Can TRON Coin Price Break the $0.50 Wall While Holding Over 50% of All USDT?

TRON coin price has dropped 5.5% from its recent high, but a new Messari report shows the network is stronger than ever.

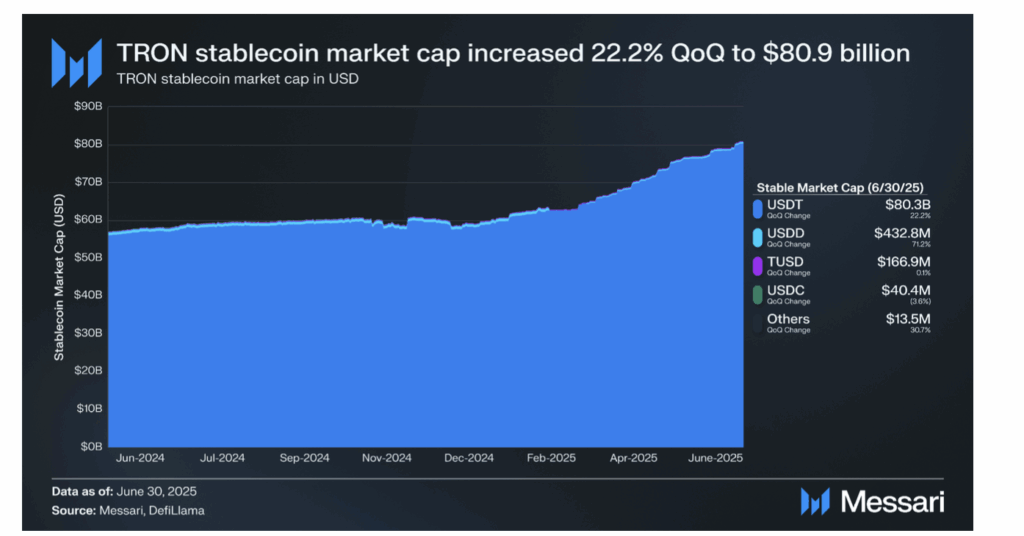

With over $81 billion in stablecoins and $21.3 billion in daily USDT transfers, TRON is now the most used chain for money movement. If this continues, TRX may soon break above $0.50.

TRON Now Moves More USDT Than Other Networks

TRON holds over half of all the USDT in the world. Out of its $81.8 billion stablecoin supply, $80.3 billion is just USDT. That’s 50.6% of the global Tether supply.

And it’s not sitting still. TRON moves $21.3 billion in USDT every day, even more than PayPal.

Each time someone sends USDT, they pay a small fee in TRX. This TRX is burned forever. That’s why TRON’s token supply is shrinking.

In Q2, supply dropped from 95 billion to 94.8 billion TRX. So, as USDT use grows, more TRX gets burned.

Less supply and more usage are good for the price. If USDT payments keep rising, TRX could get more demand too.

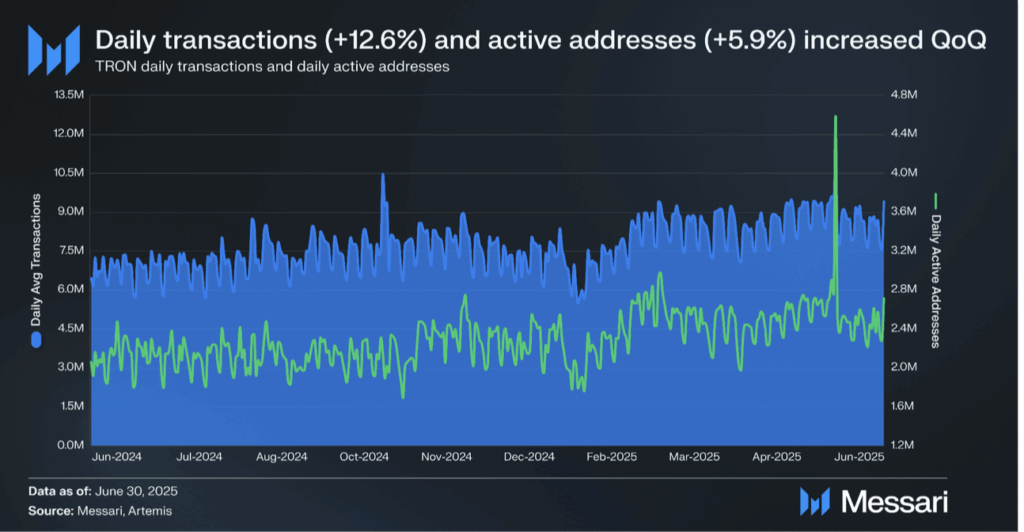

TRON is not just about stablecoins. More people are using the network every day.

