Sun.io: From TRON Eco-DEX to a Global Stablecoin Trading Hub

Recently, stablecoins have set off a wave of frenzy in the financial market and have become a strategic location for mainstream financial institutions around the world. Countries are actively legislating to promote their compliance process and try to integrate it into the traditional financial system, and a fierce battle for coinage rights has begun.

In the global stablecoin market structure, the total circulating supply of USDT issued by Tether exceeds $158.2 billion, accounting for more than 62% of the overall market share. The amount of USDT issued on the TRON network has exceeded $80 billion, accounting for more than 50% of the total USDT issuance for a long time. This means that 1 out of every 2 USDT circulating in the market comes from the TRON network, which is a well-deserved "stablecoin overlord".

Relying on TRON's core position in the global stablecoin field, Sun.io is the largest one-stop financial trading center in the TRON ecosystem, attracting the attention of global stablecoin traders. Through the DEX platform SunSwap, the stablecoin trading tool SunCurve and PSM, and the meme issuance tool SunPump, the combination of a combination of core ecological traffic, is expected to become the world's largest stablecoin trading hub.

Among them, SunSwap supports the free circulation of stablecoins as basic assets on the chain, providing a wide range of stablecoin transactions

wide space; Tools such as SunCurve and PSM, which focus on stablecoin trading, provide low-slippage and accurate stablecoin exchange services, which can meet the needs of large-scale transactions of institutions.

With these advantages, Sun.io is undergoing a magnificent transformation, gradually upgrading from a DEX within the TRON ecosystem to a core hub for global stablecoin trading, redefining the DEX boundary.

Diversified product matrix to build a one-stop financial trading center

In the thriving ecosystem of TRON, Sun.io has long since grown beyond its single role as an asset trading platform to a comprehensive one-stop financial service hub covering the entire asset life cycle with complete functions. Through the coordinated operation of three core engines, including asset trading platform SunSwap, stablecoin trading product SunCurve, PSM, and Meme issuance tool SunPump, a full-link closed-loop service system of "asset issuance, transaction matching, and value appreciation" has been built Sun.io, and has become the core hub for TRON ecological traffic aggregation and value circulation.

SunSwap, an asset trading engine

SunSwap mainly provides asset exchange services, and its operating mechanism is similar to Uniswap, using the AMM model and a constant product formula to determine the price of assets.

At present, SunSwap products have been iteratively upgraded in V1, V2 and V3, and the latest V3 version supports the "dynamic fee mechanism", that is, liquidity providers (LPs) can provide funds within a specific price range and set different fee rates, currently supporting four rates of 0.01%-0.05%-0.3%-1%, which can adapt to token assets with different risk levels and meet the needs of different trading characteristics.

According to official data, on July 2, the value of crypto assets locked in the pool on SunSwap was about $715 million. Among them, the number of fund pools created on SunSwap has exceeded 25,000+, the transaction volume processed in the past 7 days has exceeded 400 million US dollars, the number of transactions has reached more than 84,000, and the number of trading users has exceeded 13,800. Among them, the most actively traded assets are TRX and USDT, with a trading volume of more than $4,000 within 24 hours.

Stablecoin trading engines: SunCurve and PSM

SunCurve and PSM are focused on stablecoin trading. The working mechanism of SunCurve is similar to "Curve", which mainly provides users with a stable coin exchange service with low fees (0.04% per transaction fee) and low slippage, and supports the mutual exchange of stablecoins such as USDD, USDT, TUSD, USDC, etc.; The latter PSM is a stablecoin exchange swap tool launched by TRON DAO specifically for stablecoin USDD, which supports users to exchange USDD with USDT/USDC/TUSD and other stablecoins at a fixed ratio of 1:1, and the transaction process has 0 slippage and 0 handling fees, which is the main place for USDD to exchange stablecoins.

SunPump, the meme coin issuance engine

SunPump is the first meme coin issuance platform in the TRON ecosystem launched by Sun.io, which allows users to create and issue their own exclusive meme coins with one click, and only needs to pay about 20TRX (about 5 USD) for each issuance. On June 27, the market value of CSI, a meme coin on SunPump, once exceeded $10 million, an increase of more than 800% in a single day, becoming a new wealth password hotly discussed in the crypto community.

In addition, SunGenX, an AI coin issuance tool launched for the X platform, supports users to "tweet and issue coins", and only needs to @Agent_SunGenX the issuance information on the X platform, and the Meme coins can be directly deployed to the SunPump platform.

