Bitcoin broke through $120,000 for the first time, why didn't anyone shout to take off?

Original | Odaily Planet Daily (@OdailyChina)

Author|Golem (@web3_golem).

It's hard to be a Bitcoin investor, living in fear of rising every day.

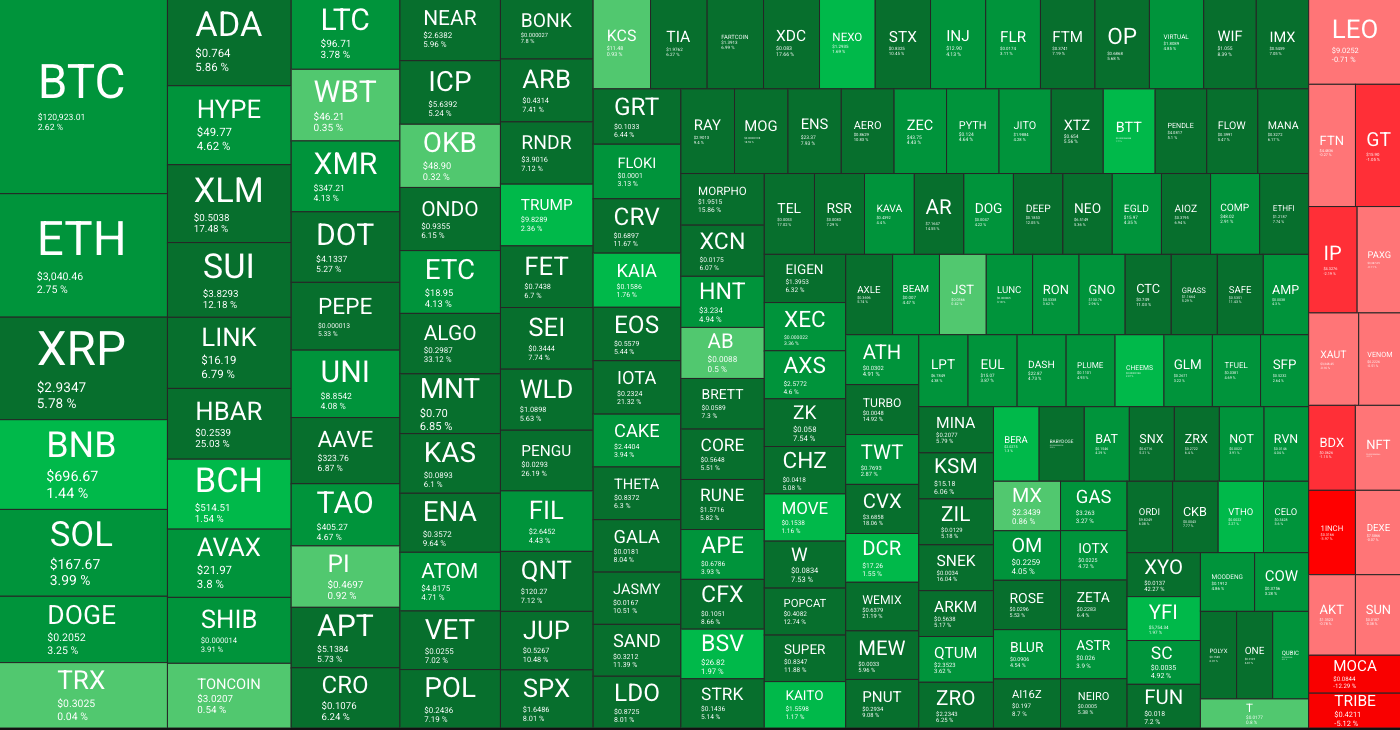

According to the OKX market, Bitcoin rose for the first time today, breaking through $120,000 and hitting a new all-time high. Altcoins are not inferior, according to Quantify Crypto data, among the top 200 copycats by market capitalization, only 15 tokens have fallen in the past 24 hours, and the rest are in a copycat trend, among which HBAR has risen by more than 25% in the past 24 hours, SUI has risen by more than 12.18% in the past 24 hours, and large copycats such as ETH, SOL, BNB and XRP have also increased by 1 ~ 5% in the past 24 hours.

At the same time, the rise of Hong Kong cryptocurrency concept stocks also continued to expand, with Ouke Cloud Chain rising by more than 30%, Xiongan Technology rising by 18%, and Langang Interactive rising by more than 10%.

If you don't look at the chart above, the situation is very good, however, unlike when Bitcoin broke through the $69,000 and $100,000 mark, the market sentiment has not been much FOMO, and while social media is full of good news, the community group chats are unusually quiet. People in the industry have already taken profit and gotten off before? Why didn't anyone shout about taking off this time?

