Governance failures, airdrop chaos, value mismatches: what kind of tokens do the crypto industry need?

Original author | Stacy Muur(@stacy_muur)

Compile | Odaily Planet Daily (@OdailyChina).

Translator | Jingle (@XiaMiPP).

Editor's note: @BinanceResearch released a research report on the evolution of token models in June 2025, an in-depth review of Web3 projects' attempts and lessons learned in token design, incentives, and market structures over the past few years. From the bubble of the 1CO era, the short-lived glory of liquidity mining, to the recent re-examination of the issuance method, governance methods and economic model.

Stacy Muur collated the report and condensed ten key observations, revealing core problems such as governance failure, inefficient airdrops, fragmented models, and supply distortions, while also pointing out the gradual return of the market to "real demand" and "income support". During the market downturn, these insights may provide an important reference for the next stage of token issuance, valuation, and mechanism innovation.

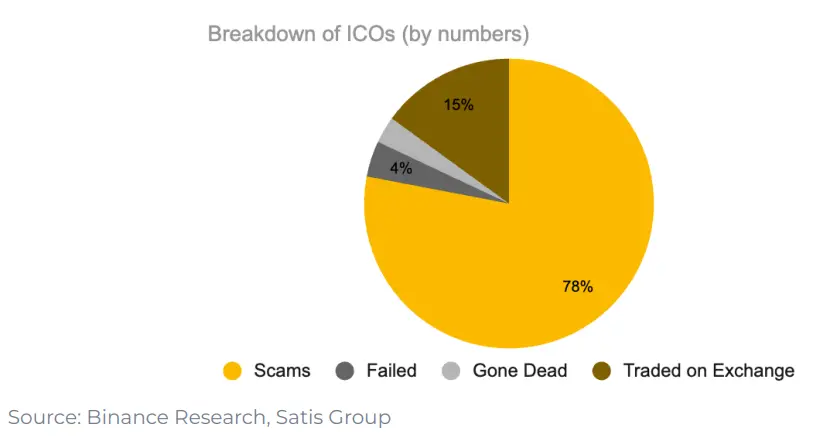

1. Only 15% of projects in the 1CO era ended up successfully listing on exchanges

78% of projects are outright hoaxes, and the rest either fail or fade into silence. This shows that the market at that time was rife with short-termism and lacked a truly sustainable construction momentum.

2. "Governance" as a design for token utility is not really working

After UNI's airdrop, only 1% of wallets chose to increase their holdings, and 98% of wallets never participated in any governance votes.

Governance sounds good in theory, but in practice, many times it's just another word for "exiting liquidity."

3. Liquidity mining started with Synthetix in 2019, but it failed to sustain long-term demand

However, the "right to govern" did not sustain a sustained focus on the project. The data shows that 98% of airdrop recipients never participate in governance, and most sell tokens directly after the airdrop.

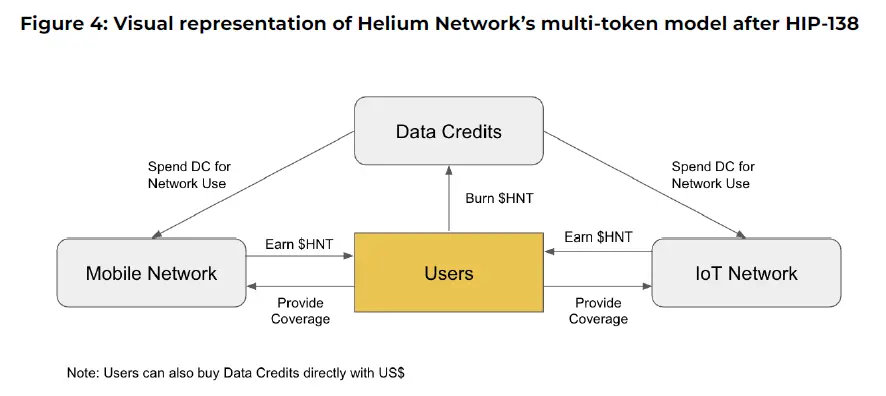

4. Axie Infinity's multi-token model with Helium failed in attempt

Projects like Axie Infinity and Helium have used a multi-token model that separates "speculative value" from "utility utility." One token is used for value capture and the other for network use.

But in practice, this split didn't work: speculators flocked to "utility tokens", incentives were misaligned, and value began to crumble. Eventually, both projects had to go back to a simpler single-token design.

