Kanye Token YZY Declares Celebrity Coin Myth Shatting?

Written by: Frank, PANews

Thecelebrity coin track is making waves again, and the world's most influential but controversial artist Kanye West (Kanye) suddenly announced the release of his personal MEME token YZY on August 21, with its market capitalization rising to more than $3 billion in a short period of time. In just a few hours, some people made millions of dollars by laying out in advance, while many more people were hung on the top of the mountain in a hurry.

PANews conducted an analysis of the initial buying and selling of YZY's top 1000 large holders. This time, YZY's launch seems to have completely ripped off the nihilistic link between the so-called celebrity coin issuance and the wealth story. The rat barn and robots are all profitable, and there is no "civilian" winner in the game of celebrity coins.

The acceleration of large investors is still hanging at the top of the mountain

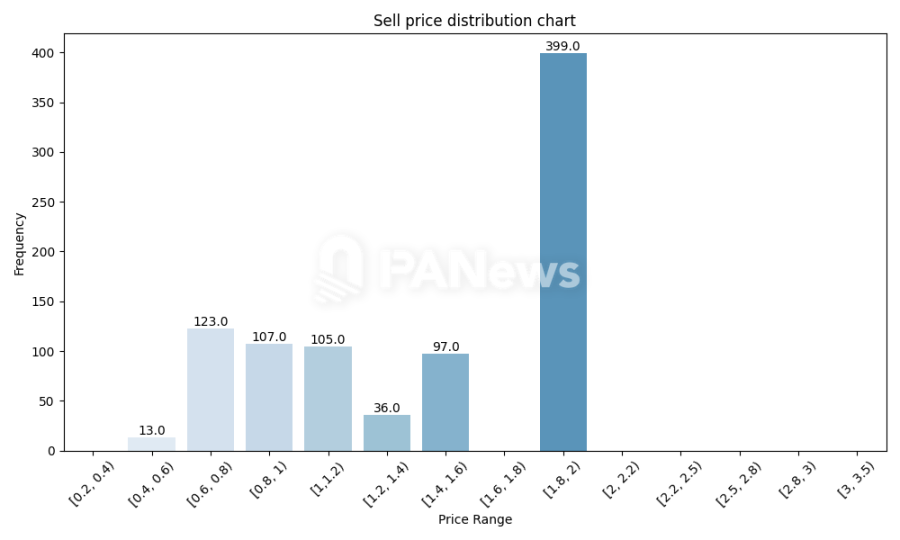

Judging from the overall data, the average cost price of the initial purchase of YZY's top 1,000 coin holding addresses is about $1.45. Among them, the initial purchase price of a large number of large investors is about 1.8~2 US dollars, and about 44% of the initial purchase cost of large investors is in this range. Perhaps because they are trapped when they buy, YZY's large investors have generally not made their initial sale as of August 25, and after 893 addresses bought it, about 275 addresses sold some tokens, accounting for only about 30% of the selling.

