You know what?

A lot of people talk about how fragmented liquidity is in this market and the same goes for insights.

Sure, KAITO and InfoFi are opening a new era of attention, but that also means feeds on X are flooded, making it harder for users to keep up.

As a Mantle Hustle YAPPER, I feel responsible for bringing accurate and up-to-date insights about how Mantle might convert trad cash flow through its products and events.

◢ @mETHProtocol is obviously the backbone!

By reshaping the structure of DeFi liquidity, mETH helps optimize capital flow in the least risky way.

If you joined the recent mETH YAP CLUB ROAST, you’ve probably heard we've emphasized mETH’s role in pushing institutional DeFi adoption.

As DeFi integrates more into institutional strategies, protocols like mETH help make Ethereum-based yield strategies more accessible and reliable, building trust and drawing Web2 capital in.

◢ It’s not just words, Bybit Megadrops proved Mantle’s potential with real numbers.

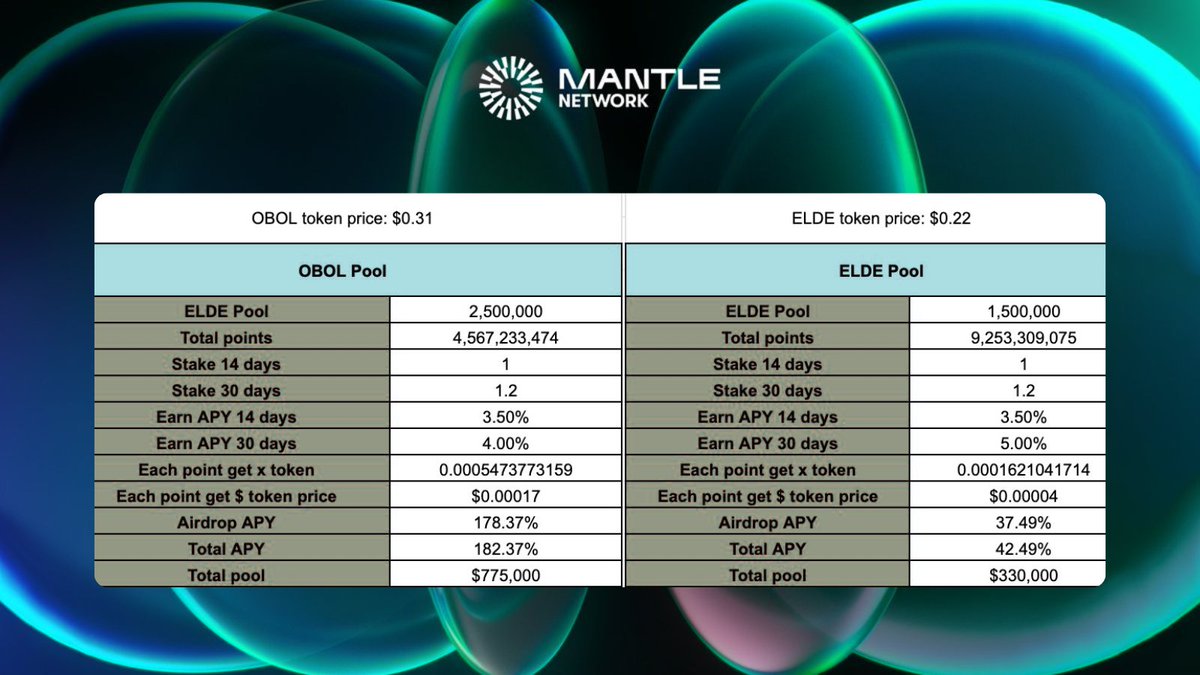

➜ APYs were insane: OBOL at 182.31% and ELDE at 42.22%, showcasing Mantle’s strength in optimizing yield for investors.

➜ OBOL Pool: 2.5M total points, 4.86B MNT staked, 12,306 participants, 875,000 tokens rewarded.

➜ ELDE Pool: 1.2M points, 8.29B MNT staked, 14,290 participants, 350,000 tokens rewarded.

The traction is massive!

And this wasn’t the first big collab between MNT and Bybit. Mantle has backed 2 Bybit Megadrops, 9 Project Drops (Rewards Station), 10 Bybit Launchpads, 31 Bybit Launchpools - building a whole ecosystem to power liquidity.

It's only getting bigger!

If mETH = the backbone, Megadrops = the performance

◢ MI4 & Mantle Banking = the future

Before diving into MI4, know that $400M from the @Mantle_Official Treasury is being committed to MI4.

By teaming up with @Securitize to RWAs, MNT is targeting TradFi liquidity. While everyone’s eyes are on InfoFi, RWA is silently booming.

According to @BinanceResearch, the RWA market has surged +260% since early 2025.

MI4 automates access to a diversified basket of crypto assets like BTC, ETH, SOL, and various USD-backed or synthetic stablecoins (e.g., USDC, USDe, sUSDe).

It integrates DeFi-native strategies using mETH, bbSOL and USDe, bringing extra yield to users.

◢ And the flow is super simple, especially for Web2 users:

1. Deposit crypto or fiat (Visa, PayPal, etc.) via Mantle Banking

2. Store both TradFi and DeFi assets

3. Enhance yield through MI4 (mETH included)

4. Sit back and profit, while others stress about inflation.

Mantle Banking will be the final piece, the ultimate liquidity pool connecting Web3 and traditional capital.

➜ While waiting for that, you might want to stake Mantle on Coinbase with APYs up to 64.83%.

Mantle now holds $1.4B in Staking MC out of a massive total $2.1B.

Hope you enjoy the flow, long-form style, homies!

Show original

31.66K

128

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.