Avalon Labs has burned 80 million AVL, accounting for 44% of the circulating supply (total supply 6%)

Valued at 16 million USD!!

Burning tokens leads to currency deflation, indirectly rewarding long-term holders.

However, that's not the main point; the key issue is how the prospects of Avalon’s BTCFi business look. This is the foundation for the future value of the token.

Recently, two news items caught my attention:

1. @yzilabs invests in Avalon

2. @SuiNetwork has repeatedly stated this year that they want to vigorously develop BTCFi, with over 5 related projects laid out.

✅ It seems that top public chains and investors are still enthusiastic about BTCFi.

So why is institutional interest in BTC finance still high? ❓

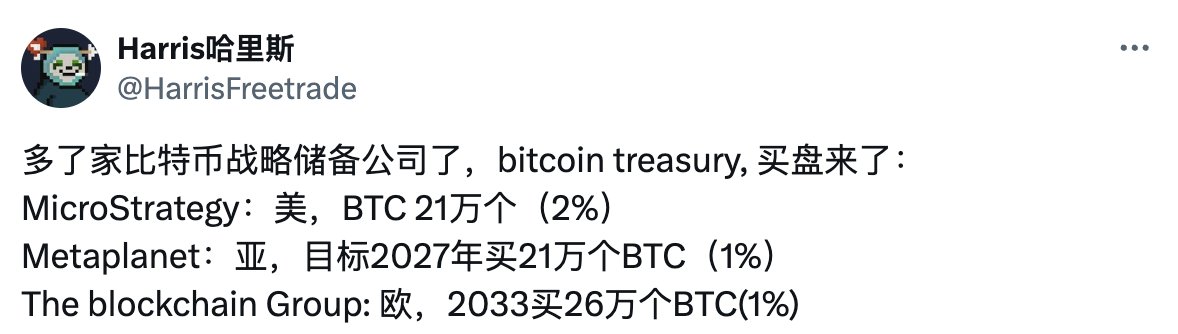

It's because web2 institutions and companies are crazily buying BTC, often allocating 1%, 2% of their total holdings...

Some positions will definitely choose to stake BTC for "lending," borrowing liquidity to invest.

This is a reasonable assumption; it’s unlikely that BTC will just sit in wallets or custodians.

Instead, BTC is treated as a base asset, with more financial plays and operations built on top of it, creating immense business opportunities! ❗️

✅ Whoever can first position themselves in BTC finance will be able to enjoy the largest piece of the pie in the future.

Avalon Labs has officially burned 80M $AVL, representing 44% of the circulating supply.

These unclaimed airdrop tokens, worth approximately $16 million, have now been permanently removed from circulation. Over the past year, a total of $20M worth of $AVL has been claimed by more than 100,000 Avalonians. We’re proud to have our users, supporters, and believers as key stakeholders in Avalon Labs. As $AVL enters a deflationary cycle, more value will be unlocked, aligning long-term incentives and strengthening the foundation of our ecosystem. Thank you for your continued support.

This burn isn't the end, it’s the beginning. Today, we launch a new phase: Business Expansion.

Expect more. Avalon moves forward.

13

5.12K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.