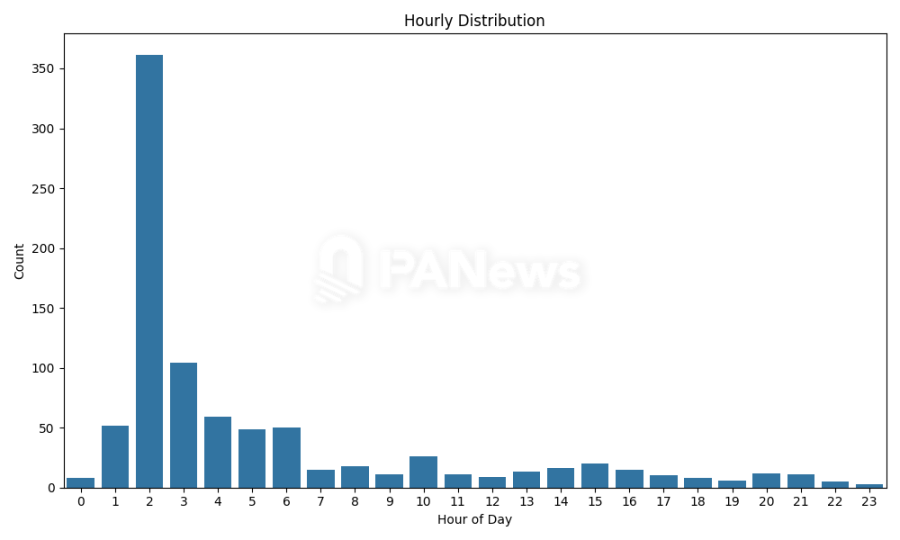

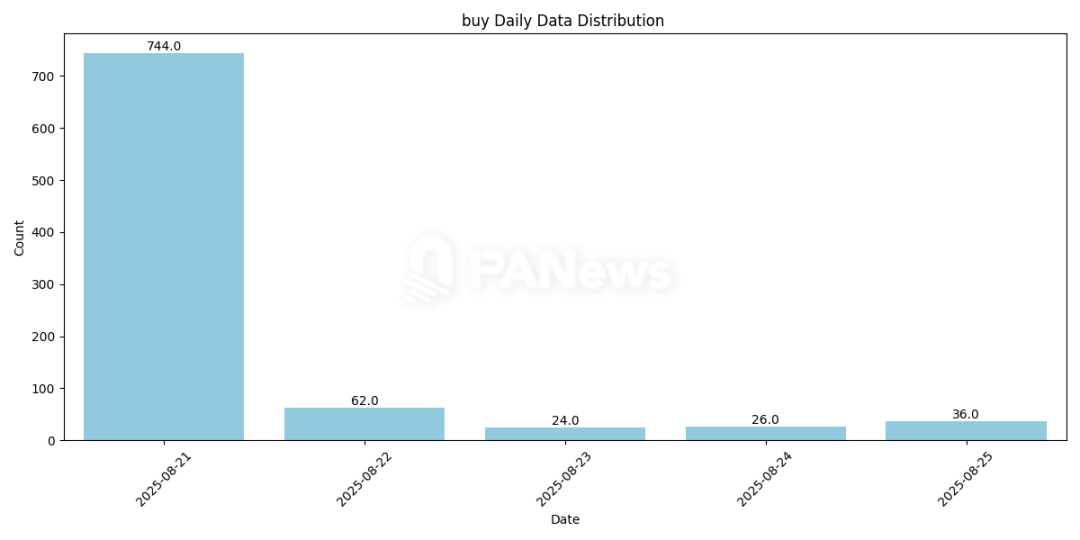

From the perspective of time nodes, the timing of these big players entering the market is not slow. Basically, it is concentrated on August 21 (the day the token is released), and the time is also concentrated within 1 hour after Kanye's announcement. More than half of the addresses were bought within 2 hours of the token's opening.

terms of the size of the capital, the average initial investment of these large investors is about $285,000. This value is much higher than Libra's top 1,000 addresses (the average is about $9,696), but far lower than the average of $590,000 bought by the top 1,000 TRUMP tokens at the time. Overall, the total holdings of these large investors are about $46.76 million (excluding team holdings), accounting for about 8.5% of the total market capitalization and about 65.3% of the total circulating supply.

From the perspective of the effect of selling, although only some large investors have carried out selling operations, from the data point of view, these large investors who left the market are basically selling at a loss. The average initial sale price was $1.19, which is about 18% of the average loss compared to the average entry price of $1.45. In addition, the average position to sell is also much smaller than the entry, which is only $11,800.

From this perspective, it seems that the main participants of YZY this time are no longer retail investors, but large investors who are keen on celebrity coins. Compared with the previous TRUMP and LIBRA, the big players entered the market faster this time, and they were all concentrated in the early stages of the opening. However, the follow-up market recognition seems to be insufficient, and by August 22, although the price of YZY has fallen back to less than half of the price of the initial large investors, only sporadic large investors still choose to enter the market at this stage.

The rat barn and robots are the harvesting game of knives and knives

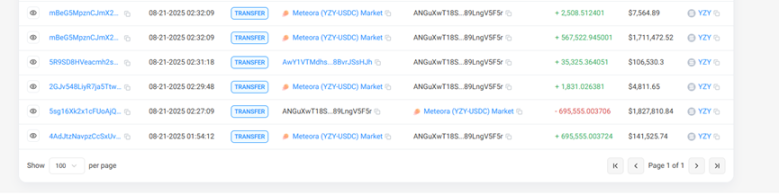

,and the largest single buyer is ANGuXwT18StoX2Ghp3387x6vajPk3sEsxC89LngV5F5r, which spent $200,000 to buy 695,000 tokens within a minute of Kanye's announcement of the address, with an average price of about $0.287. To complete this buy-in, the address not only set a 40% slippage but also paid an additional 3.8 SOL to Jtio as a priority fee.

