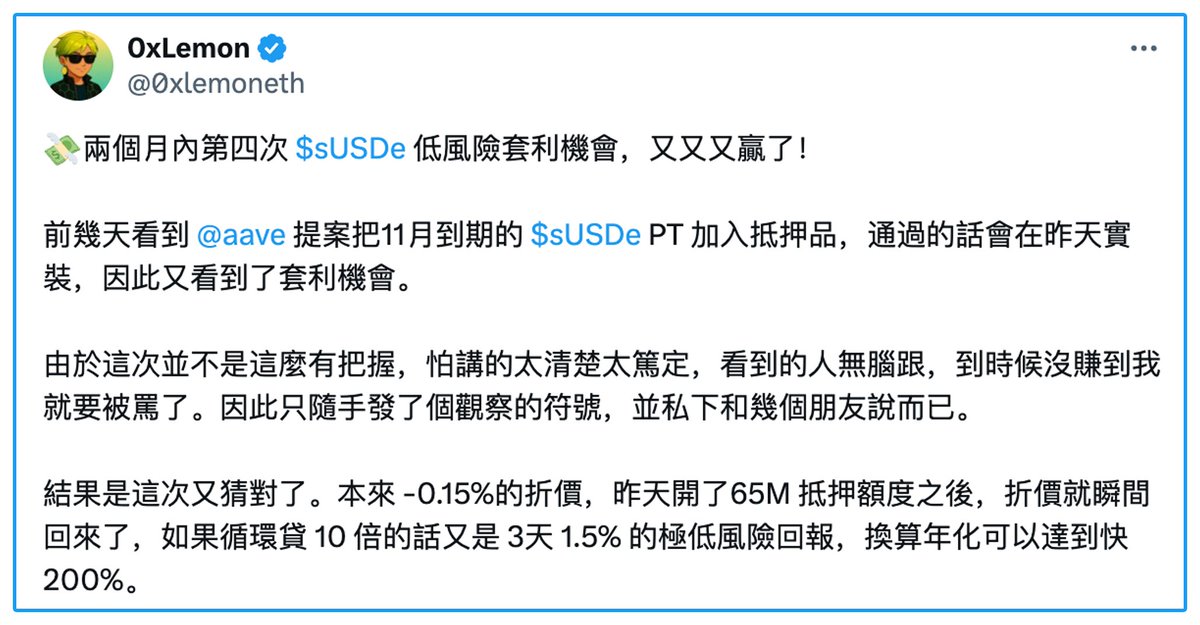

Arbitrage Logic Breakdown: Event-driven Opportunities Driven by Aave Proposals~ Arbitrage windows for USDe/sUSDe appear periodically, and the core of this round of opportunities lies in Aave's new proposal: to include PT-sUSDe, which expires in November, in the collateral list. Once the proposal is passed, Aave will open a collateral limit of $65 million, directly generating a new round of circular lending and arbitrage demand. The main driving force behind the arbitrage comes from: circular loan participants who wish to lock in deposit interest rates. Demand-side operation path: Use sUSDe to purchase PT-sUSDe, deposit it into Aave as collateral, borrow USDT, and then use the borrowed USDT to continue buying sUSDe, forming a circular structure. Driven by this demand, the price of sUSDe quickly rebounded from about -0.15% discount back to par, becoming a certain arbitrage opportunity. Additionally, the circular lending structure can further amplify returns. According to...

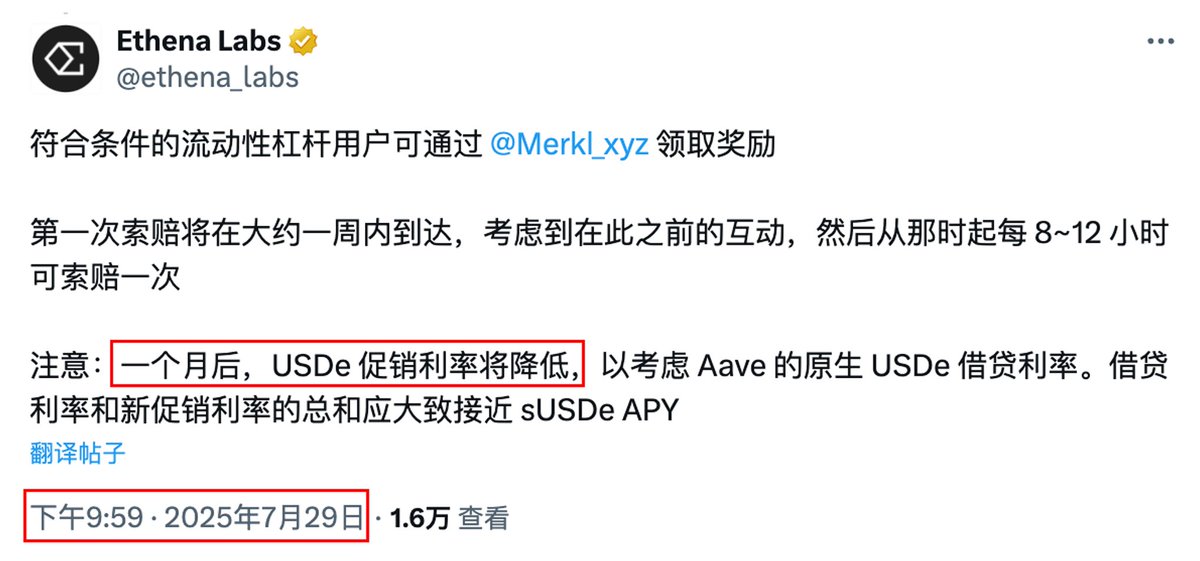

🤔 The community members are starting to discuss the opportunities of USDe/sUSDe again~ Besides the subsidized circular loans and PT circular loans, the most reliable method remains risk-free arbitrage. For example, a community member mentioned: borrow USDe on Aave, exchange it for sUSDe via 1Inch, and then perform Unstake to unlock. Based on the current situation, the annualized yield can reach up to 20% (if the timing is right, the APY can be even higher). The core logic of this approach is to utilize the price of sUSDe on-chain or on exchanges and the exchange rate difference between its official Unstake unlock price for arbitrage. According to the practical experiences of several big players in the community, if the timing is accurately grasped, the profit from a single operation can be quite substantial, with operational capacity potentially reaching millions. The best timing to bottom out the exchange rate often occurs when the USDe/sUSDe PT expires or when circular loans...

28.22K

90

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.