Investors who have been ramped up by Bitcoin to Mame

The rebound after the altcoin has experienced an 80% retracement, even if it is small, the investors who are trapped will be excited to shout bull back; But bitcoin, which continues to reach new highs, even if there are no investors at the moment, the smaller and smaller relative value of "+%" will only make people more numb. Moreover, with the continuous favorable global crypto regulatory policies, the increase in the number of listed companies in the Bitcoin treasury, and the entry of stock tokenization into a period of compliant operation, since April 2025, Bitcoin has closed up for three consecutive months, with a three-month increase of more than 46%.

Investors' excitement threshold is gradually rising, and the expectation is that more will fall on altcoins. Google Trends data also shows that the public's search interest in bitcoin is already much lower than it was during the bull markets of 2017 and 2021.

The latest report from 10x Research also points out that Bitcoin's recent all-time high is not driven by market speculation, but by deeper macroeconomic changes. The $5 trillion US debt ceiling hike, large deficit spending, and the upcoming crypto policy report from the Trump Task Force are working together to reshape the macro landscape. According to the report, bitcoin has transformed into a macro asset as a hedge against unrestrained fiscal spending, and its narrative logic has undergone a fundamental shift. The July 22 and 30 FOMC meetings could be a key catalyst for redefining Bitcoin's role in the financial system.

Therefore, there is no direct stimulus in the market for bitcoin to break through $120,000 this time, but the result of a series of previous positive fermentation. Cryptoquant analyst Axel Adler Jr also justified the July rally from an empirical point of view, "According to historical data from 2012-2025, July was one of the most reliable months for Bitcoin growth: 10 out of 14 cases (71%) showed positive returns. In addition, the month of October was the most reliable, with 77% of the months being 'positive'. ”

Although the cottage has improved, it has not achieved the desired effect

Another major reason for the market sentiment may be that altcoins as a whole have risen since July 11, but they have not yet met investors' expectations. OKX market data shows that after 5 months, ETH rose above 3050 USDT today (February 3), but the sad thing is that also 5 months ago (February 3), Bitcoin's highest price was $102500, relatively speaking, Bitcoin still rose by 17%, and Ethereum stayed completely in place.

The market of "bitcoin is only beautiful, copycats do not rise or even fall" has been a topic of continuous discussion among investors in 2024, when bitcoin had US bitcoin spot ETFs and institutional purchases, while altcoins instead experienced VC trust crisis, large unlocking and smashing and meme sucking away speculative funds, and shorting copycats became the main trading strategy at that time. Therefore, even to this day, some investors are still suspicious of altcoins and have no hope for the altcoin.

However, the crypto market is changing rapidly, and as investors, we should assess the situation and adjust in time. James Seyffart, an ETF analyst at Bloomberg, released a forecast for the approval probability of crypto spot ETFs by the end of 2025 in July, saying that the SEC may approve a number of altcoin ETFs in the second half of 2025, of which LTC, SOL, and XRP have a 95% probability of approval, and DOGE, HBAR, Cardano, Polkadot, and Avalanche expect a 90% probability of approval. SUI expects a 60% chance of passing, and Tron/TRX and Pengu have a 50% chance of passing.

In addition, various "altcoin" micro-strategies have been established, and CZ has even said that at least 30 teams want to launch public co.-related projects related to BNB treasury, and altcoins will also attract an era of ETF and institutional buying.

A number of KOLs also posted in July that they were optimistic that the copycat season was coming. Yi Lihua, founder of LD Capital and "E General", said in an article that the copycat season may not really usher in liquidity overflow until the interest rate cut is confirmed in August or September.

Crypto KOL Miles Deutscher commented on the copycat over yesterday's $500 million PUMP 12-minute public sale, saying, "This shows that there is still a lot of liquidity willing to participate when the right opportunity arises." Altcoins aren't 'dead', they just need the right narrative. Additional reading: "PUMP sold out in 12 minutes of public sale, two scripts after the opening, which one do you believe?" 》。

BitMEX co-founder Arthur Hayes also posted, "Sentiment has now shifted and Bitcoin has broken through all-time highs with good volumes; Ethereum is not far behind and will outperform, with altcoin season just around the corner, markets pricing in a surprise action on tariffs by Trump, and Arthur Hayes family office fund Maelstrom has added to its bullish position. ”

Of course, there is a lot of information about the copycat season coming up, but no amount of listing is as strong as the confidence in the hearts of investors themselves. I hope next time we can shout together, the cottage takes off!