Tron Dominates USDT Circulation as Big TRX Upside Emerges

Layer-1 blockchain protocol Tron now holds over half of all USDT in circulation after the U.S. passed the GENIUS Act earlier in the 2nd quarter.

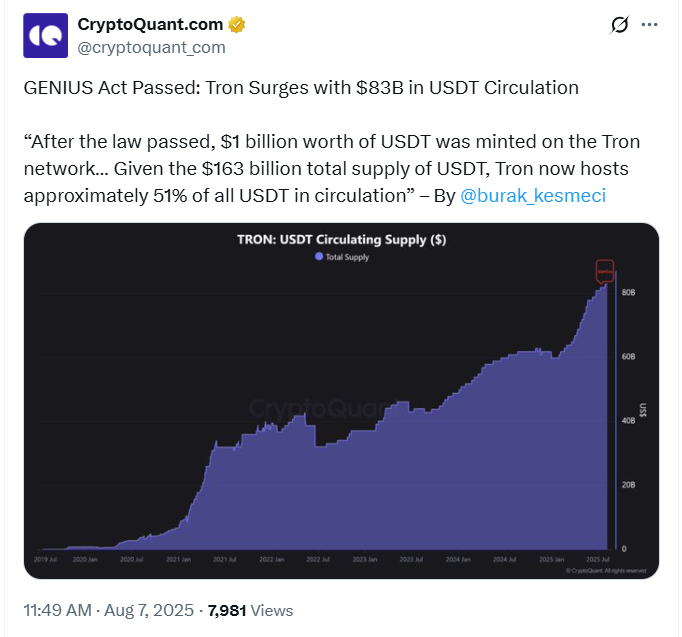

The law gave clear rules for payment stablecoins, and Tron quickly added billions in USDT to its network, bringing its total to more than $83 billion.

Tron Expands Its USDT Share After U.S. Law Approval

Tron gained more ground in the stablecoin market after the GENIUS Act became law in the United States on July 18, 2025.

Notably, the law is the country’s first clear guideline for payment stablecoins. It covers issues like customer safety, money laundering checks, and other detailed financial rules.

Shortly after the law passed, $1 billion in new USDT was issued on the Tron network.

This pushed the total amount of USDT on Tron to more than $83 billion. That figure represents about 51% of all USDT in circulation, out of a total supply of $163 billion.

It is worth mentioning that this made Tron the biggest network for moving USDT, a dominance it has maintained for years.

Tron has been known for its low fees and fast transfer times, which helped it attract more users and stablecoin traffic.

With the new law giving clear support for dollar-backed tokens, more users and companies now feel safe using them.

Market participants believe strongly that Tron’s share of the market shows its readiness to take on that role.

Data showed that in July 2025, the stablecoin market reached $261 billion in value, a 4.87% rise from the previous month.

If anything, Tron’s part of this growth was clear. The stablecoin market on Tron hit a record high of $81.9 billion, according to TRON DAO.

This made it the top chain for USDT by a wide margin.

Tron Marks 8 Years With Major Growth

Tron as a layer-1 protocol has also reached a milestone of its own. It marked its eighth anniversary this week with a shoutout on the X social media platform.

TRON DAO used the moment to share highlights of the network’s journey so far.

The network has processed trillions of dollars in transactions and serves millions of users around the world.

It has built a large global user base while focusing on fast, cheap digital payments. Its growing role in the stablecoin space is now one of its strongest points.

This steady growth has helped Tron stay active through different phases of the crypto market.

It has focused on becoming a solid tool for digital money, and its numbers show that the plan has worked.

More importantly, as stablecoin use grew, Tron’s native token TRX also showed strong adoption signs. The price recently reached $0.3390, its highest point in months.

However, many long-term holders began selling to take profits. Most of this selling came from people who had bought during the 2020 to 2021 market rally.

Data from Glassnode showed that TRX was third in realized gains among all coins this year, behind only Bitcoin and Ethereum.

For about five days, nearly $1 billion in gains were taken by investors. Despite this, TRX coin held firm above the $0.33 level, which many traders saw as strong support.

TRX also continued to see high trading activity, with daily volume near $920 million. The steady price and strong volume suggested that Tron’s native token was still in demand.

It is important to add that as more people use stablecoins and tokenized dollars, networks like Tron may continue to play a key role.

Its ability to hold more than half of all USDT shows how it has grown to become a major platform for digital payments.

The post Tron Dominates USDT Circulation as Big TRX Upside Emerges appeared first on The Coin Republic.