Curve Finance Swaps on Arbitrum Could Vanish in Coming Months: Here’s Why

Key Insights:

- Curve Finance’s Arbitrum usage has dropped below 2% of its total TVL, raising sustainability concerns.

- A new proposal suggests cutting all L2 developments due to low returns across 24 chains.

- Ethereum continues to dominate Curve’s fees, volume, and governance focus; L2s are barely holding on.

Curve Finance, a decentralized exchange (DEX) known for stablecoin and low-slippage swaps, might be closing shop on Arbitrum, and possibly other Layer 2 (L2) networks too.

A new proposal on Curve’s governance forum suggests killing off all future L2 deployments. And if you check the numbers, that call isn’t coming out of nowhere.

Arbitrum TVL Is Shrinking Fast

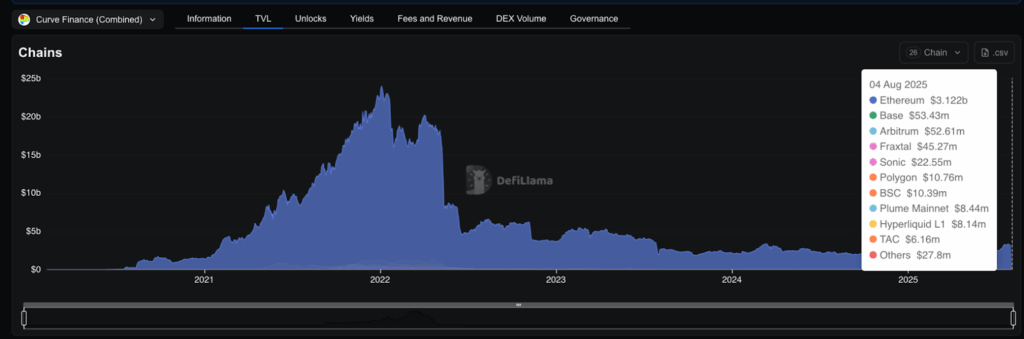

To understand what’s going wrong, start with total value locked (TVL), which shows how much money users have deposited into Curve’s smart contracts.

On August 4, Curve’s TVL on Arbitrum stood at just $52.6 million. For comparison, Ethereum, the original base chain for Curve, had over $3.1 billion. That’s not a typo. Arbitrum now makes up barely 1.6% of Curve’s total TVL, and it’s dropping.

Arbitrum is one of the most popular Ethereum L2s, offering cheaper and faster transactions by offloading data from Ethereum’s main chain.

Yet despite its broader adoption, Curve’s presence there is fading. Other chains like Base, Fraxtal, and Sonic aren’t doing much better either.

Curve’s TVL on all L2s combined is less than 3% of its Ethereum TVL. That’s a major warning sign for Curve on Arbitrum and its other L2 deployments.

