Institutional capital is testing DeFi in new ways. Hedge funds and fintech desks are quietly running on-chain credit and yield strategies.

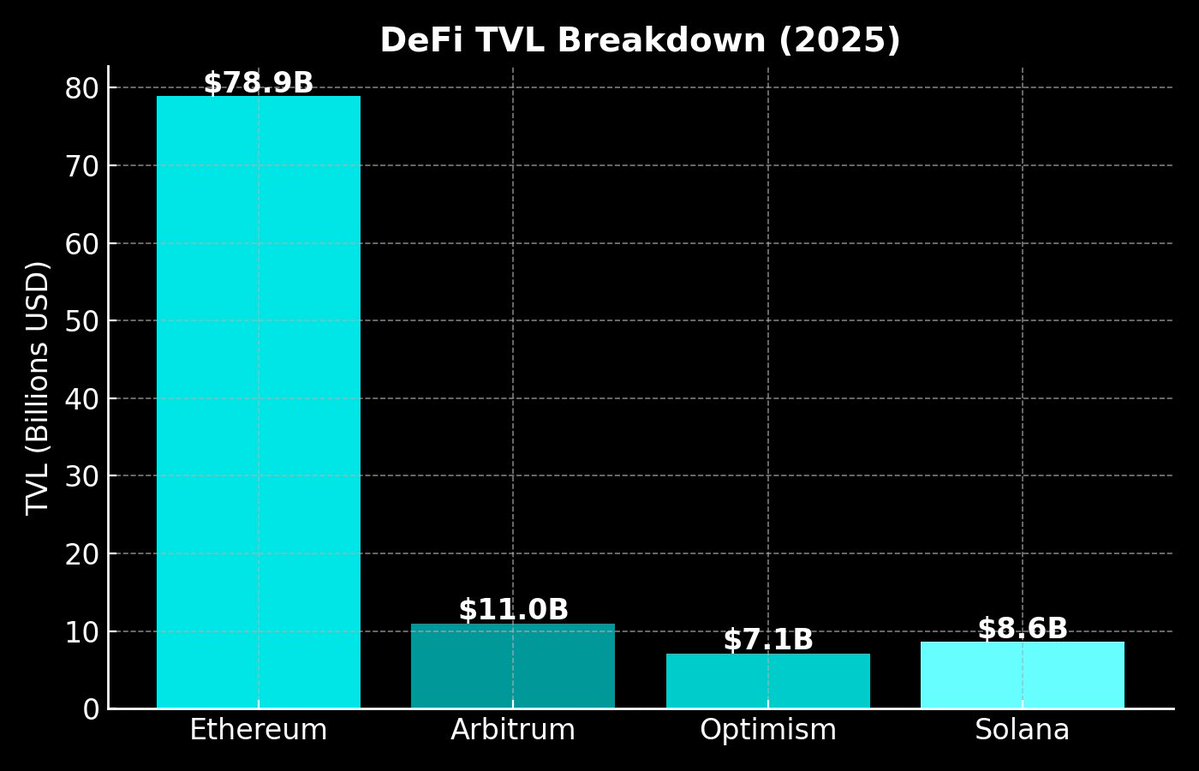

DeFi TVL is at $123.6B, up 41% year-on-year. Ethereum still anchors ~63% of that, but Arbitrum and Optimism are taking share, and surprise - Solana DeFi has climbed to $8.6B - I see this as a great sign, a shift away from meme driven hype.

The signal is clear: institutions are deploying into programmable, non-custodial yield. The risk is equally clear - macro tightening or regulatory shocks can reverse this as quickly as it builds.

What do aarnâ Quintets think and how are you reading this shift: @crypto_linn @hackapreneur @CryptoVonDoom @JackNiewold

Show original

8.95K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.