Meme stocks dumping on the news that they bought $BTC is not really surprising even if it might be counter-intuitive :

Once a company starts adopting a BTC Treasury Strategy, it automatically means that the valuation gets anchored to something "real" instead of a pure memetic value, and this real thing is the BTC stack.

When this happens, you can calculate the mNAV premium, which is the ratio of the company valuation over the BTC value (= NAV = net asset value).

$DJT mcap is $6.5bn, if they buy $2.5bn worth of BTC, the company trades at 2.6x mNAV.

$GME mcap is $14bn, if they hold $4.5bn in cash and $500M in BTC, their mNAV is somewhere around 3 (if we include the cash in the NAV...).

One thing to note too is that DJT is raising $1bn through convertible bonds, which usually means that there is selling pressure during the period of pricing of the bond.

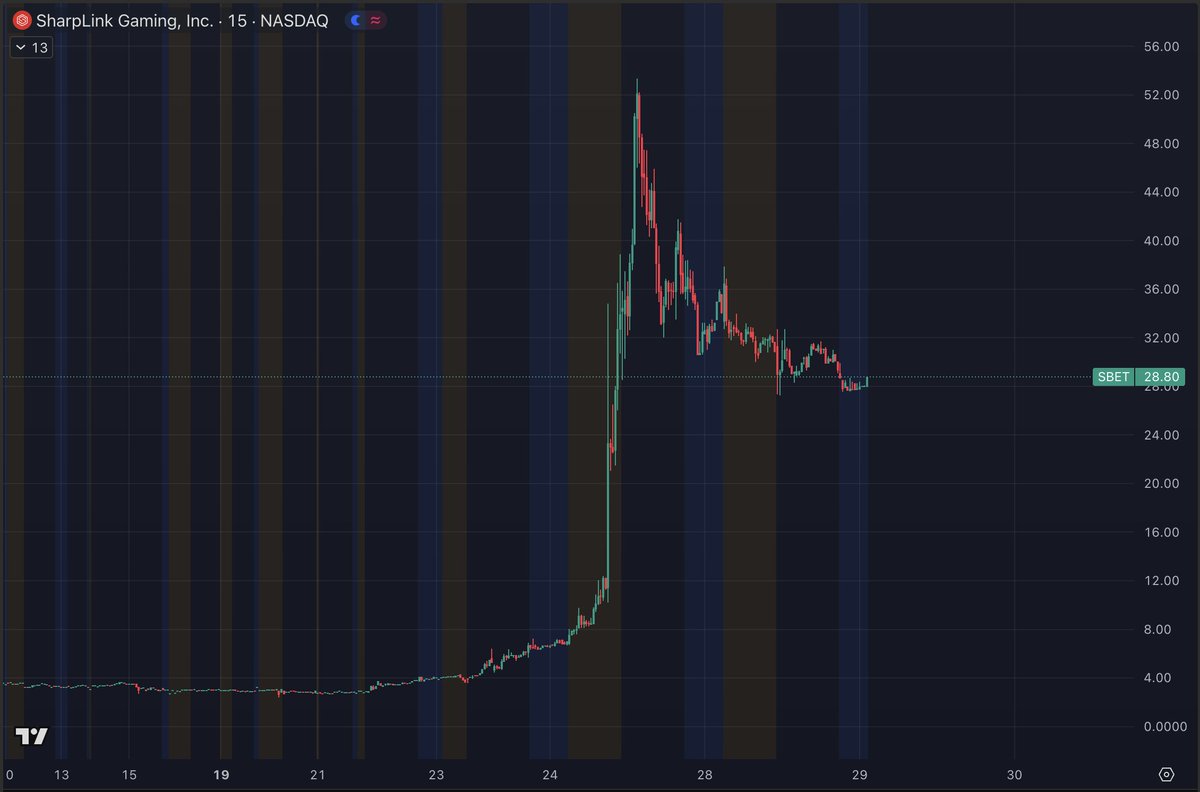

I wrote a tweet today which stated that the mNAV of $SBET (the Eth version of MSTR) was around 6 at yesterday's close, so the price going down today is very logical too, because 6 is a high multiple.

Show original

22.55K

56

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.