In summary, in the Sun.io product matrix, it mainly relies on the three engines of SunSwap, SunCurve/PSM, and SunPump to drive the efficient flow of funds in the ecosystem, creating a one-stop financial experience for users. Among them, the DEX platform SunSwap provides asset exchange transactions and liquidity mining services, allowing users to easily realize the free exchange of assets and earn huge returns by providing liquidity (LP); The SunCurve and PSM exchange tools specially designed for stablecoin trading provide a guarantee for stablecoin transactions with low slippage, ensuring stable value transmission and maintaining market balance. SunPump, an innovative meme asset issuance platform, accurately covers emerging assets in long-tail traffic, stimulating a steady stream of innovation in the community. These three engines work together to inject a steady stream of power into the Sun.io ecosystem.

This diversified layout enables Sun.io to provide users with one-stop asset issuance, trading and value-added solutions, and users no longer need to operate across multiple platforms, but can easily complete the whole process from asset creation, large-amount exchange of stablecoins to value enhancement on Sun.io platform, which greatly improves the user experience and operation efficiency, and makes on-chain transactions more convenient and efficient.

Compared with general DEXs such as Uniswap and PanCakeSwap, Sun.io has redefined the boundaries of DEXs through the combination of diversified product matrices, embarked on a differentiated development path, and demonstrated unique competitive advantages. No matter which product is taken out alone, it can stand out and dominate the track. For example, despite the first-mover advantage of the Pump.fun, SunPump once surpassed the platform in terms of revenue when it was launched, relying on the huge user traffic base of TRON and sufficient liquidity in USDT. Since TRON accounts for more than half of the USDT issuance, SunCurve and SunSwap will have more obvious advantages once large-scale trading is launched, easily surpassing any DEX product.

More than 600 million SUN tokens have been burned, and TVL ranks among the top five DEXs in the world

The ecological value of Sun.io lies not only in its perfect product matrix, but also in its unique token economic model and strong capital precipitation ability, which has built a double moat. As the governance token of the Sun.io platform, SUN token is gradually moving towards deflation by virtue of the continuous repurchase and destruction mechanism; At the same time, the TVL (total value locked) of the Sun.io platform has been among the top five in the global DEX market for a long time, providing a solid foundation for the stable operation and development of the platform.

SUN tokens run through the product matrix of SunSwap, SunCurve/PSM, SunPump and other products, with rich and diverse application scenarios. It is not only a core tool for platform governance, providing rewards to liquidity providers, but also continuously empowering token holders through a buyback and burn mechanism.

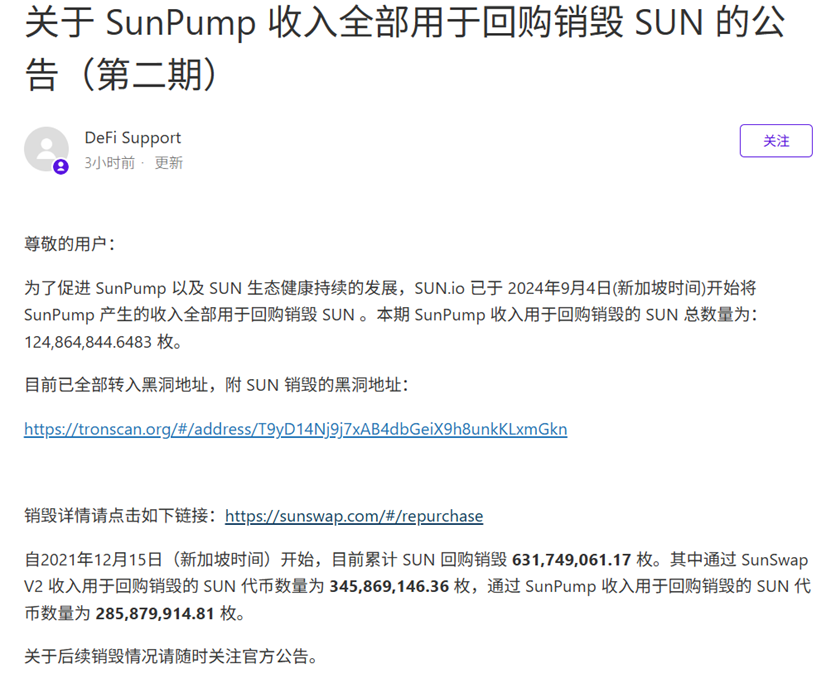

On July 2, SunPump issued the second phase of the announcement of "SunPump revenue is used to repurchase and burn SUN", starting from September 4, 2024, all the revenue of the SunPump platform will be invested in the repurchase and destruction of SUN tokens, and a total of 124 million SUN will be burned in this period, and all of them have been transferred to the black hole address. So far, the number of SUN tokens used to repurchase and burn through SunPump revenue has exceeded 285 million.

