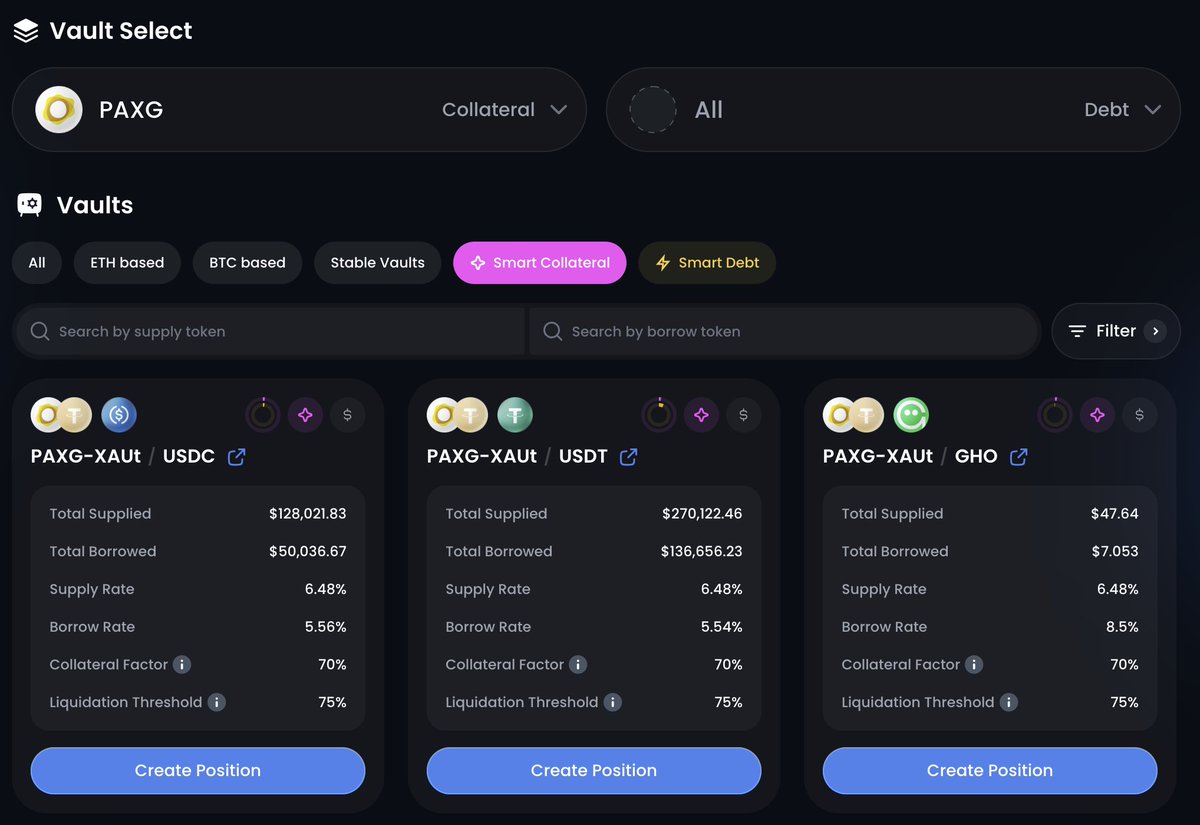

If you want on-chain exposure to gold-backed stablecoins like @Paxos $PAXG or $XAUt (by @tethergold) with up to 4x leverage, there are Smart Collateral vaults on @0xfluid.

+ Vault owners hold an LP as collateral (PAXG-XAUt)

+ They can borrow up to 70% LTV (75% LLTV)

+ Loans are denominated in USDC, USDT, or GHO

+ And they can get leverage by using the Leverage recipe on Fluid (borrow, buy more collateral, deposit, borrow etc)

Plus, these vaults earn trading fees in PAXG+XAUt when trades are routed through Fluid DEX for PAXG<>XAUt.

I'd be happy to store my crypto gains in Gold stables during longer-term crypto uncertainty or bear runs vs. USD stables.

Especially as DXY is down by 10% since January.