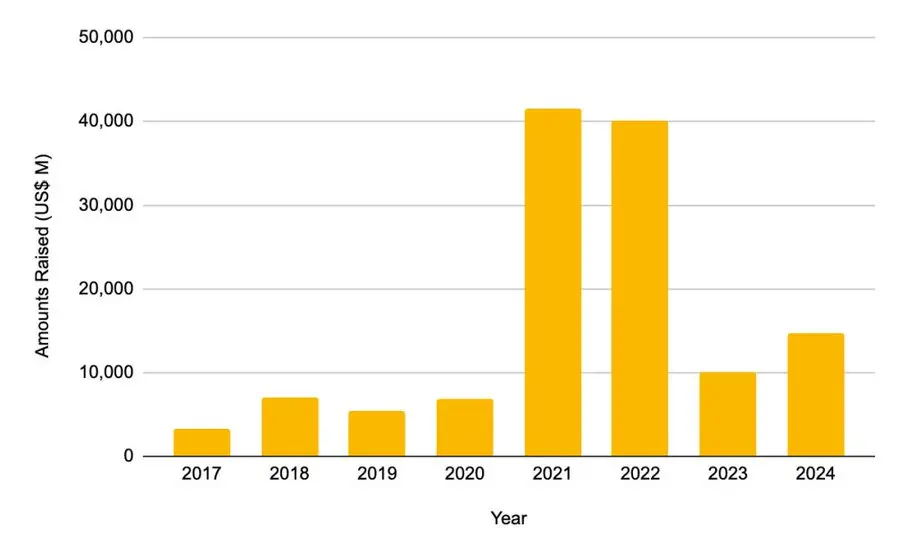

5. Private equity financing peaked in 2021-2022

-

In 2021, the total amount raised was $41.46 billion

-

In 2022, it was $40.12 billion

This is more than double the total amount raised for the entire 2017-2020 cycle. However, this funding boom did not last since.

6. After the L2 airdrop snapshot, the usage of cross-chain bridges plummeted

Whenever L2 announces an airdrop snapshot, the usage of cross-chain bridges drops rapidly. This means that this surge in usage is not due to real demand, but to the airdrop party's transaction.

Most users sell their tokens after the airdrop, and projects often mistake this short-term "flow" for a true product-market fit.

7. In 2025, the token issuance method will be adjusted

-

Initial liquidity in the market has increased significantly

-

The average fully diluted valuation (FDV) decreased from $5.5 billion to $1.94 billion

The data shows that tokens that have a higher percentage of circulation at the time of issuance and have a more reasonable valuation perform better after listing. The market is gradually rewarding more authentic and transparent tokenomics models.

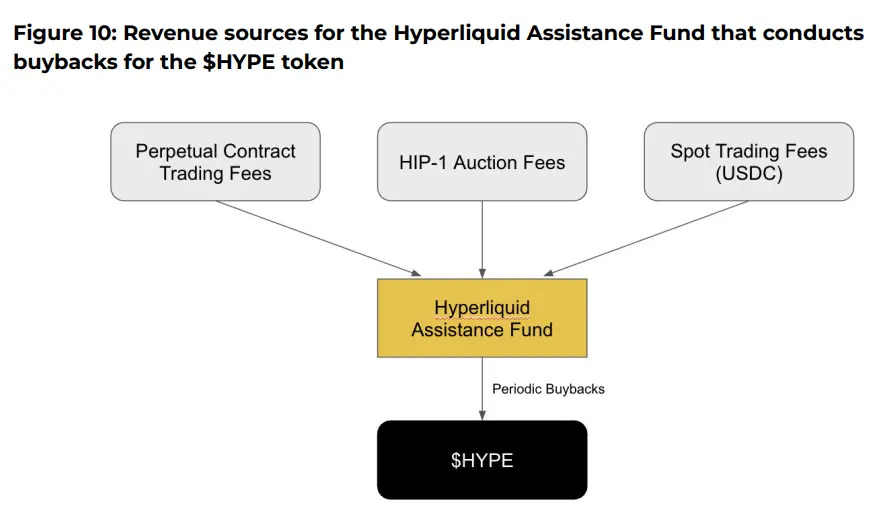

8. The repurchase mechanism returns

Protocols such as Aave, dYdX, Hyperliquid, Jupiter, and others have launched structured "redeem and burn" programs, using protocol revenue to buy back tokens from the market and burn them. This is both a symbol of financial health and a stopgap measure when the "lack of utility of tokens" issue has not yet been resolved.

9. Hyperliquid's Repo Truth

In the case of @HyperliquidX, the protocol has repurchased and burned more than $8 million worth of HYPE tokens, which comes from 54% of its transaction fee income. However, these buybacks do not pay dividends to token holders, but only support the token price by creating "scarcity".

Critics argue that such buybacks are a mismatch of capital. It creates artificial deflation instead of giving the actual gains back to token holders. In contrast, a token model with income dividend attributes may bring better incentive matching.

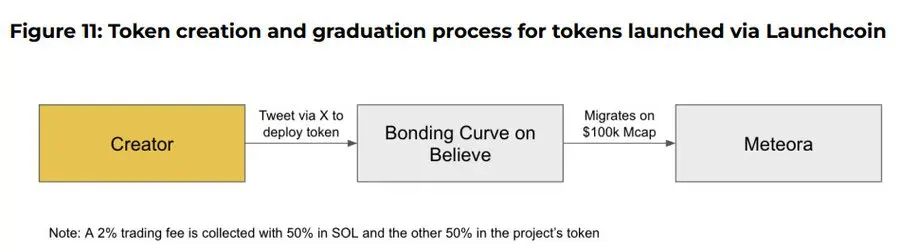

10. The Believe App is an emerging player in the current ICM (Instant Marketplace) narrative

The app allows users to easily create tokens on the Solana chain by posting tweets in a specific format on X (formerly Twitter), such as "$TICKER + @launchcoin", which will trigger price discovery and liquidity deployment through the binding curve model, enabling community tokens to be issued and traded without development.

Final Conclusion: Despite the evolution of the model, the utility of tokens remains an open question

-

Governance mechanisms have proven to lack user stickiness

-

The buyback program is somehow just an alternative to the token's lack of intrinsic demand

-

The points and airdrop mechanisms are more short-term strategies