In DeFi, you're told you can't have it all:

🌱 High LP yields

📈 Full (or even leveraged) exposure to your favorite token

🚫 No Impermanent Loss

But what if you actually could?

Here’s how to supercharge your LP strategy using @peapodsfinance and rewrite the rules 🧵

1/ Let’s start with the problem:

LP farming can be one of DeFi’s most profitable strategies… but it comes with 2 big issues:

1️⃣ You need to split your capital between two assets

2️⃣ You suffer from Impermanent Loss

Let’s break it down 👇

2/ Say you want to LP in ETH-USDC with $5K of $ETH.

You’ll need to sell half into $USDC.

You end up with:

→ $2.5K ETH + $2.5K USDC

→ LP position worth $5K

Congrats, you’ve now cut your ETH exposure in half. ☹️

3/ Now let’s say ETH pumps. 🚀

To maintain a 50/50 ratio, your LP auto-sells ETH into USDC.

So even the ETH you didn’t sell is slowly sold off.

Result?

You earn yield from the LP positions but miss out on the gains you would’ve had by just holding ETH.

4/ Impermanent Loss (IL) = your LP position is worth less than if you simply held ETH.

In a bull market, this can wipe out any yield you earned from fees as ETH might have appreciated more than the yield you earn.

In such a case, just holding ETH would’ve been more profitable.

5/ But what if you could fix that?

✅ Keep full ETH exposure

✅ Earn 2x+ LP yield

✅ Avoid Impermanent Loss entirely?

Well... you can with @PeapodsFinance Leveraged Volatility Farming (LVF) mechanism!

6/ With Peapods, you can LP at 2x leverage, without selling your ETH - all while earning 'volatility yield' on top!

Example:

1️⃣ You have $5K ETH

2️⃣ Borrow $5K USDC

3️⃣ LP with $10K total

Result:

✅ Still hold $5K ETH exposure

✅ Farming yield on 2x capital, without selling a single ETH

7/ But we can go even further…

To reduce Impermanent Loss to near-zero, increase your ETH exposure using 2.33x leverage:

1️⃣ Start with $5K ETH

2️⃣ Borrow $6.65K USDC

→ $5K USDC goes to LP

→ Swap $1.65K USDC for ETH

→ Add $3.3K (50% ETH, 50% LVF-borrowed USDC) into LP

3️⃣ LP with $13.3K total

8/ 💡 Why does this matter?

Your LP now contains more ETH than you started with.

So even if ETH pumps and your LP auto-sells some ETH, you’re still left with more ETH than you began with.

This drastically reduces Impermanent Loss or 100% eliminates it with management 🤯 ⬇️

9/ And here’s where it gets powerful:

As ETH pumps, your LP position becomes healthier (higher collateral value).

You can then:

→ Borrow more USDC

⤷ Buy more ETH

⤷ Re-LP it

You maintain or increase your ETH exposure while compounding LP + volatility yield. Goodbye, IL🧠

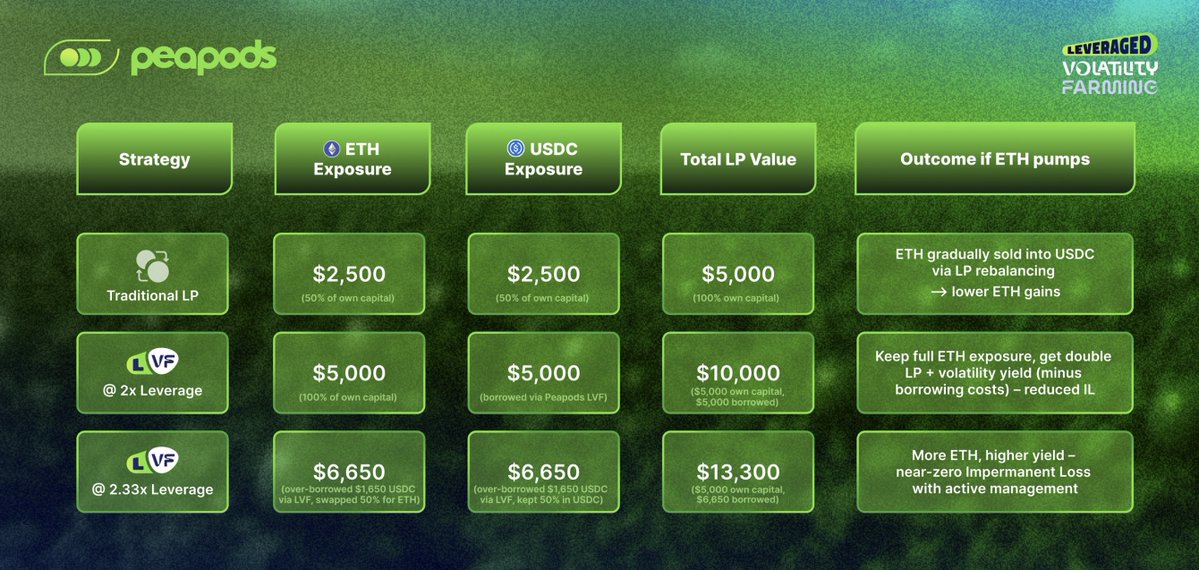

10/ Let’s compare outcomes between a traditional LP strategy vs Peapods LVF with an initial $5K capital 👇

11/ AND that is how you LP without compromise on @PeapodsFinance

✅ Keep full exposure to your bullish token

✅ Earn boosted LP yields at 2x–2.33x leverage

✅ Eliminate or minimize Impermanent Loss

Farm smarter and harder with Peapods. 🌾

12/ And it’s not just for $ETH.

On Peapods, you can LVF any token you’re bullish on – up to 2.33x.

Borrow assets like:

$USDC, $WETH, $OHM, $S, $BERA and soon, $PEAS.

You choose the token. @PeapodsFinance gives you the tools to earn with it.

13/🚨 Risks to keep in mind:

Though liquidation-resilient 'Soft Leverage', this is still leverage

@ 2x: liquidation at ~66% token drawdown

@ 2.33x: liquidation at ~50%

It’s powerful, but with great power comes great responsibility

So always monitor your position + manage risk

14/ END

✅ The best LP yields.

✅ The smartest farming strategies.

✅ Fully permissionless.

Only on @PeapodsFinance.

Try it 👉

Disclaimer: This is not financial advice, always do your own research and manage risk appropriately.

1.47K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.