In Q2, TRON handled 8.6 million transactions daily, up 12.6%. Active wallets hit 2.5 million per day. These are real users, not bots.

Most activity happens on TRON’s DEXs. SUN V3, the top one, makes up 74.1% of all DEX volume.

Overall, DEX trading rose 25.2% this quarter. Even with prices down, users kept trading. DeFi locked value is now 16.5 billion TRX.

Also, staking is rising. Now, 47.1% of all TRX is staked.

Stake 2.0, the new staking system, grew by 8.5% in adoption. People are staking more and voting more.

All of this means more TRX is being used, burned, or locked away. That reduces supply, which helps the price stay strong.

TRON Is Powering Real Payments With USDT

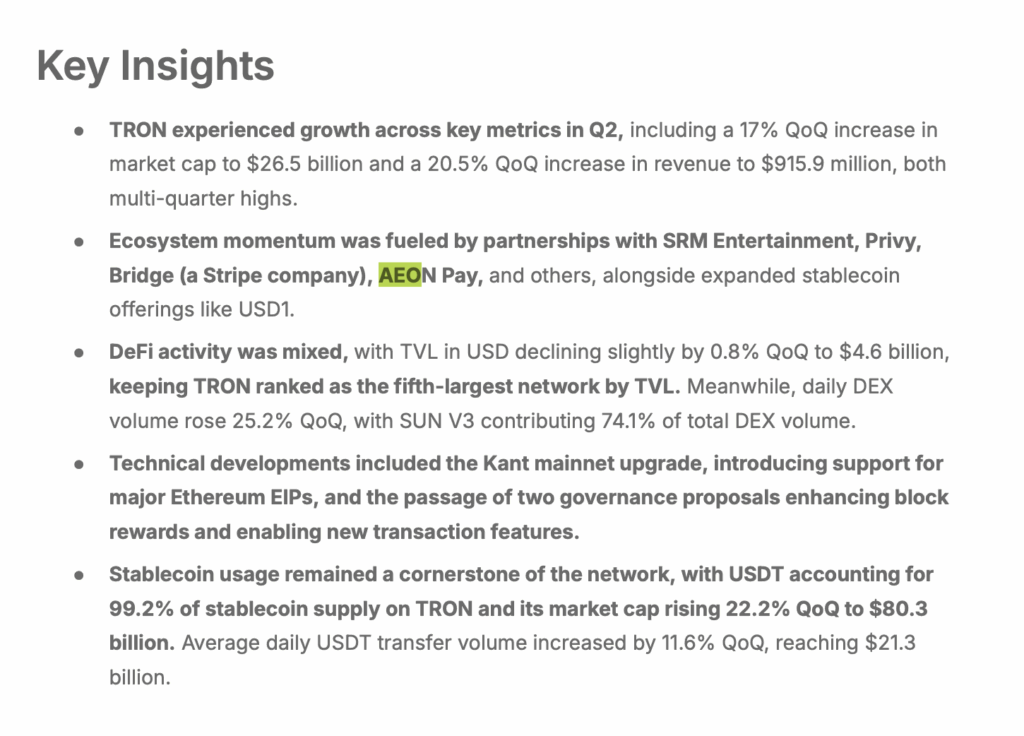

TRON is no longer just a crypto chain. It’s turning into a global payments network. In Q2, TRON partnered with AEON Pay to let people use USDT online and in stores.

It also teamed up with Bridge (a Stripe company) for global transfers. In Latin America, people now pay with TRON-based USDT using apps like Oobit, Krypton, and El Dorado.

Big companies are also jumping in. SRM Entertainment changed its name to “TRON Inc.” and locked up $100 million worth of TRX.

This matters because every payment uses TRX gas. More payments mean more TRX is burned. Also, 70% of all USDT transfers now happen wallet-to-wallet; on-chain, not on exchanges (CryptoQuant data).

The more TRON grows in the real world, the more its token gets used. That’s a strong long-term signal for TRX.

