30 million tokens releasing monthly through October 2025

- Early backers received 33% of their tokens after year one, with the remaining 67% unlocking during year two

This creates what researchers have estimated as an average 12% inflation rate from unlocks alone during months 24-60 of the project.

The structural selling pressure is not a side effect, it’s literally the primary feature of the tokenomics design.

Things get worse though. Much worse.

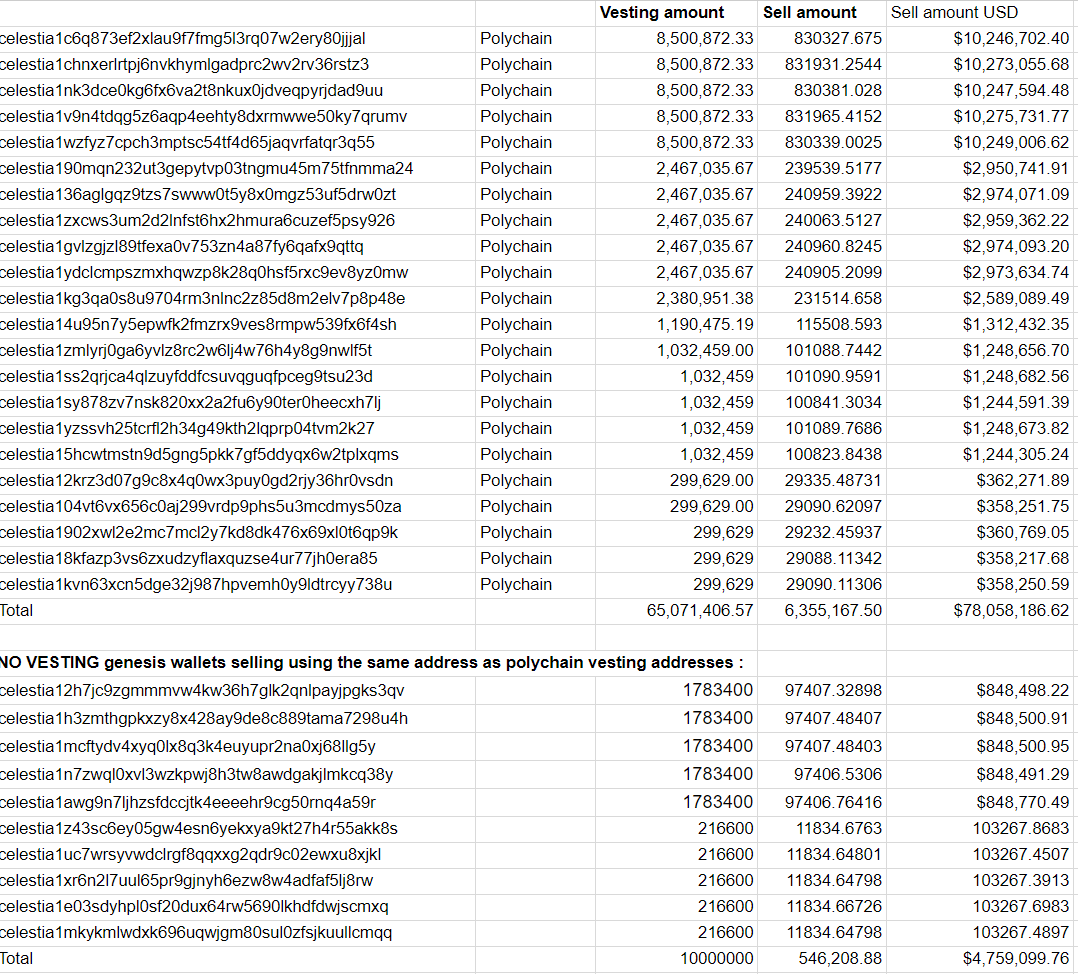

The most damning example is @polychaincap, which invested approximately $20 million across Series A and B rounds.

Through the staking rewards loophole (see screenshot below), Polychain already sold over $82 million worth of TIA (achieving a 4x return on investment) before a single one of their primary tokens has unlocked (also see comments for more info on this).

Wow that’s pretty wild, no?

Unfortunately, there is more. Much more.

Celestia launched with an 8% annual inflation rate that decreases by 10% yearly until reaching 1.5%.

This mechanism appears reasonable on paper but becomes predatory when combined with the token distribution.

With only 25% of tokens initially circulating, the 8% inflation effectively adds 33% more tokens to the circulating supply in the first year.

Research modeling shows that this inflation pressure escalates from 1.1 million tokens per month to over 7 million tokens monthly during major unlock periods, and that the network requires > $2 million in monthly fee revenue just to offset this selling pressure (while it currently makes about $200 per day!).

So let’s quickly recap the situation so far:

- High inflation dilutes existing holders at 8% annually

- Massive periodic unlocks flood the market with supply

- Liquid staking rewards from locked tokens provide immediate selling opportunities

What this ultimately means?

They rewarded their early investors and themselves at the expense of retail, and keep dismissing legitimate concerns as “ridiculous FUD” when the token is down >95%.

Mustafa’s post below, claiming all tokens see 95% drawdowns and that critics spread “ridiculous FUD” further reinforces this, showing a worrying indifference for the losses of the people that should ultimately be the ones using the (app)chains built on Celestia.

All just a coincidence?

Possible but unlikely.

Because even when compared to other heavily VC-funded peers, Celestia’s tokenomics stand out as particularly extractive:

- Celestia: 80% insider allocation, 20% public

- Aptos: 49% insider allocation, 51% public

- Ethereum: 83.47% sold to public in crowdsale

- Bitcoin/YFI: 100% fair launch with no insider allocations

Combined with the staking rewards loophole and aggressive unlock schedule, this 80/20 distribution creates a perfect storm for value extraction.

This inevitably leads to a system where retail investors serve primarily as exit liquidity for venture capital funds.

So is it all over for $TIA?

No, but things are not looking great.

There are various proposals aiming to radically alter/improve the tokenomics, including reducing inflation by 33% or abandoning the PoS consensus (where the chain currently heavily overpays for security) entirely. Admissions that the current structure is fundamentally broken.

However, with Series A investors still up 14-17x despite a 95% price decline, the damage to retail has already been done and trust can likely not be repaired.

A price that Celestia (even though largely a B2B business model) will likely pay in the long-term, as the entire ecosystem suffers under a damaged reputation, regardless of the great tech.

That there is literally 0 organic demand for the token or utility beyond governance (which is a meme, especially if 80% of tokens went to insiders) and paying for (almost free) DA makes things even worse.

The counter-thesis to $TIA is $HYPE. No insiders and VCs dumping on retail from day 1. Clear token utility, fueling organic demand, millions in daily holder revenue, and low inflation that is also countered by a baked-in buyback mechanism.

Proof that not "every token" does a -95% from peak.

The key takeaway for builders?

It’s easy to make yourself and your VC friends rich by dumping on retail at an artificial 200x valuation.

But if you’re here to “change the game” or “build for the long-term”, you have to acknowledge that your token is ALSO a core product, and will ALSO define the success of your tech. Regardless of a $100m “war chest” full of VC funds that will be there to pay handsome salaries.

Yet the question remains: how much do you actually care if you already made all the retirement money you could have dreamed of?

Also not entirely sure if it’s funny or sad that influential insiders have actively kept trying to mislead retail along the way.

Since the below post by @cburniaje, we’re down another 75%+

4.78K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.