Millions of Bitcoin are idle

Billions in value locked away, barely moving

Lombard is changing that

→ building LBTC, a yield-bearing Bitcoin that finally moves onchain

How @Lombard_Finance works, let's dive in ↓

1. Three Pillars of Lombard

• LBTC unlocks liquidity and generates yield

• EigenLayer restaking enhances security and capital efficiency

• Strong initial TVL builds credibility and trust

2. LBTC: Unlocking Bitcoin Liquidity

There are currently over 19.7M BTC in circulation, with the majority still sitting idle in cold storage

LBTC tokenizes BTC at a 1:1 ratio, allowing holders to:

• stake and earn yield

• move BTC seamlessly across multiple chains

• use BTC as onchain collateral

LBTC currently holds a market capitalization of around $1.4B

3. EigenLayer Integration

Most wrapped BTC solutions stop at providing liquidity

LBTC goes further

Through its integration with EigenLayer, LBTC can:

• restake to strengthen security

• support other protocols across the ecosystem

• unlock and optimize value from otherwise idle BTC

This makes LBTC stand out from tokens like wBTC

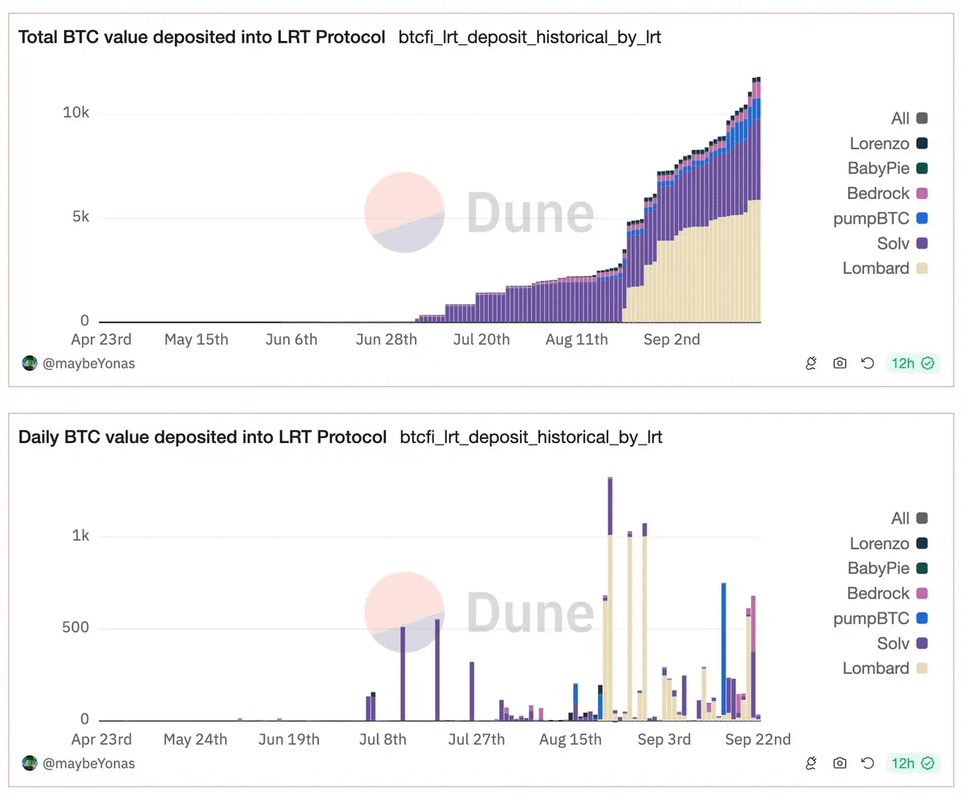

4. Bootstrapped TVL

Credibility comes from real liquidity

• LBTC has surpassed $1.5B in TVL

• around 13,000 – 15,000 LBTC are currently in circulation

• @Lombard_Finance commands roughly 40% of the Bitcoin LST market share

10.21K

34

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.