Of course, in the end, half an hour later, the address sold $1.82 million, making a profit of more than $1.6 million.

– >

– >

it is worth noting that this address is also considered by the community to be part of an insider group. This address was created on August 19 (YZY's token was also created on the same day), and then about $200,000 in USDT and 49 SOL were withdrawn from the Binance exchange. Since then, the address has not traded other meme coins until YZY was listed. Obviously, this address was created to ambush the YZY token.

In our sample, 4 addresses bought YZY within 1 minute of opening. However, there are also robot masters who rush to open the market, such as the address 6xuMV6W6QVxrVmsZxEdLfV6kfhuBsg3ah1X8rydLfQvy, which invested 300 SOL to buy YZY within 2 minutes of the opening, and finally made a profit of about $80,000. In terms of transaction behavior, this address often conducts MEME token transactions, with over 10,000 transactions conducted so far.

In addition, according to a survey released by Bubblemaps, Hayden Davis, who had previously planned and sniped celebrity coins such as MELANIA and LIBRA, made another move this time, scattering funds through multiple centralized exchange addresses and sniping at YZY tokens for the first time, ultimately making a profit of about $12 million.

The myth of celebrity coins has been shattered

Nearly a year ago, since Trump issued TRUMP, the issuance track of celebrity coins has entered a period of centralized issuance. However, judging from the results, these celebrity tokens generally fell by more than 90%, causing great harm to investors.

As of now, TRUMP has a circulating market capitalization of approximately $1.65 billion, down about 90% from its high. The president's wife token, MELANIA, has a circulating market capitalization of approximately $148 million, down about 99% from its high. The market capitalization of LIBRA, a token issued by the Argentine president, is only $5.4 million, a 99.9% evaporation from its high of $4.7 billion. And the trajectory of these tokens is the same L-shaped, and since the climax of the early issuance, there has been no waves and has been declining.

In terms of the number of coin holding addresses, the 27,000 coin holding addresses of YZY are far less popular than the previous celebrity coins. On the other hand, the cost range of large investors is as high as $1.8 or more, and the dilemma of those who do not come after them makes it exponentially more difficult to make a profit. From the perspective of the K-line, as long as they failed to rush into the market within 10 minutes, almost all of them were hung at the highest point, and the decline was very fast, and it only took 2 hours to fall 70% from the highest point. This decline and speed are even more exaggerated than some contextless meme coins.

YZY's Initial Chart

Looking back at the numerous celebrity coins from TRUMP to YZY, we can clearly see a similar trajectory:

Blitzkrieg and head effect: The launch of celebrity coins relies on the huge influence of celebrities themselves, which can instantly attract global attention and funds. This led to a price spike in the early opening, creating amazing profit margins for a very small number of "insiders" or "frontrunners". They use information advantages and technical means to complete the harvest before retail investors enter the market.

"Big Investors" Take Over and Retail Investors' Confusion: Unlike ordinary meme coins, the main participants in the second wave of celebrity coins are often large investors with deep funds. They may have missed the first golden minute, but with their superstition about the celebrity effect and the gambler's mentality, they chose to take over at a high level. However, once the popularity is difficult to sustain and the follow-up funds cannot keep up, these large investors will be trapped along with the retail investors who have heard the wind.

Value Vacuum and L-Shaped Movement: Peeling back the aura of celebrities, these tokens themselves have little to no real value and use case to back them. When the hype subsides and market sentiment cools quickly, the price will "free fall", eventually forming an unsightly "L" candlestick. The myth of skyrocketing only exists in the first minutes or hours, and with it comes a long road to zero value. From TRUMP to LIBRA and now YZY, this "iron law" has been verified without exception.

This turmoil in YZY once again proves that the celebrity currency track is not a blue ocean of value, but a dangerous casino manipulated by information asymmetry and market sentiment.

In this game, the real winners are always those insiders and capital hunters who can lay out in advance and harvest accurately. For the vast majority of ordinary investors, when they see news from social media, they are often at the peak of risk. YZY's rapid rise and sudden cooling have once again sounded the alarm for the frenzied meme market: under the aura of celebrities, there is often an investment abyss that is unbearable for ordinary people.

When the next "Kanye" appears, investors should probably first ask themselves whether they want to be the fuel in other people's wealth myths, or choose to stay away from this carnival that is destined to profit for a few.