Exchanges had a rule:

• Fast meant custodial.

• Safe meant slow.

Don't want to choose?

You need a new gen exchange, like @cubexch.

[Airdrop strategy] ↓

Exchanges don’t collapse from slowness, they collapse from custody. FTX misused funds, Mt. Gox lost keys, Quadriga died with them.

@cubexch makes that structurally impossible:

• Assets stay in your MPC Vault

• Cube can’t move them

• Guardians verify every withdrawal

Think of @cubexch as the system fix for everything that broke last cycle:

• It trades like a CEX

• Secures like a vault

• Settles transparently on-chain

All of that is possible because of what’s underneath, a new coordination layer called Isometric.

It doesn’t just power @cubexch

. It redefines how custody, execution, and intent work across chains.

At the heart of Isometric is $ISO, not just a token, but a participation key.

• It governs how intents get resolved

• It secures custody logic

• It powers the validator and Guardian sets

If @cubexch is the product, $ISO is the control panel.

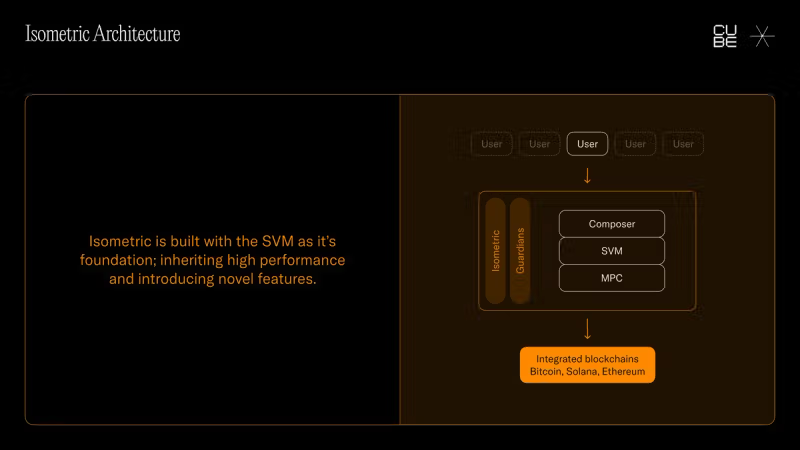

Isometric runs on Solana-grade speed, secures your assets using MPC, and lets you define what you want to do then handles how it gets done behind the scenes.

A stack designed to talk to Bitcoin, Solana, and Ethereum without losing speed or safety.

While most cross-chain systems bridge tokens, Isometric bridges intent; who owns what, what they want to do, and how it gets resolved securely.

It tracks ownership, respects custody, and coordinates actions across chains.

No wrapping, no waiting, no guesswork.

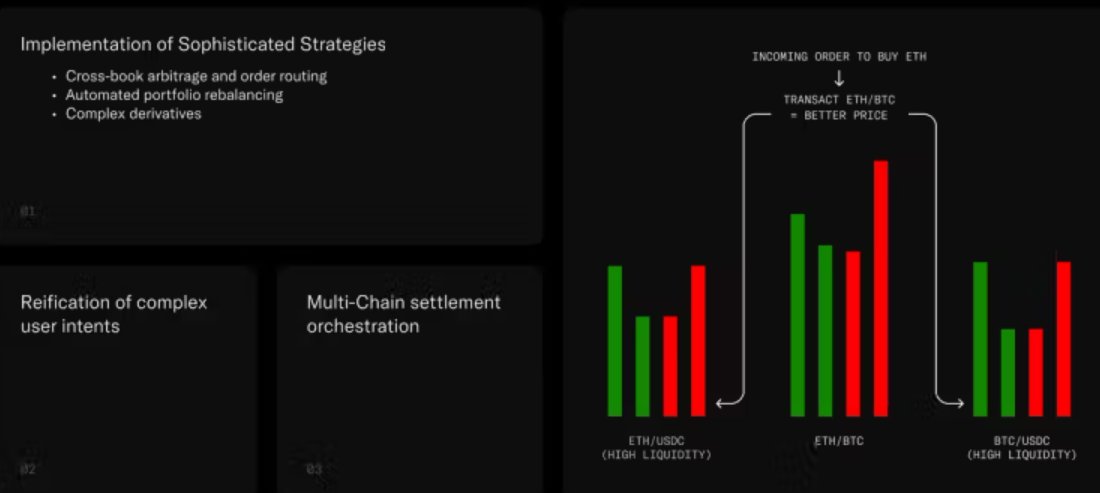

And when intent becomes programmable, coordination becomes powerful.

Isometric can route trades across books, chains, and assets, all resolved through one intent and not a dozen fragmented transactions.

Let’s say you want to buy ETH:

• Normally:

USDC → BTC → ETH

(manually across chains, interfaces, and swaps)

• With Isometric:

Just click “Buy ETH”

It routes across books, finds the best price, and settles it for you.

Every coordinated trade, every routed swap, every matched order produces blocks: units that track your contribution to the network.

And those blocks convert to $ISO. But it is not only about points or badges. It’s about earning a real stake in the infrastructure you’re activating.

Every action feeds the architecture:

• Trades → coordination load

• Coordination → block generation

• Blocks → $ISO ownership

• $ISO → influence over how the network runs

And the fastest way to move up this stack?

Trading campaigns!

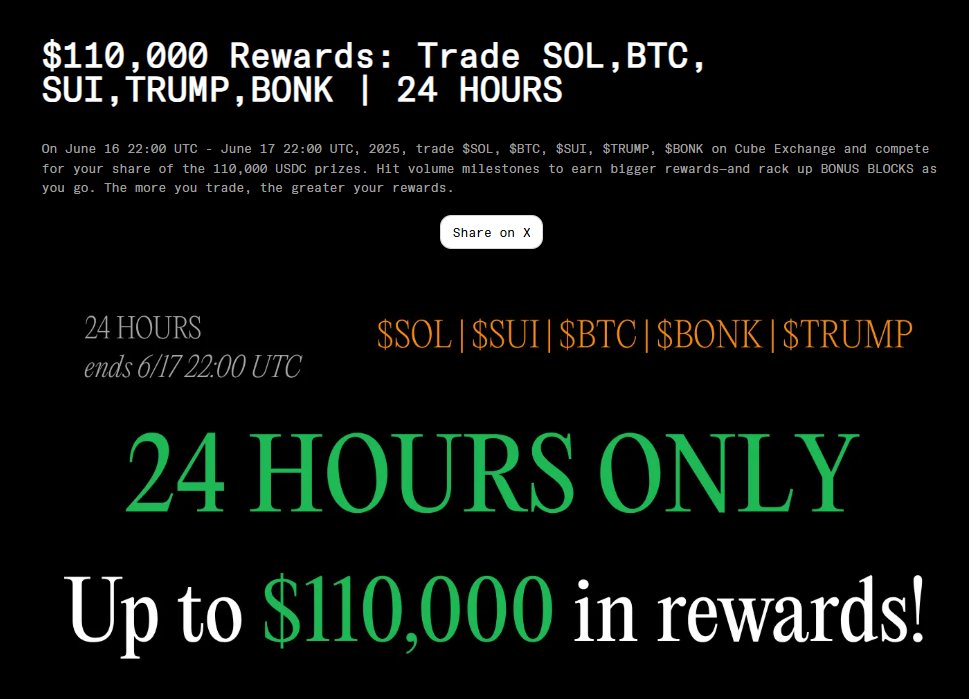

@cubexch is constantly giving out hundreds of thousands in rewards just for doing volume. It's like a gameplay where the more you move, the more you earn.

770

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.