New Crypto ETFs to Change Altcoin Season Forever

Crypto investing has entered a new era. With U.S. regulators greenlighting 19 spot cryptocurrency ETFs, including 11 for Bitcoin and 8 for Ethereum. Successively, traditional and new investors alike can now access digital assets with a click, minus the wallet headaches.

But as we edge closer to possible altcoin ETF launches, will this disrupt the classic “altseason” cycle? In this report, I’ll break down the numbers, trends, regulatory pivots, and first-hand opinions (including mine and those of fellow crypto investors). That paints the picture of this ETF-driven transformation.

Table of contents

- The Crypto ETF Boom: By the Numbers

- Leading Crypto ETFs

- Crypto ETF Flows

- ETF Flows Table

- Potential Upcoming Crypto ETFs

- Impact on Market Cycles

- Regulatory Winds

- Regulatory Timeline Table

- Why are Crypto ETFs So Attractive?

- Potential Risks and Limitations

- Conclusion

- FAQs

The Crypto ETF Boom: By the Numbers

Here’s how the U.S. spot ETF landscape looks today (as of August 8, 2025):

| ETF Type | Number Approved | Key Funds (Top Flows) | Combined AUM | % of Market Cap |

| Bitcoin | 11 | IBIT, FBTC, ARKB, BITB | $150.97B | 6.47% |

| Ethereum | 8 | ETHA, FETH, ETHE, EZET | $21.80B | 4.66% |

- In total, U.S. BTC Spot ETF daily inflow: $280.7M

- Cumulative net inflow: $54.02B

- BTC ETF value traded (daily): $3.55B

- ETH Spot ETF net inflow (daily): $222.3M

- ETH ETF value traded (daily): $1.90B

Insight: Bitcoin ETFs command roughly 6.5% of Bitcoin’s global market cap in ETF wrappers. While Ethereum is nearing 5%, a sign that mainstream capital is flooding in, especially as traditional institutions diversify beyond just holding shares or bonds.

When choosing between ETF options, expense ratio, liquidity, and custody arrangements truly matter. Here’s a quick comparison.

| Fund | Asset | Expense Ratio | Custodian | Liquidity | Standout Feature |

| IBIT | Bitcoin | 0.25% | Coinbase | High | #1 for volume, top liquidity |

| FBTC | Bitcoin | 0.25% (0% init.) | Fidelity | Growing | Self-custody, strong brand |

| GBTC | Bitcoin | 1.50% | Coinbase | Dropping | High outflows, former leader, now higher risk |

| BITB | Bitcoin | 0.20% | Not Spec. | Fastest AUM | Cheapest, open-source focus, $1B in assets |

| ETHA | Ethereum | Not Stated | Not Spec. | Very High | Tight bid-ask, precise ETH price tracking |

| FETH | Ethereum | Not Stated | Not Spec. | Good | Fidelity exposure to ETH, strong tracking |

| ETHE | Ethereum | Not Stated | Not Spec. | Good | Trust, not ETF, can trade at a NAV discount |

Redditor wisdom:

“IBIT is very liquid, attracting a lot of trading activity, which means it’s easier for you to trade without big price swings.”

“Lots of ups and downs past few months. Could probably get a good return buying the dips and selling on the bull runs.”

“FETH has shown strong tracking accuracy and is a solid choice for those looking for direct Ethereum exposure.”

“GBTC has been experiencing outflows, meaning people are selling off their investments, which could indicate issues with liquidity or investor confidence.”

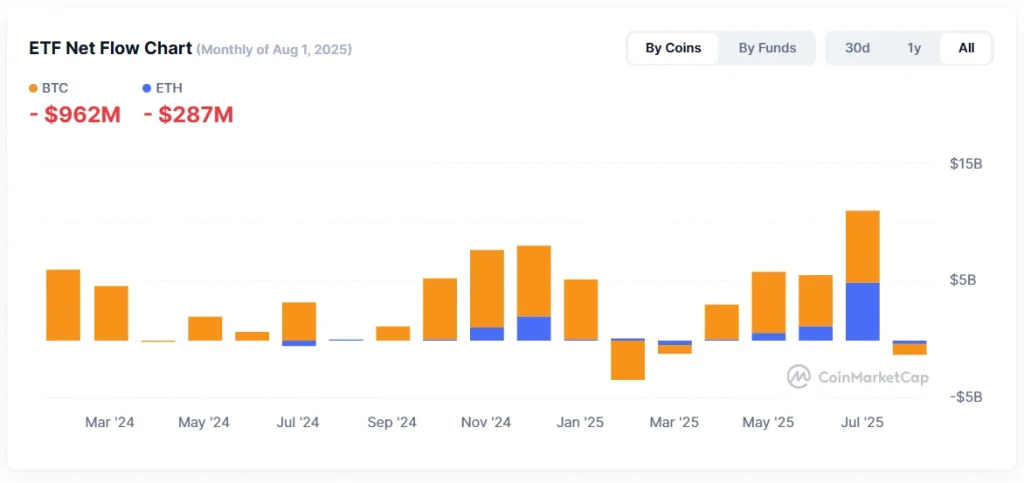

Crypto ETF Flows

ETF flows now actively influence both short and long-term price action in the crypto market. Recent stats show:

- BTC ETF Netflow (Aug 2025):

+$277M in weekly positive flows; FBTC, IBIT, and ARKB take the lion’s share. - ETH ETF Netflow (Recent Weeks):

+$222M cumulative inflow, with ETHF, CETH, and EZET leading.

