Avalanche In Focus 🔺

3 exciting things from this week in 30s

- DAT on Avalanche

- Korea's crypto adoption

- RWA's exponential growth

Let's dive in 👇

Why it matters

- Legitimacy and Trust from institutions

- Liquidity for RWA on Avalanche

- Demand for the Native Token

DATs bring real-world money, credibility, and new financial products into the Avalanche ecosystem

Korea has had a massive month with many huge announcements on Avalanche

- Mirae signed an MOU with Ava Labs at KBW

- KRW1 is a fully collateralized, won-backed stablecoin

- Fandom is moving onchain with Festival tickets and KPOP fan app

Why it matters

Korea has always been a tech pioneer, and has led the way with new tech adoption

Banks, the government, and some of the largest national companies are all looking to build an onchain economy

Other countries are watching, and will want their slice of the pie soon

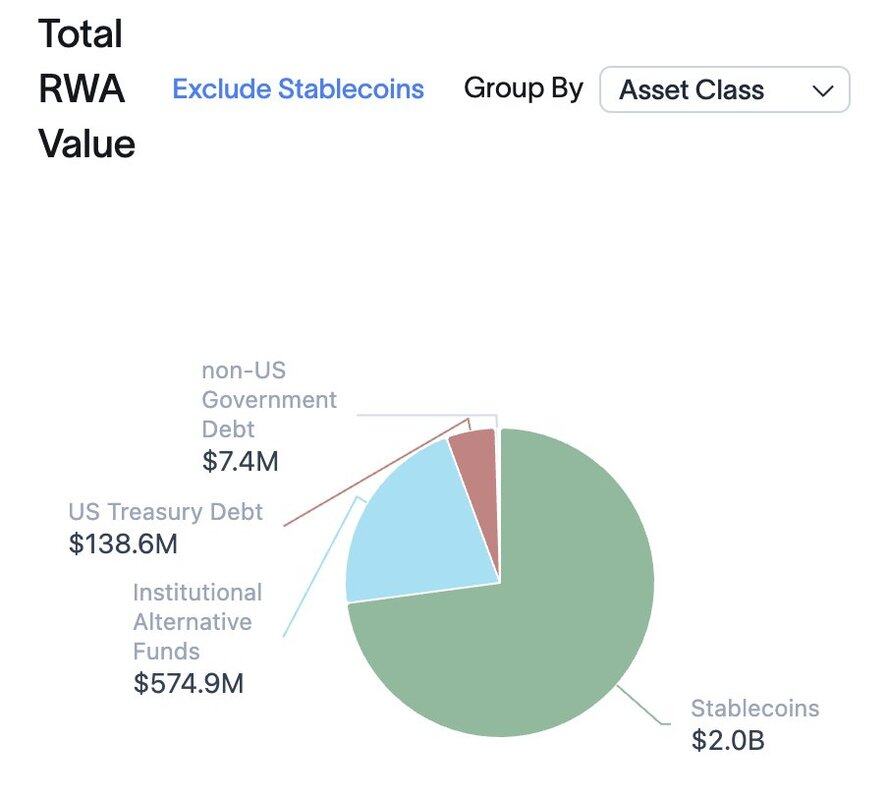

RWA's growth on Avalanche is going exponential

Since the start of the year, the RWA market has gone from $136M to $750M

A 5x growth in 10 months, and the sectors include real estate, commodities, hedge funds and stablecoins

4.61K

74

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.