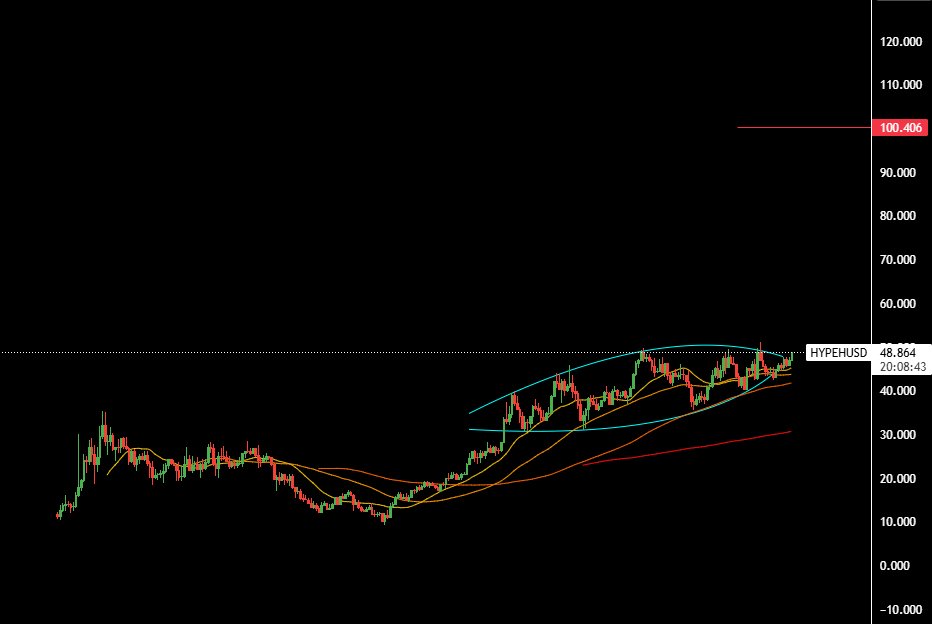

🔥The demand for $HYPE is enormous $HYPE is trading at a valuation (fdv) of nearly 50 billion USD, with a market cap of 13 billion USD. In which: - The fund using revenue to buy back $HYPE currently holds 30.5 million $HYPE, worth 1.5 billion USD. - Hyperliquid Strategies Inc (HSI): The treasury company backing $HYPE is supported by @paradigm, Galaxy Digital, Pantera Capital, D1 Capital, Republic Digital, and 683 Capital. > They have established the company with 12.6 million $HYPE, worth over 600 million USD. And at least 305 million dollars in cash to continue the strategy of buying $HYPE (whether they have finished buying is unclear). - @a16zcrypto: Holds 1.428M HYPE (worth 70 million USD), accumulated from mid-August until now. - @hiFramework: The founder of this fund announced they will create a trading market on Hyperliquid (HIP-3), with the condition that they must stake 1 million $HYPE (worth nearly 50 million USD). Roughly calculated, there is already about 2.5 billion...

🔥Native stablecoin on @HyperliquidX - $USDH Currently, there are 5.7 billion USD in stablecoins (mainly $USDC) on the @HyperliquidX chain, making it one of the top 5 chains with the most stablecoins. It is estimated that with a 4% annual interest rate from U.S. bonds, Circle will earn 230 million USD from this amount. Therefore, the @HyperliquidX community has proposed a stablecoin, $USDH, to share this significant revenue with the community. However, $USDH is not developed by @HyperliquidX, but by a third party that is accepted to develop independently (generally unrelated to Hyperliquid). In terms of structure, groups will propose the model and detailed development plan for $USDH within the governance community. After that, validators will vote to select the group allowed to develop it. Finally, the chosen group will have to bid for gas to launch $USDH on the mainnet. (This is Hyperliquid's mechanism; issuing a token requires a bidding fee, at least 10k USD). Groups...

3.69K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.