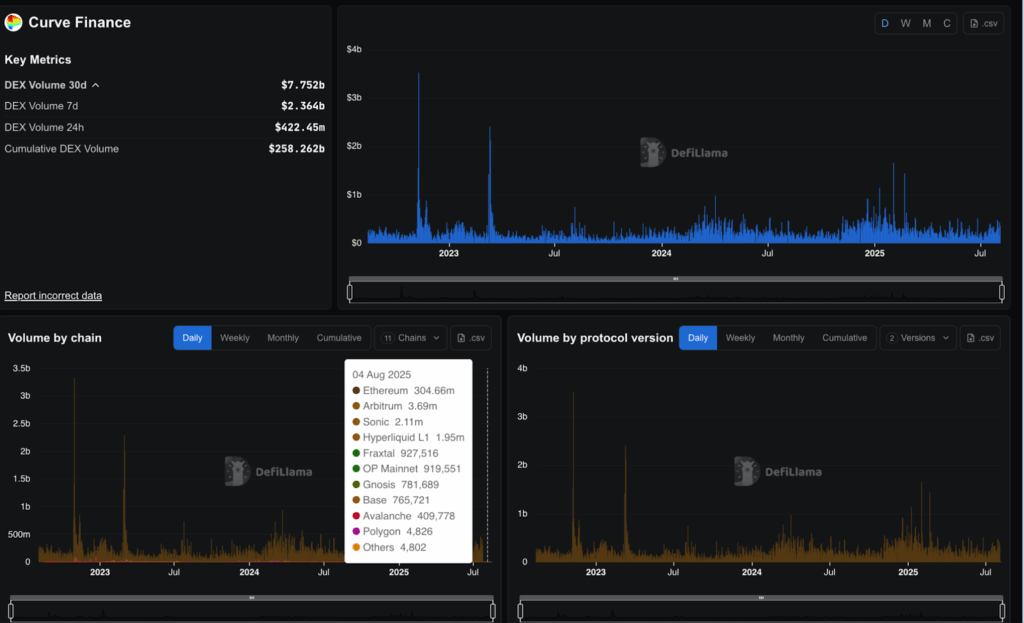

TVL tells you where the money is parked, but what about activity? Let’s look at Curve’s 24-hour DEX volume on August 4. Ethereum pulled in $304 million. Arbitrum?

Just $3.6 million. Even Sonic, a much newer chain, clocked $2.1 million. That’s not just bad; it’s borderline irrelevant in the bigger picture.

DEX volume measures how much trading actually happens.

Curve specializes in stablecoin swaps like USDC, USDT, DAI, and crvUSD, and typically thrives on high, consistent volume. But Arbitrum isn’t delivering.

When you zoom out to 30-day DEX volume, Curve processed about $7.7 billion overall. The bulk came from Ethereum. Arbitrum didn’t even scratch the surface. Its role as a trading hub for Curve is quickly fading.

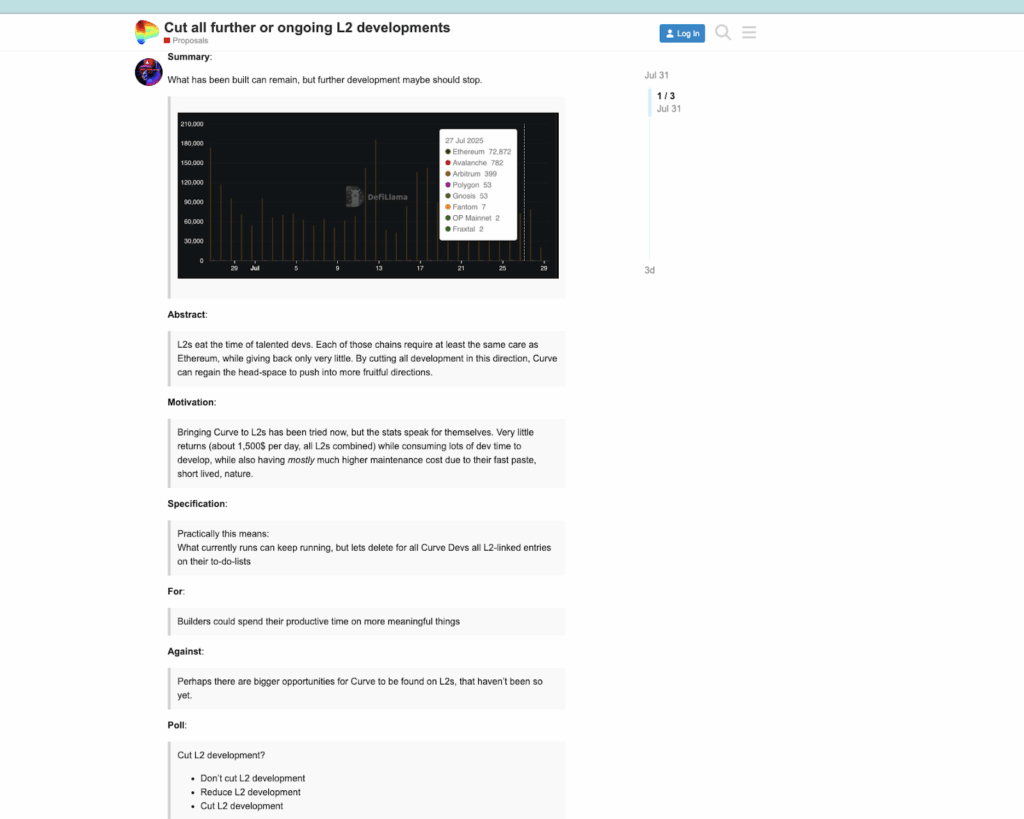

Proposal To Cut All Curve Finance L2 Work Gains Momentum

These numbers have sparked a serious governance proposal titled “Cut all further or ongoing L2 developments.” In Curve Finance, token holders vote on such proposals using veCRV, its locked governance token.