In addition, the 0.05% transaction fee generated by SunSwap V2 is also used for the repurchase and burning of SUN tokens, and the SUN team has publicly disclosed the relevant burn data of 43 phases.

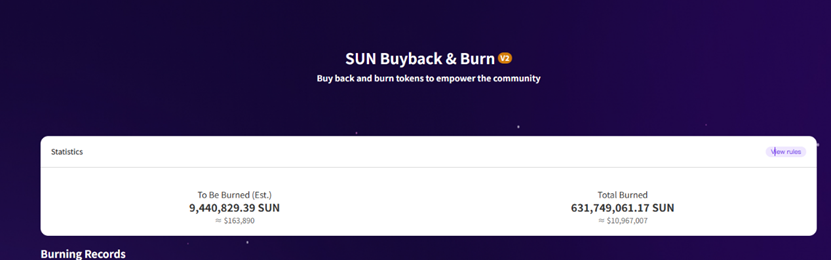

According to the latest disclosure data, as of July 2, the number of SUN burned has exceeded 600 million (about 632 million in detail), accounting for more than 3% of the total supply of SUN (about 19 billion). Among them, the number of SUN tokens repurchased and burned through SunSwap V2 revenue is about 345 million, and the number of SUN tokens repurchased and burned through SunPump revenue is 285 million.

This continuous buyback and burn mechanism effectively reduces the circulating supply of SUN tokens. Since the total supply of SUN remains the same, as the amount of SUN burned increases, the amount that flows into the market will also decrease, thus automatically deflationary. Prices are influenced by supply and demand, and all other things being equal, a decreasing supply increases scarcity, which in turn pushes its value up. According to Coingeck data, the current price of the SUN token is only $0.017, an increase of more than 50% in the past 1 year.

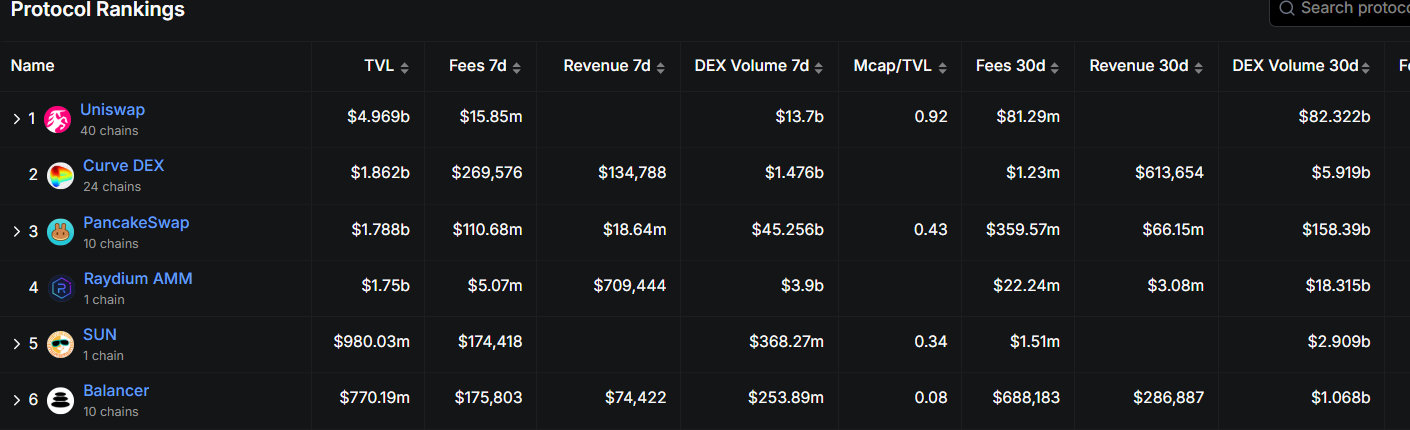

Regarding the competitiveness of SUN.io platforms in the DEX track, it can be seen from the TVL data. According to DeFiLlama data, as of July 2, the TVL of the Sun.io platform exceeded $970 million, ranking among the top five in the entire DEX market for a long time.

TVL not only reflects the value of crypto assets locked by the platform, but also is an important indicator to measure the scale and market influence of the platform. High TVL means that a large number of users and assets are staked and traded on the Sun.io platform, which reflects the high trust and recognition of users on the platform. At the same time, high TVL also has a strong attraction, which can drive more users and funds to flow into the platform, forming a virtuous circle and further consolidating Sun.io's leading position in the DEX market.

With the increasing attraction of the TRON ecosystem and the continuous influx of a large number of users, it is foreseeable that the Sun.io platform users and capital trading volume will enter explosive growth, the amount of income and capital precipitation will increase, the number of SUN used to repurchase and burn will only increase, the SUN burning rate will accelerate, and the platform TVL will continue to rise.

