BNB price

in AEDCheck your spelling or try another.

About BNB

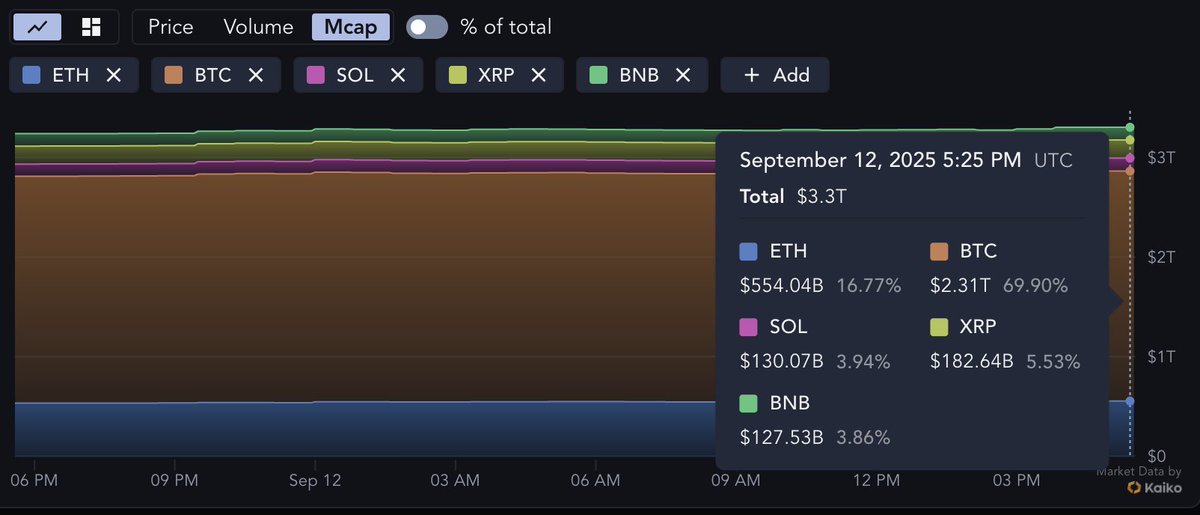

BNB’s price performance

BNB in the news

Binance set a record $2.63 trillion in futures trading volume in August. BNB can be used for trading fee discounts on the exchange.

The advance came as broader crypto markets rose and after CEA Industries announced it expanded its BNB stash to 388,888 tokens worth $330 million.

The rebound from support was fueled by above-average activity and a clean break above nearby resistance could shift sentiment.

The attack involved updating a contract to a malicious address, affecting tokens like vUSDC and vETH.

Underlying network activity surged, with daily active wallet addresses on BNB Chain more than doubling to 2.5 million, but transaction volumes have been dropping steadily since late June.

ETF provider REX Financial and asset management firm Osprey Funds filed paperwork with the US...

BNB on socials

Guides

BNB on OKX Learn

BNB FAQ

No, the Binance Smart Chain (BSC) operates independently as a separate blockchain and is not dependent on the Binance Chain (BC). While they exist within the Binance ecosystem, the BSC is designed to maintain its technical and business capabilities, ensuring its continued operation even if the BC ceases its activities.

While Binance initially created BNB, it has evolved into more than just a part of the Binance platform. The BNB Chain has become an independent decentralized network with its own ecosystem and use cases, extending beyond its association with the Binance cryptocurrency exchange.

Easily buy BNB tokens on the OKX cryptocurrency platform. Available trading pairs in the OKX spot trading terminal include BNB/USDT and BNB/USDC.

You can also swap your existing cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and Chainlink (LINK), for BNB with zero fees and no price slippage by using OKX Convert.

Dive deeper into BNB

As the Ethereum network witnessed a substantial increase in user activity and the adoption of decentralized applications (DApps), the need for scalability became a prominent issue for the first Layer-1 smart contract blockchain. To tackle this challenge, various Layer-2 scaling solutions were introduced to mitigate scalability concerns.

Among these scaling solutions, the Build 'N Build (BNB) Chain has emerged as a competitive player by offering asset-bridging capabilities across different chains. This has provided the BNB Chain with a distinct advantage over established platforms like Ethereum, enabling it to address the scalability limitations and cater to the growing demands of the DApp ecosystem.

What Is the BNB Chain?

The BNB Chain, established in February 2022, is a comprehensive modular system that combines the advancements of the Binance Chain (BC) and the Binance Smart Chain (BSC). The introduction of the BNB Smart Chain (BSC) was a response to certain limitations observed in the BC to complement its functionality.

While the BC was primarily designed to cater to decentralized exchanges (DEX) and focused on achieving high transaction throughput and delivering an enhanced user experience, it lacked smart contract functionality. Instead of incorporating additional functionality into the BC, which could have impacted network efficiency, the Binance community developed the BSC as a separate entity to address these concerns and provide the desired smart contract functionality.

After the merger of both chains, the BC assumed the role of a dedicated layer for governance, encompassing voting and staking functionalities. On the other hand, the BSC was specifically designed to execute Ethereum Virtual Machine (EVM) consensus and support Ethereum-compatible applications, including MetaMask. This strategic implementation allows for seamless integration with smart contracts on the BSC

The BNB Team

The BNB team is led by Changpeng Zhao "CZ," the founder of Binance, who introduced the BNB token and established the BNB Chain in 2017. Another key member of the team is He Yi, the co-founder and chief marketing officer. Before joining Binance, Yi served as Vice President at Yixia Technology, a leading mobile video tech company.

BNB: The utility token of the BNB Chain

BNB, the native utility token of the BNB Chain, plays a pivotal role within the BSC ecosystem. As the governance token, BNB enables holders to actively participate in shaping the development and future of the ecosystem. Additionally, BNB is essential for developers seeking to participate in token sales conducted on the Binance Launchpad.

BNB tokenomics

The BNB token operates under specific tokenomics. It has a maximum capped supply of 200,000,000 tokens, and a deflationary burning mechanism is in place to gradually reduce the supply to 100,000,000 coins. Currently, the total supply of BNB is 157,900,174, with 157,886,280 tokens currently in circulation.

BNB use cases

In recent years, the use cases of BNB have expanded significantly, offering a range of functionalities. These include participating in governance proposals through voting, staking to contribute to the network's security, utilizing BNB as collateral for loans on decentralized finance (DeFi) platforms, and covering transaction fees within the Binance ecosystem. Furthermore, BNB is accepted as a form of payment for credit card transactions at select merchants who support it.

BNB distribution

BNB was introduced in July 2017, initially distributing 200,000,000 coins according to the following allocation:

- Fifty percent of the supply was issued through an initial coin offering (ICO) held in 2017.

- Forty percent of the supply was reserved for the foundation team.

- Ten percent of the supply was distributed to angel investors.

Expanding the utility of the BNB Chain

The BNB community is dedicated to enhancing the BNB Chain by integrating side chains and implementing zk-rollups. These advancements aim to provide customized blockchain solutions and improve scalability, enabling efficient and high-performance operations. With these developments, there is optimism for a resurgence in interest and value for BNB, potentially approaching or surpassing its previous peak of $690.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.