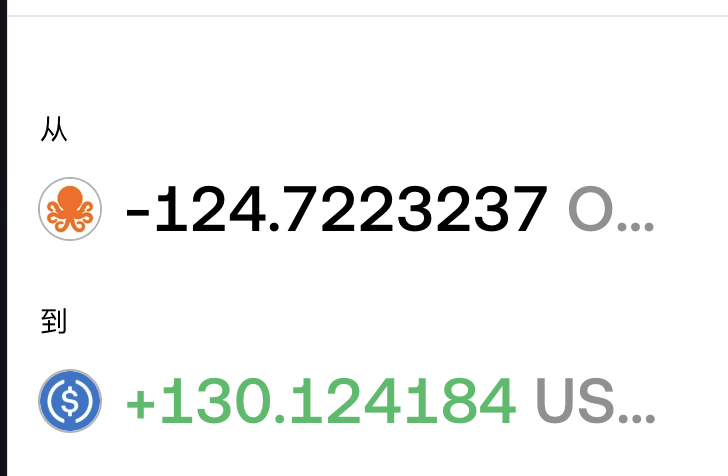

I just saw that the open in my wallet, the cookies reward from the little octopus has been sent, directly airdropped to the wallet without needing to claim it!

There were about 4 to 5 articles sent, giving 124, sold for 130u.

Converted, that's over 20u each.

I don't want to say much more @OpenledgerHQ.

Friends in the crypto circle should all know @injective, a well-established public chain that has been running since 2018. As of today, the cumulative trading volume has surpassed $62 billion, showing very stable growth while continuously promoting new ways to play.

Speaking of Injective, let's take a moment to admire its CEO @ericinjective, who is truly impressive! He started the project at just 20 years old, and now at 27, he has led the team to achieve this scale. Plus, he is super handsome! With such a capable and attractive CEO leading the way, it's no surprise that Injective is developing so well!

Now, getting to the point, why are we talking about Injective today? Because we noticed that its Multi-VM is about to enter public testing. This means that more projects requiring performance and architectural design can easily join the Injective ecosystem, allowing on-chain financial applications to be assembled like building blocks, greatly enhancing the flexibility of assets and transactions.

Moreover, Injective is gradually turning on-chain assets into investment tools recognized by institutions.

DAT narrative: Pineapple Financial has already included INJ in its company treasury and is directly participating in staking, targeting a yield of 12%. This is a public signal of the institution's "INJ-first" strategy.

ETF application: Canary's Staked INJ ETF has already been publicized with the SEC, and if approved, it means that institutions can compliantly access INJ, and on-chain staked assets are moving towards legalization and mainstream finance.

Supporting all this is Injective's RWA product architecture and its flagship DEX: iAssets and Helix DEX @HelixMarkets. Foreign exchange, gold, and Pre-IPO stock RWA perpetual contracts can all be put on-chain, with a cumulative transaction volume exceeding $1.7 billion. Helix provides a high-performance, low gas trading environment, making it easy for both ordinary users and institutions to get started.

These designs are also showing results in the data: last week, the RWA transaction volume on Helix reached $107 million, growing 14 times since January this year.

Additionally, Injective's flagship product @HelixMarkets not only allows trading of crude oil, gold, and US stocks but also brings GPU leasing rates on-chain. For example, the recently launched H100 GPU leasing rate contract can be used for investment and hedging. Computing power, stocks, and precious metals are all being financialized and tokenized, allowing ordinary users to participate in risk management, no longer just an exclusive play for institutions.

In summary:

Injective @InjectiveLabsCN is moving traditional financial assets on-chain, creating a market that both ordinary people and institutions can participate in. Multi-VM, RWA, Staked INJ ETF—these strategic moves clearly indicate that INJ is no longer just a token but is evolving into an on-chain investment tool recognized by institutions.

In the future, GPUs, precious metals, and stocks will also be traded on-chain. If you're interested, you can go experience Helix:

Link:

13.12K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.