This post argues that developing and maintaining Curve’s presence across 24 different L2s is a huge time sink with little reward.

According to one comment on the proposal, these 24 L2s combined bring in only $1,500 of daily revenue. That’s just $62 per day per L2.

Curve’s Ethereum pools, in contrast, generate $28,000 per day on a slow day. That means Ethereum alone performs like 450 L2s stitched together. From a resource allocation standpoint, the decision is almost a no-brainer.

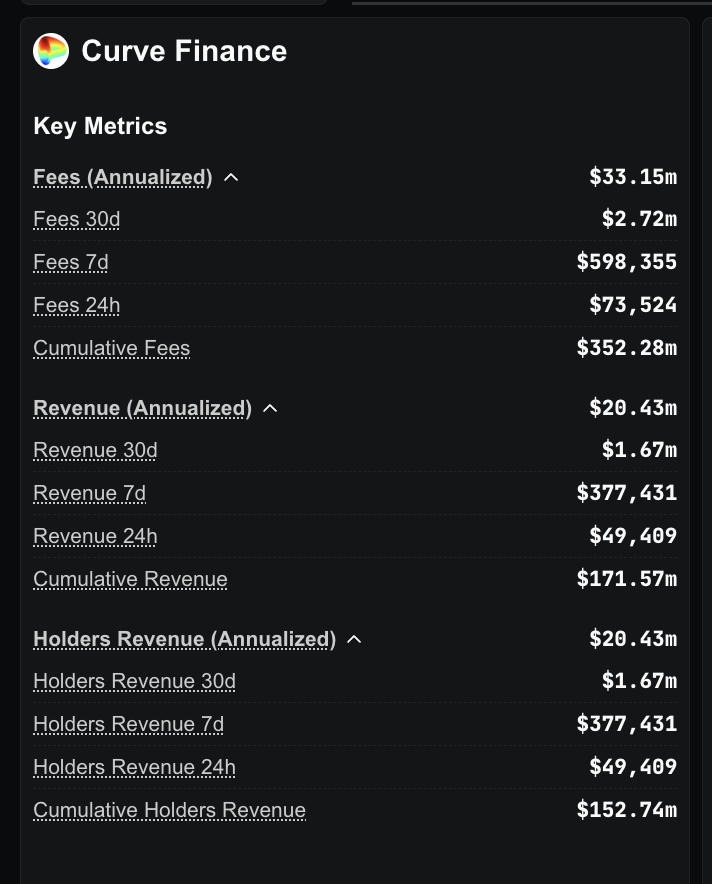

Curve Finance Revenue Data Supports This Move

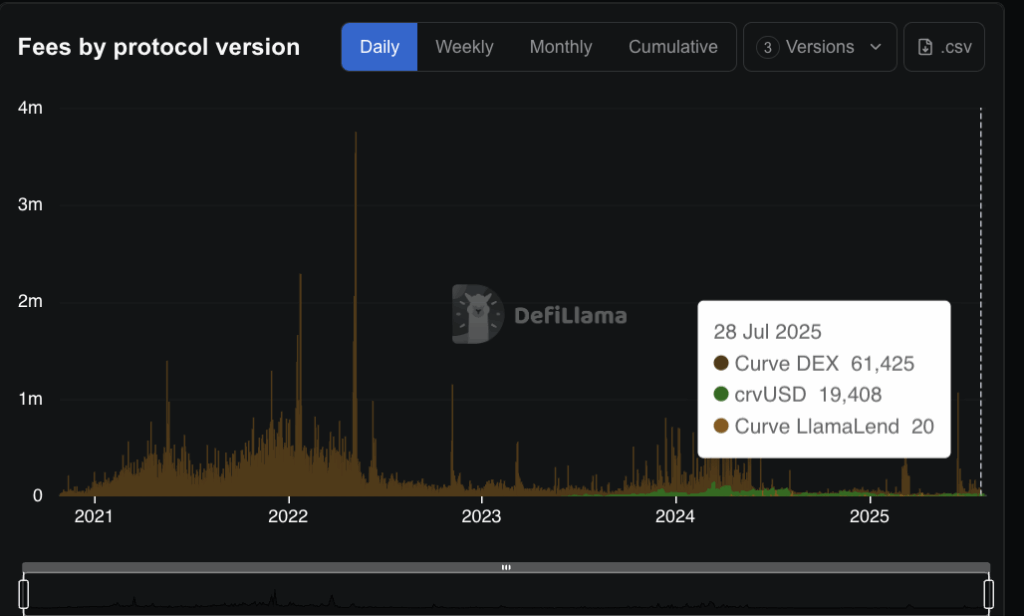

The broader revenue and fee breakdown backs this up. Over the past 30 days, Curve generated $2.72 million in fees and $1.67 million in revenue. Ethereum was the main driver. Since launch, Curve has pulled in a cumulative $171 million in revenue.

