On the topic of @OpenEden_X, IMO these are one of the protocols that have maximized the value of a Pendle integration by taking advantage of our 'Volume-Liquidity Flywheel'.

Let me break down exactly what I mean by this by looking at what they've done.

👇

_____________________________________

The Volume-Liquidity Flywheel

An interesting quirk of @pendle_fi is that YT and PT swap volume directly contribute to TVL to an underlying protocol.

This is by virtue of how swaps work under the hood:

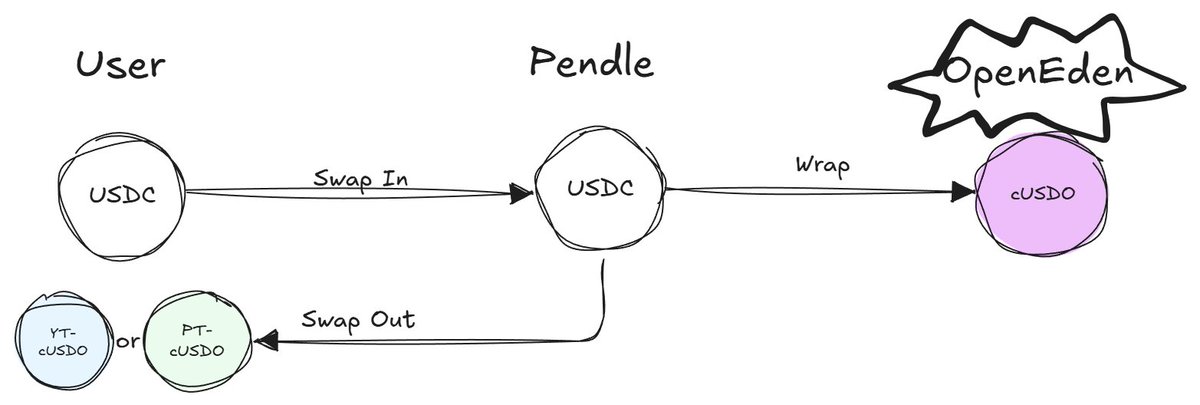

1. User swaps in USDC

2. Pendle wraps USDC as cUSDO

3. User receives YT-cUSDO or PT-cUSDO

This means that each dollar in swap volume contributes to the underlying protocol's TVL.

You can read my full dissertation here:

How impactful is this to Open Eden?

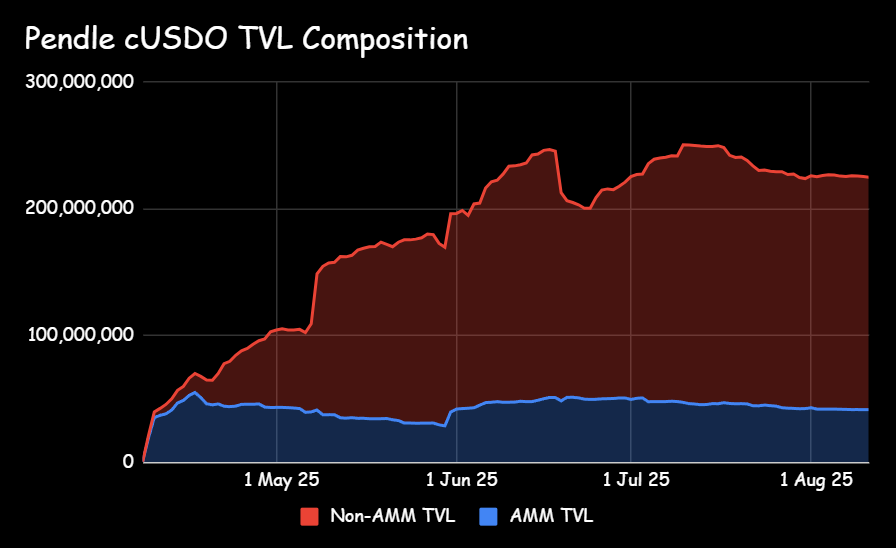

If you look at their composition of TVL contributed to Pendle, you'll note that ~$37m of their total ~$222m comes from Pendle LPs.

This means $185m (~83%) of the TVL contributed by Pendle is attributable to swap volume.

_____________________________________

🅰️ Treat YTs Well

So what has Open Eden done right to make volume attractive? Intern posits a few important learnings.