Can TRON Coin Price Break $0.50? The Setup Looks Strong

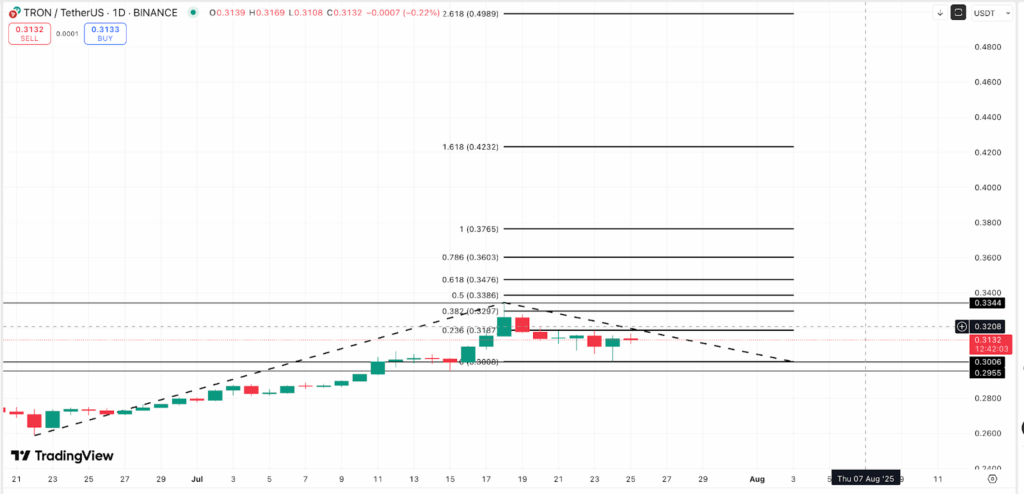

TRX is now trading at around $0.313. It was at $0.50 not long ago, but the pullback hasn’t shaken the trend.

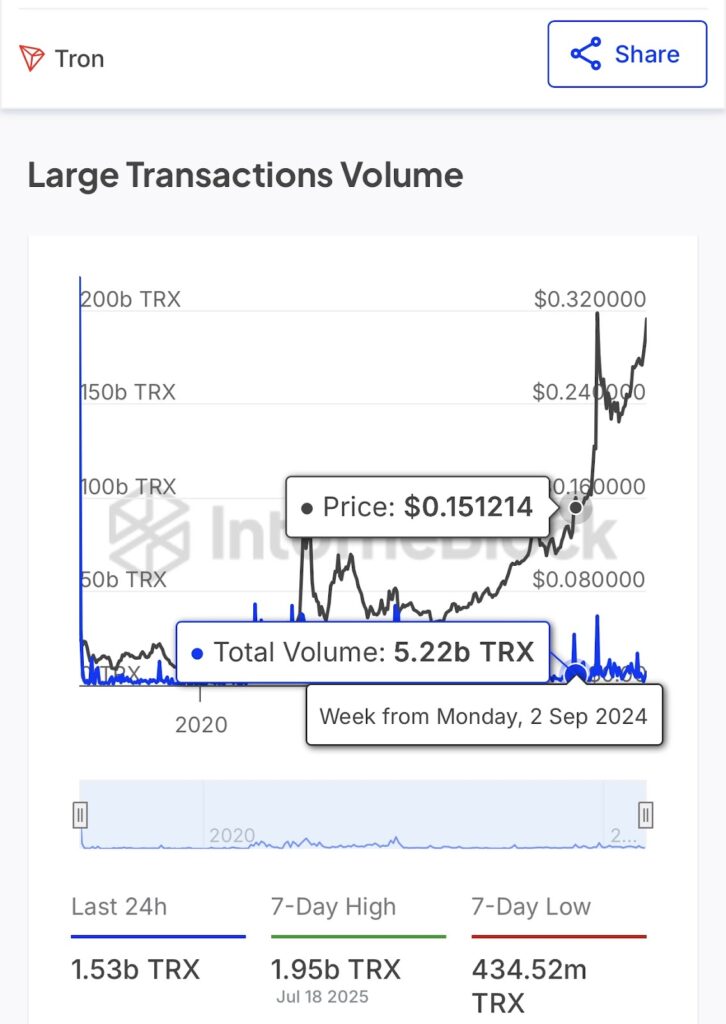

IntoTheBlock data shows whale transactions peaked at 1.95B TRX on July 18. Even now, volume is still high at 1.53 billion TRX.

On the chart, TRX price is sitting above key support at $0.30. If it can break above $0.33–$0.34, the next price targets are $0.42, $0.49, and possibly even $0.50. The Fibonacci chart shows a top level around $0.498.

At the same time, spot exchange flows are turning negative.

Coinglass data shows big red bars in late July, meaning whales are pulling Tron coin off exchanges. This is usually a bullish signal.

The post Can TRON Coin Price Break the $0.50 Wall While Holding Over 50% of All USDT? appeared first on The Coin Republic.