While Curve has three major services: its core DEX, its stablecoin crvUSD, and the lending platform LlamaLend, most of the daily fees still come from the DEX. L2 platforms like Arbitrum barely show up in fee distribution charts. That’s a problem for long-term sustainability and developer incentives.

It’s Not Just Arbitrum; Other Chains Are Bleeding Too

Arbitrum isn’t the only underperformer. Curve’s TVL and trading volume on chains like Polygon, BNB Smart Chain (BSC), and even Base are minimal.

Volume-by-chain data shows Arbitrum falling behind newer players like Sonic, and far behind Ethereum. Gnosis, Avalanche, and Polygon each contribute a tiny sliver of total Curve volume.

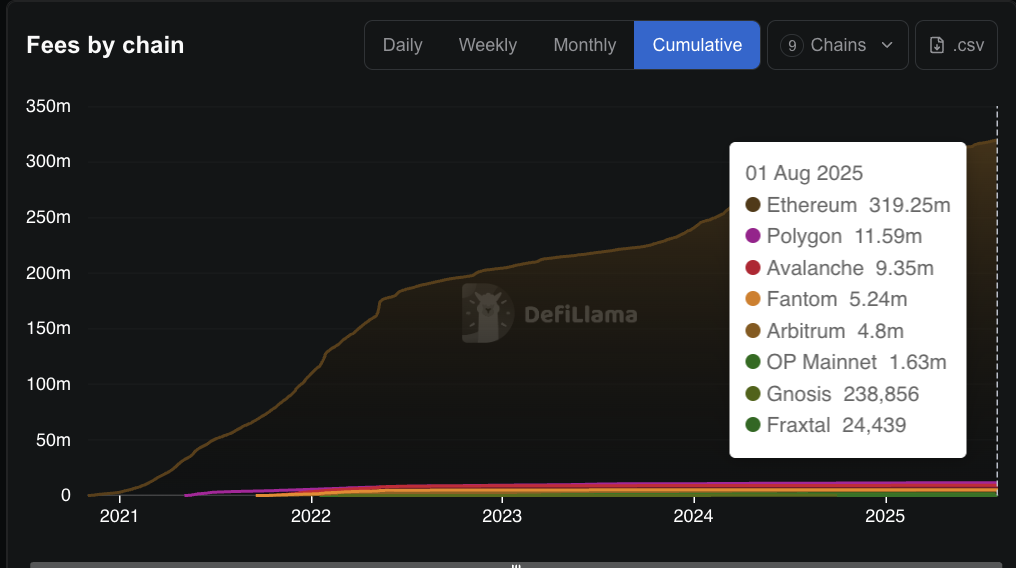

Cumulative fee data makes the contrast even clearer. Ethereum has generated over $319 million in fees for Curve since launch.

Arbitrum? $4.8 million. Polygon? $11.5 million.

Curve Finance on Ethereum is not just dominant; it’s the only chain truly pulling its weight.

If the governance proposal and early signs point to strong support, Curve swaps on Arbitrum could be sunset in the coming months. This won’t mean a total shutdown.

Existing liquidity pools on Arbitrum and other L2s will remain live. But there’ll be no new developments, no added incentives, and likely no future growth.

Instead, Curve appears ready to double down on Ethereum. Governance members are already pushing for deeper crvUSD adoption and tighter integration within the Ethereum ecosystem, where Curve is still a DeFi heavyweight.

In short, Curve Finance may be winding down its L2 experiment. Arbitrum and its peers haven’t delivered on expectations. And unless something changes drastically, Curve swaps on these chains may slowly fade into irrelevance, while Ethereum continues to carry the torch.

The post Curve Finance Swaps on Arbitrum Could Vanish in Coming Months: Here’s Why appeared first on The Coin Republic.