1. Points Transparency

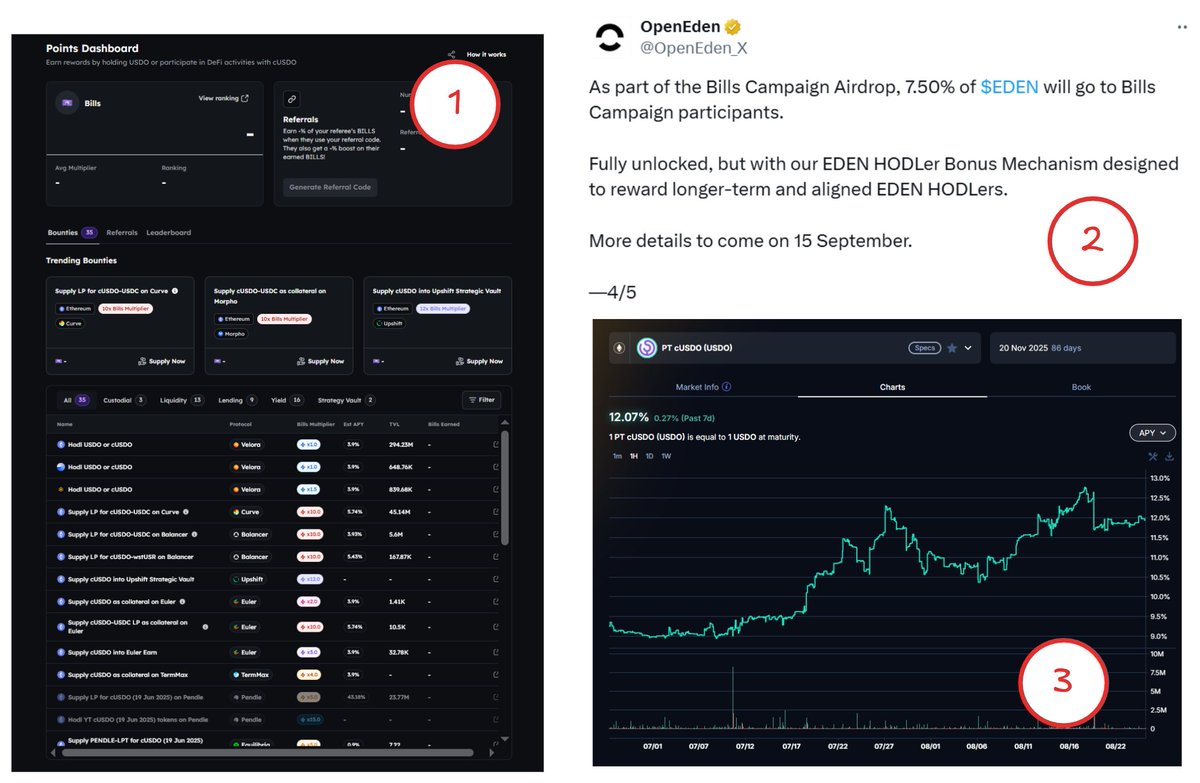

Instead of a 'trust me bro' point system, these suckers started the campaign off with a comprehensive points dashboard.

For YT buyers, additional data points like leaderboards and up-to-date balances are critical in converting a 'maybe' into a 'yes'.

2. Communication

A lot of protocols leave TGE communications to the last minute OR simply leave point systems running until positions have been excessively diluted (i shan't name names hehe)

If you don't give users information about these things, it's an uphill battle to driving volume (and thus TVL)

3. Outcome

These bad boys ability to tackle the above is why cUSDO's Implied APY has managed to remain extremely attractive.

If you DON'T manage YT buyers expectations there won't be any YT buyers to begin with - and this is your loss.

_____________________________________

🅱️ Treat PTs Well

With YT demand sorted, providing an outlet for PT supply is how the Volume-Liquidity Flywheel can be elevated to the next level.

Observe the PT-cUSDO/USDC market powered by @MorphoLabs.

That $111.38m in USDC liquidity?

That's essentially free liquidity for Open Eden made possible by treating their YT Buyers well (🅰️)!

_____________________________________

Just a lil lesson to all you aspiring protocols looking to make the most of Pendle.

You get out what you put in 😋

NFA NLA NMA MDMA

Pendiddler

Show original

10.51K

74

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.