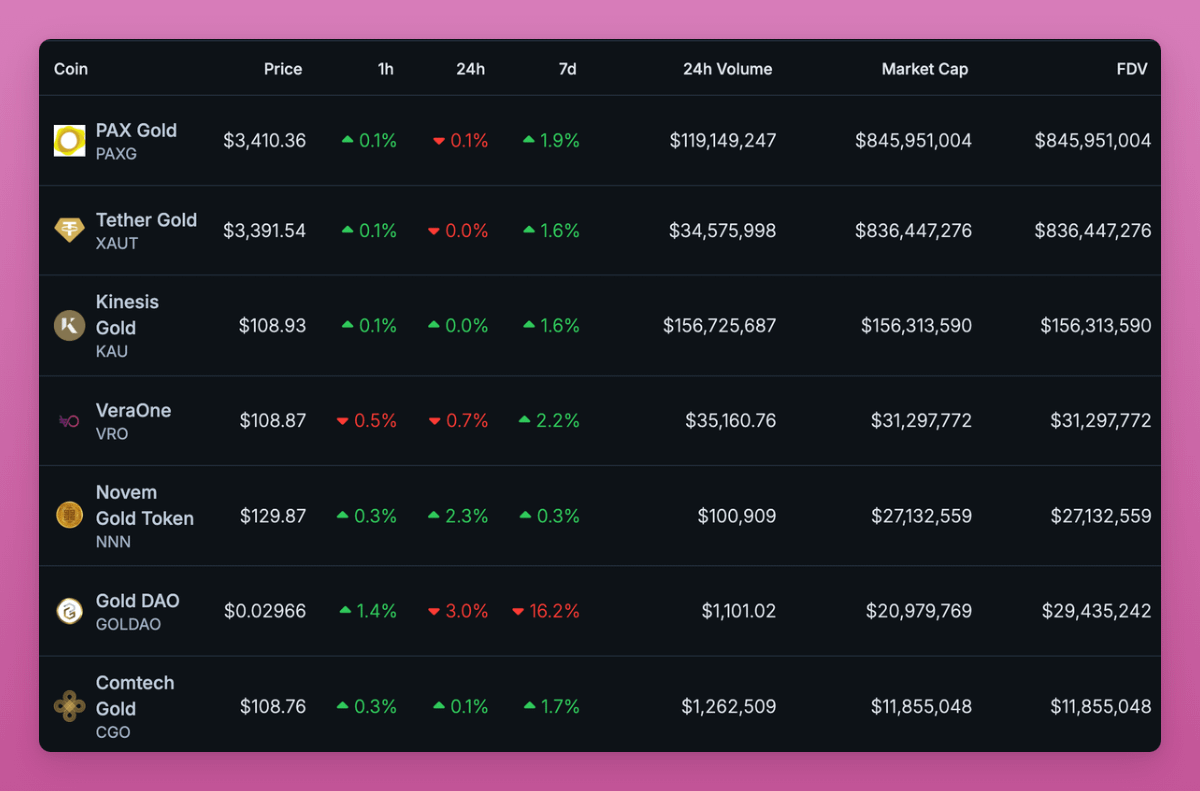

Last cycles it wasn't an option but now gold-backed stablecoins hit a $1.9B market cap.

PAX Gold and Tether's each have ~$840M MC.

Yet, their onchain liquidity is... not great not terrible..

Trading $1m USDC on Cowswap with 0.76% slippage.

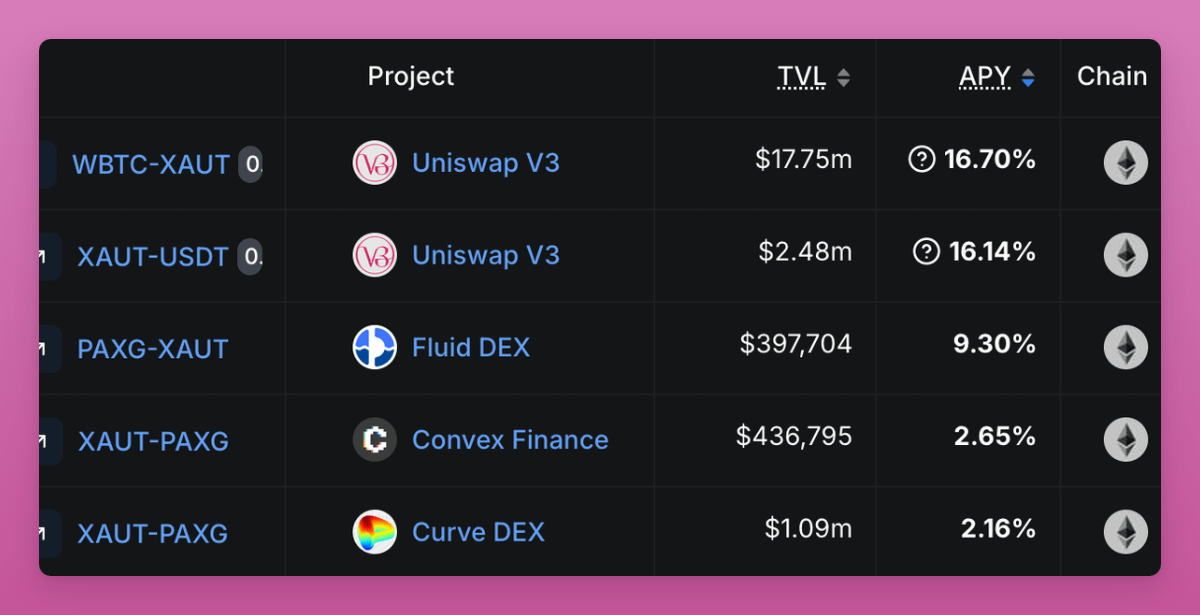

Still, liquidity is improving as more DeFi protocols add them as collateral:

- Fluid supports both with 9.3% yield

- Aave just voted to Temp check to onboard XAUt

- Curve supports XAUt-PAXG LP with 2% yield

But how fast can they grow?

Problem: fiat backed stablecoins earn interest from U.S. Treasuries but gold has no yield.

Instead, both Paxos and Tether charge a 0.25% issuing and redeeming fees (although Paxos fees depend on amounts).

So profitability depends on their issuance/redemption fees.

Obviously, the higher the MC of gold stables, the more transactions will happen thus higher fees are generating.

And they need them to get integrated into DeFi and trading platforms.

Anyone knows how much both issuers make from Gold stables?

btw, fun fact: both issuers hold physical gold, not ETFs. Tether holds it in Switzerland vaults while Paxos in London.

31

11.23K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.