Arch Network is going to change the entire perception of BTC Infra

going to be posting a lot about the ecosystem and opportunities as they come up

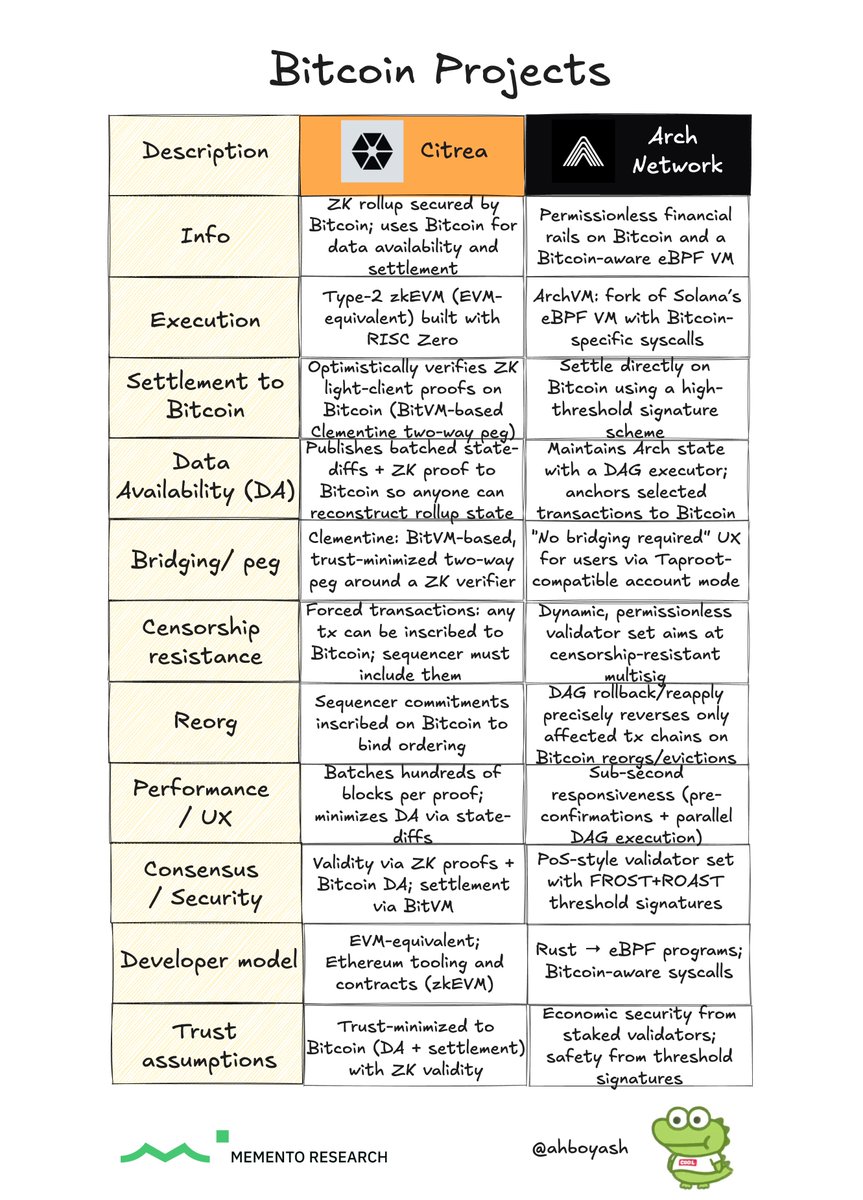

check out this great writeup from @ahboyash to understand the excitement

After the whole Bitcoin L2 + Ordinals/runes hype, it seems like a lull period in terms of exciting Bitcoin innovation.

Two projects that are still building which caught my eye:

• @ArchNtwrk: Bitcoin-native execution layer that delivers fast, composable, bridge-free smart contracts while anchoring security and settlement to Bitcoin itself.

• @citrea_xyz: the first zk-rollup fully secured by Bitcoin, unlocking a programmable layer for native BTC applications without compromising Bitcoin’s security.

- - - - -

1. Arch Network

a) Intro

• Bitcoin-native execution layer: computation layer that works directly with Bitcoin’s security model, rather than a rollup/bridge-based L2.

• Bridge-free programmability: Solves the core problem that L2s have which is silo liquidity and can’t interoperate; Arch’s goal is a trust-minimized execution without bridging assets off Bitcoin.

• Taproot-compatible accounts + existing wallets: can use any Xverse or Magic Eden wallets with no need for bridging tokens.

• Benefits: Solana-like UX with Bitcoin finality.

b) Tech architecture

• UTXO-aware VM (eBPF) + custom syscalls: Lets programs execute complex financial logic while interoperating with real Bitcoin UTXOs.

• Programs: Core primitives for writing apps, with a full developer toolchain (CLI, explorer, RPC).

• Network roles: Bootnode (discovery), Leader (coordination), Validators (program execution), plus tight Bitcoin node/RPC integration.

• FROST + ROAST threshold signatures: A decentralized validator network signs state transitions; design emphasizes permissionless PoS-style validator sets and gradual decentralization as the number of signers grow.

• Traction: Featured apps include Saturn (DEX), funkybit (memecoin launchpad), ChaChing (borrow/lend); testnet shows 346k wallets and 2M+ txs.

This solves Bitcoin’s dilemma where L1 dApps are secure but slow and non-composable; L2s are fast but fragment liquidity and require bridges.

Arch proposes a middle playing field: fast, composable UX that anchors to L1 and avoids bridge risk.

2. Citrea

a) Intro

• Execution layer: The first zk-rollup fully secured by Bitcoin, transforming Bitcoin into a programmable platform for applications (called “₿apps” that consists of DeFi and consumer apps), while maintaining Bitcoin’s security, decentralization, and censorship resistance.

• The mission: unlike wBTC or centralized custodians, Citrea keeps native BTC on-chain and leverages trust-minimized bridging via their Clementine bridge. This stops the “value drain” of BTC to CEXes or other centralized chains and unlocks the full potential of Bitcoin as a base layer for finance, gaming, and payments.

b) Tech architecture

• zk-Rollup on Bitcoin: executes tx off-chain (periodic checkpoints to Bitcoin) + zk-STARKS for state validity.

• Bitcoin as Data Availability: leverages Bitcoin for settlement and data availability (all state transitions are provable and reconstructible from Bitcoin inscriptions + Citrea inherits Bitcoin’s chain finality guarantees).

• Clementine Bridge: trust-minimized 2-way peg bridge, optimistic verification of withdrawals and supports single-round fraud proofs for fast dispute resolution.

• ₿apps (Bitcoin Applications): non-custodial apps using Bitcoin such as DeFi, payments, Gaming, and NFTs.

The importance of Citrea is how it retains liquidity and expands Bitcoin’s role in global finance.

Developers are provided with a familiar environment (EVM tooling) with Bitcoin-level security guarantees while users enjoy the benefit of eliminated custodial risks to unlock their native BTC in DeFi and other applications.

- - - - -

Closing thoughts

Citrea is taking a bet on a modularity approach (zk-rollup anchored to Bitcoin to bring EVM-style tooling, liquidity, and composability); while Arch takes the Bitcoin-native route with a UTXO-aware eBPF VM, FROST/ROAST multisig, Taproot-wallet UX, and optional pre-confirmations.

In short, builders/users would choose Citrea for EVM-aligned scale and interoperability, and Arch Network for a more pure-Bitcoin UX with direct settlement --> both are likely to coexist as complementary rails in a BTC-denominated economy.

4.24K

35

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.