Okay hear me out @ResolvLabs looks undervalued af.

With stablecoins now having regulatory clarity, the focus is now on protocols that capture real revenue while keeping yields good.

Resolv has been scaling fast on that front:

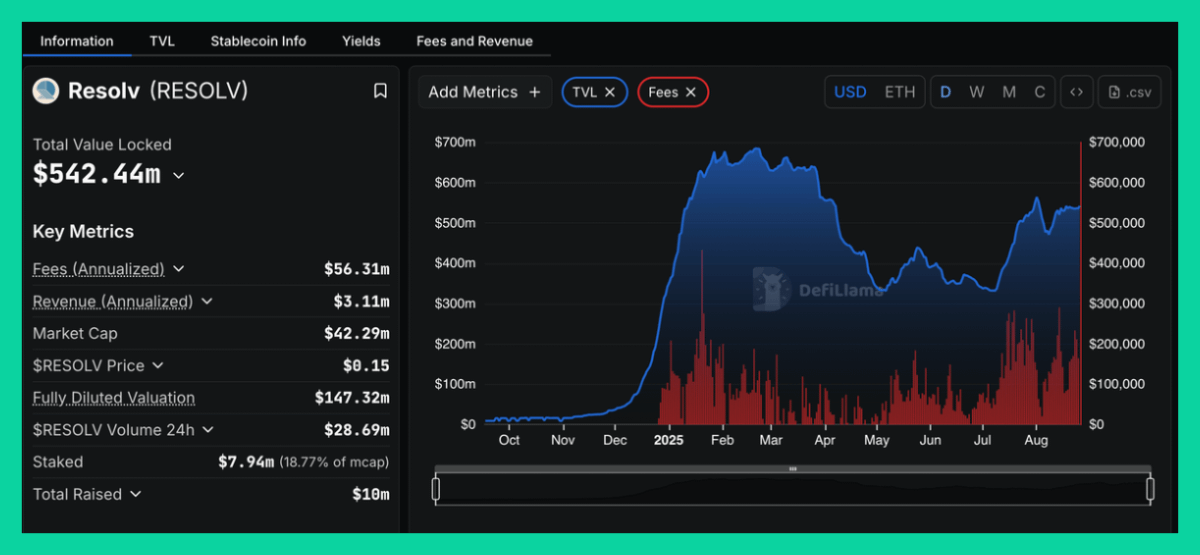

▸ TVL ~$540M (nearly 2x since TGE)

▸ Annualized fees ~$56M

The bullish part?

10% fee switch has been live since Aug 21.

That already produced ~$380k revenue, which annualizes to ~$7.3M if pace holds.

majority of those fees (first allocation at 75%) flow into weekly $RESOLV buybacks

While stUSR still prints ~9% APY (same as Ethena’s sUSDe), the alignment is insane.

Comparing efficiency:

▸ Ethena: $1B ann. fees / $12.2B TVL (~8% fee-to-TVL)

▸ Resolv: $56M ann. fees / $540M TVL (~10% fee-to-TVL)

Even at a fraction of Ethena’s size, Resolv is pulling more fees per $TVL, and with the fee switch on, protocol revenue should scale fast

Ethena ~$4B mcap vs Resolv ~$45M - feels seriously undervalued imo.

Show original

11.79K

31

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.