Can Circle sustain a 250x PE? The inflated concerns of the "first stock of stablecoins"

On June 5, Circle successfully went public, and the market valuation is astonishing: a PE of over 250! However, the fundamentals show: compliance costs are so high that there are no profits, the interest rate cut cycle can easily lead to losses, the issuance relies heavily on substantial subsidies, and future market competition is fierce.

Is this a rapidly growing fintech newcomer, or a "bond arbitrage unicorn" disguised in USDC?

Let's break it down 👇

1/ First, let's review Circle's business model:

- Issuer of $USDC

- Revenue comes from T-bill reserve interest

- Complete compliance path, all licenses in place

- Deep collaborations with Coinbase, Base Chain, Solana, Sui, etc., sounds like a "Stripe + BlackRock" hybrid in the stablecoin space.

2/ First, let's look at the most important core data: Sources of profit

Circle's revenue exceeded $700M in the past year,

but the vast majority came from the interest earned on U.S. Treasury bonds from "USDC reserves."

This means two major issues👇

1/ First, Circle's profits are highly dependent on interest rate levels.

Once we enter a rate-cutting cycle (which is now), the spread on U.S. Treasury bonds narrows, and Circle's profits are directly halved.

It is not a platform company, nor is it a tech flywheel; rather, it is a disguised "stablecoin interest arbitrage company."

4/ Second, it lacks a diversified income structure.

There is no payment closed loop, no SaaS products, no asset management services,

it doesn't even control the wallet, and it completely relies on Coinbase and third-party wallets for toC.

→ The profit structure is singular, making it extremely vulnerable to cyclical pressures.

5/ Looking at market competition again:

The GENIUS stablecoin bill has just been passed, lowering the threshold, allowing Paxos, PayPal, JPMorgan, and Visa to legally issue stablecoins.

Circle is no longer the only "legal stablecoin player."

6/ Moreover, the growth of USDC has also hit a ceiling:

- Not as flexible as USDT

- Adoption driven by subsidies

- Neglected by some emerging L1 and L2 chains

- No user network effect

In the past, market share was gained through "compliance"; in the future, compliance will be a standard for everyone.

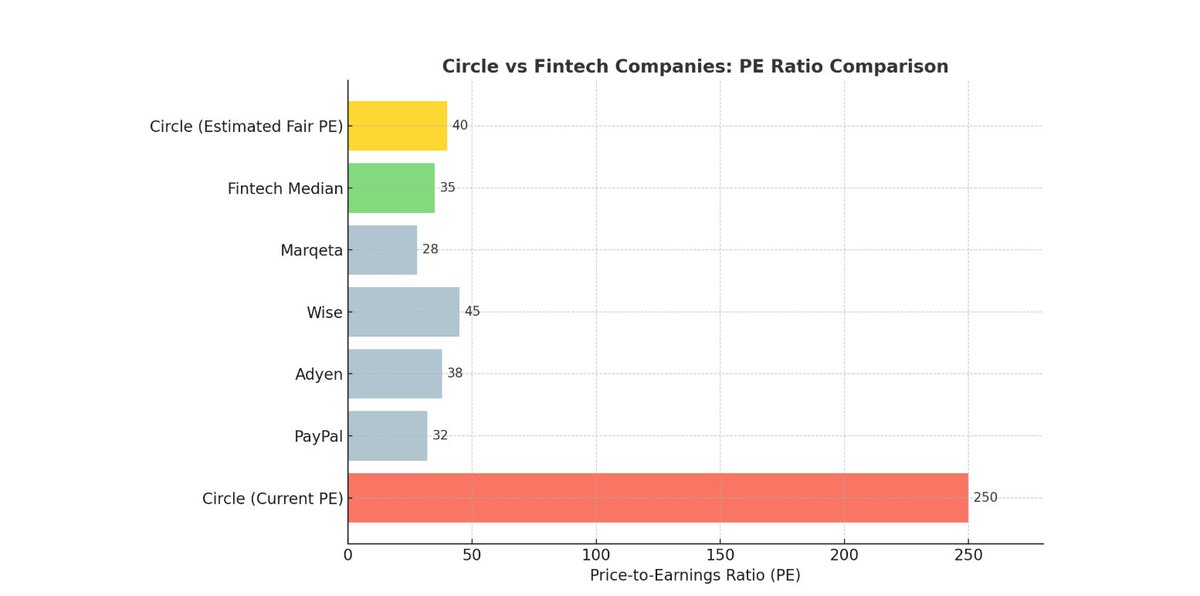

7/ Comparison of valuations with other payment fintech companies: Circle does not have a stronger user base, a broader product line, or a flywheel effect, yet it is valued higher than anyone else.

To maintain a 250x PE, it means:

- Must sustain high growth in the long term

- Must not lose market share to other stablecoins

- Must have the U.S. Treasury yield spread continue to hold

- Must also withstand multiple impacts from central bank digital currencies, Tether, and localized stablecoins.

8/ In summary:

✅ Circle is a compliance pioneer in the stablecoin space.

✅ It is one of the core infrastructures for the circulation of on-chain dollars.

✅ It has a brand, licenses, and an ecosystem.

However, it is by no means the ultimate destination for stablecoins, nor is it the "NVIDIA of fintech."

9/ A more reasonable Circle PE valuation should perhaps be in the range of 30–50, benchmarking against companies like Stripe, Wise, Block, etc.

The current 250 times is more of a liquidity premium + scarcity speculation + compliance sentiment bonus; the valuation will eventually return to rationality.

10/ The listing of Circle is worth celebrating, but we must also be wary of it becoming a typical example of a "faux unicorn."

As more stablecoins enter the market and U.S. Treasury yields decline, USDC's market share is decreasing, and the market will eventually reassess its true value.

Kay's perspective

So far, CRCL's most profitable post is the 45-year-old North American old man on the City of Literature, who mindset:

Dominate the national strategy, replace VISA, and rush to 2000.

We, the real users of the so-called cryptocurrency circle, see him as follows: the compliance cost is so high that there is no profit, the interest rate cut cycle is easy to lose, the issuance depends on a large number of subsidies, and the reasonable valuation is 30-50 laugh haha.

Like the currency circle, the listing of the currency means that the gambling chips and fundamentals are gradually detached, and you have to know who you can pour it on.

@OdailyChina reported

1

7.58K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.