ETF Flows Table

| Coin | ETF Netflow (YTD) | Netflow Leaders | ETF AUM | Market Cap % via ETF |

| Bitcoin | $962M | FBTC, IBIT, ARKB | $58.28B | 5.61% |

| Ethereum | $287M | ETHF, CETH, EZET | $10.63B | 1.77% |

Potential Upcoming Crypto ETFs

| Crypto ETF Type | Applicants | Expected Approval Window | Notes |

| Solana (SOL) | VanEck, 21Shares, Bitwise, Grayscale, Canary, Franklin Templeton | Q3/Q4 2025 | Regulatory confidence is high, the first staked ETF is already live |

| Dogecoin (DOGE) | Grayscale, NYSE Arca, WisdomTree | Q3/Q4 2025 | Meme coin ETF gaining traction |

| Litecoin (LTC) | Canary, Grayscale, CoinShares | Q3/Q4 2025 | Most likely next altcoin ETF |

| XRP (Ripple) | Grayscale, 21Shares, Bitwise, Canary, Franklin Templeton, CoinShares, RexShares | October 2025 | Multiple filings; Canadian precedent |

| Multi-Asset Index | Bitwise, Grayscale, Hashdex, Franklin | Delayed, expected by Q4 2025 | SEC “stay” on first launches |

| Meme/Novelty Coins | REX-Osprey, Trump Media | Q4 2025–2026 | Regulatory caution, but applications are active |

Impact on Market Cycles

Historically, “altcoin season” occurred after Bitcoin price surges, as investors rotated profits into smaller coins, hoping for outsized returns. The launch of major BTC and ETH ETFs appears to have deepened their market dominance. This is evidenced by the AUM and ETF netflow metrics above. Should altcoin ETFs for coins like Solana, Dogecoin, Litecoin, Ripple, or Cardano be approved, here’s my take:

- Altcoin ETF launches may catalyze a new, institutional altseason, dragging more speculative capital into the alts space.

- ETF wrappers could bring stability, but also tighter correlation to macro market cycles, potentially muting wild altcoin swings of the past.

- BTC and ETH ETF growth have already compressed their volatility compared to previous years, as large institutions move in.

Regulatory Winds

Regulatory clarity remains central. This year, SEC Chairman Paul Atkins made waves with the “Project Crypto” announcement:

“We’re at the threshold of a new era… Project Crypto is an initiative to modernize the securities rules and regulations to enable America’s financial markets to move onchain. The PWG report is the blueprint to make America first in blockchain and crypto technology. We will not watch from the sidelines. We will lead, we will build, and we will ensure that the next chapter of financial innovation is written right here in America.”

This bold U.S. government push means the ETF pipeline is just beginning, and “America First” in crypto assets could soon be official policy reality.

Regulatory Timeline Table

| Year | Event | Impact |

| 2023 | First BTC ETF Approved | Sparked $50B+ inflow in 12 months; made BTC more accessible |

| 2024 | ETH Spot ETF Greenlight | Additional $10B in ETF AUM, ETH gains increased institutional trust |

| 2025 | “Project Crypto” Announced | New rule reforms expected, altcoin ETF approvals projected as next step |

Why are Crypto ETFs So Attractive?

- Simplicity & Security

- Tax Advantages

- Transparency & Open Source

Potential Risks and Limitations

- Volatility

- High Fees (for some)

- Counterparty Risk

Conclusion

Crypto ETFs have fundamentally reshaped how investors from Wall Street to Main Street access digital assets. The rise of Bitcoin and Ethereum ETFs demonstrated massive demand, driving institutional assets and inflows at breakneck speed.

I believe the next market cycle could see this dynamic replicated in altcoins if and when their own ETFs get the green light. The U.S. government’s “Project Crypto” shows regulatory support isn’t fading, rather, it’s accelerating. As adoption grows, expect increased market stability, but also new patterns in how altcoin cycles emerge, dominated less by retail and more by institutional flows.

My call: Watch the ETF approvals list. The next time an altcoin ETF drops, don’t be surprised if the classic altseason and the old rules get rewritten forever.

FAQs

Bitcoin and Ethereum ETFs channel billions in institutional money into crypto, boosting liquidity and price stability, but also more tightly linking crypto cycles with broader financial markets.

Yes, altcoin ETFs will likely bring a new wave of institutional investment, fueling fresh altcoin cycles and changing classic market dynamics, though possibly with less volatility.

The upcoming altcoin ETFs most likely to be approved by the U.S. SEC include those for SOL, XRP, LTC, DOGE, ADA, and AVAX.