From a TRON eco-DEX to a global stablecoin trading hub

In the on-chain financial landscape of TRON, with Sun.io's full-stack product layout, users can easily complete the whole process from asset creation to transaction value-added on only one platform, becoming the traffic aggregator of the TRON ecosystem. On the asset issuance side, Sun.io Meme platforms SunPump and SunSwap can greatly lower the threshold for project cold start-up, providing a stage for rapid growth for many innovative projects. On the transaction matching side, SunSwap, SunCurve, PSM, etc. provide 100 million US dollars of in-depth support; SunPump will serve as an emerging traffic portal, actively guiding assets to trade on SunSwap and precipitating and increasing value in the LP pool, further enhancing the activity and liquidity of the market.

Sun.io is not only the core source of mobility in the TRON ecosystem, but also plays an indispensable role as a coordinator within the ecosystem. It is like a precision operation of the central system, on the one hand, it efficiently connects buyers and sellers, provides a smooth channel for accurate docking of transactions, and ensures that every transaction can be completed quickly and accurately; On the other hand, as a key entry point for project cold launch and asset issuance, it can accurately guide the liquidity of new assets, find suitable trading opportunities for each project and asset, and become a central hub that accurately connects assets, projects and users. In this way, Sun.io continues to drive the flow of value and the cohesion of consensus within the TRON ecosystem, laying a solid user base for it as a stablecoin hub and redefining the boundaries of DEX.

With the strategic upgrade of TRON and the entry of traditional capital, Sun.io is also accelerating its transition from an ecological DEX to a global stablecoin trading hub.

In the field of stablecoins, TRON has taken a multi-pronged approach to build a "stablecoin matrix" covering different scenarios. While consolidating the hegemony of USDT, it actively adopts the multi-track parallel strategy of "compliant stablecoin + decentralized stablecoin", constantly expands the boundary, and forms a multi-line layout of "USDT + USDD + USD1". As of July 3, TRON had $80.7 billion in USDT issuance, an increase of more than $20 billion since the beginning of the year. USDD, the native decentralized stablecoin, has surpassed $450 million in issuance, and USD1, a compliant financial stablecoin backed by the Trump family, has also been minted on TRON.

In the traditional financial market, TRON successfully entered Wall Street as a listed company, breaking down the gap between traditional finance and the on-chain ecology. In mid-June, TRON entered the mainstream financial market through a reverse merger with NASDAQ-listed SRM (SRM Entertainment) and entered the U.S. stock market. At the same time, the "TRX Micro Strategy" was launched simultaneously, and TRX assets were included in the reserve assets of listed companies, so that traditional financial institutions can indirectly allocate TRX through SRM holdings. On June 30, SRM-listed companies announced that they had pledged their 365 million TRX tokens on-chain through JustLend DAO, a lending platform based on the TRON ecosystem. In addition, as the application result of TRX ETF is approaching, TRON is expected to leverage tens of billions of dollars of incremental new funds into its ecosystem.

With the dual blessing of the scale of 100 billion stablecoins and listing dividends, Sun.io will become the beneficiary of the TRON ecosystem, and as the first stop of the capital flow entrance, it will be the key channel entrance for institutional funds to enter the market. There is a strong demand for low slippage and large-value trading channels for institutional funds, and SunSwap will become the best place for institutional large-amount transactions with its depth of 100 million US dollars. With a low fee rate of 0.04% and a PSM exchange tool, SunCurve will become the preferred platform for stablecoin exchange by using USDD to redeem USDT, TUSD and other stablecoins at a 1:1 zero fee.

In addition, Sun.io products can work in tandem with TRON ecosystem applications to build multiple revenue paths. Taking the RWA product stUSDT as an example, users can obtain the RWA certificate token stUSDT by staking USDT. This certificate token can not only be freely exchanged for other stablecoins or various assets on SunSwap, but also can easily earn fee income by providing relevant liquidity pool (LP) shares, realizing asset appreciation and flexible use. It can also be linked with the lending protocol JustLend DAO, users can pledge USDT, USDD and other stablecoins to carry out asset lending business, and the borrowed assets can be directly invested in the SunSwap liquidity pool, thus forming a triple cycle of "deposit-borrowing-mining", with a comprehensive annualized rate of return of more than 10%, bringing users rich and stable returns.

With the deepening of diversified product layout and the coordinated development of the ecosystem, Sun.io has broken the boundary limitation of a single DEX and become a global stablecoin trading hub connecting traditional finance (TradFi) and decentralized finance (DeFi), compliance and decentralization, and the real world and the on-chain world.