Tron Celebrates New Stablecoin Milestone But Risks This

Tron just celebrated a major win largely thanks to the latest market excitement. The network now holds the highest share of the USDT stablecoin, courtesy of the latest wave of crypto demand and minting.

The amount of USDT on the Tron network maintained an aggressive uptrend since early 2020. The network now controls over $82 billion worth of USDT, which represents about 51% of the stablecoin’s total marketcap.

The network’s total stablecoin marketcap pushed above $83 billion in the last 24 hours. This stablecoin growth was largely fueled by Tron’s focus on a low-cost and rapid blockchain infrastructure.

Tron network’s heavy focus on stablecoin growth and its recent milestone meant that the network was able to tap into stablecoin-driven revenue.

This was evident in its rising daily chain revenue, which has been pushing above $2 million more often lately.

Aside from the stablecoin growth, Tron’s TVL also pushed back above $6 billion towards the end of the week.

Tron’s Stablecoin Expansion Fuels Higher Transfer Volumes

The higher stablecoin count on the network had a significant impact on the network’s performance. According to a recent update, Tron’s daily transfer volume surged by 67% year-over-year.

The higher transfer volume meant that more people were choosing Tron to transfer value through USDT.

Data on the network’s performance before August revealed key milestones such as collective stablecoin transfer volumes above $15 trillion and over 10 billion transactions.

Tron’s dominant USDT position was the primary reason why its daily transactions were consistently higher, compared to top rival networks such as Ethereum.

Meanwhile, Tron’ DEX performance has lagged behind but still maintained significant activity. Weekly DEX volume revealed that although there have been some surges here and there, it struggled to reach levels observed in 2021 and early 2022.

Tron’s dominant position also meant that it might be the best network positioned to take advantage of the GENIUS act’s stablecoin support.

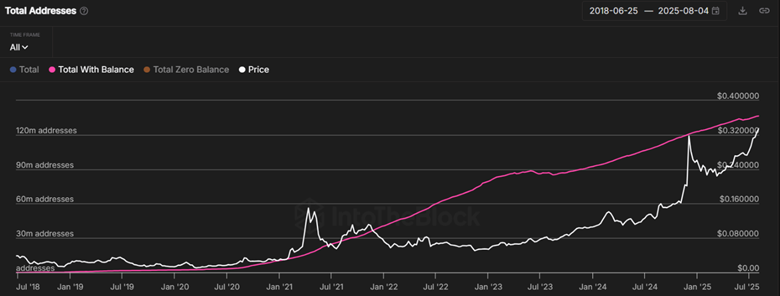

The network’s address stats revealed that the number of addresses holding TRX grew 8-fold compared to the peak address count in 2021.

Tron had a total of 136.45 million addresses with a balance as of 4 August. In comparison, there were roughly 16.44 million addresses with a balance on 12 April, 2021.

Tron addresses with a balance/ Source? IntoTheBlock

The rising number of holders have no doubt contributed a great deal to TRX’s price action. Soeaking of, the coin maintained a bullish bias lately but key observations flash potential shifts.

Tron (TRX) Dominance Retreats Despite Rising Altcoin Season Optimism

The market concluded the week with some interesting developments like BTC dominance dipping below 60% and some altcoins gaining dominance.

In a surprising twist, TRX dominance tanked from 0.87% to 0.82% in the last 2 days. A similar event played out in June where TRX dominance dropped followed by a price pullback just days later. But will a similar scenario play out this time?

TRX price action recently encountered resistance at the $0.34 price level and its RSI has been showing signs of a declining momentum. It also experienced overall selling pressure in the last 2 days of the week, albeit limited.

Aside from the declining RSI and MFI, there were a few other signs that could sway the odds in favor of the bears.

For example, funding rates just dipped into negative territory for the first time in 4 weeks. Spot flows also switched in favor of outflows since Thursday.

While these observations underscored the potential for a pullback, price whale activity still favored the upside. This meant the probability of short liquidations surging was quite high.

The post Tron Celebrates New Stablecoin Milestone But Risks This appeared first on The Coin Republic.