Lombard, one of the hottest Bitcoin liquid staking platforms right now, just launched $BARD. But the real question is whether Lombard’s LST model is actually sustainable.

The problem is that Babylon the protocol securing Lombard has seen its staking yields collapse, with APR now sitting at just 0.34%. At that level, there’s basically no incentive for new BTC liquidity to flow in.

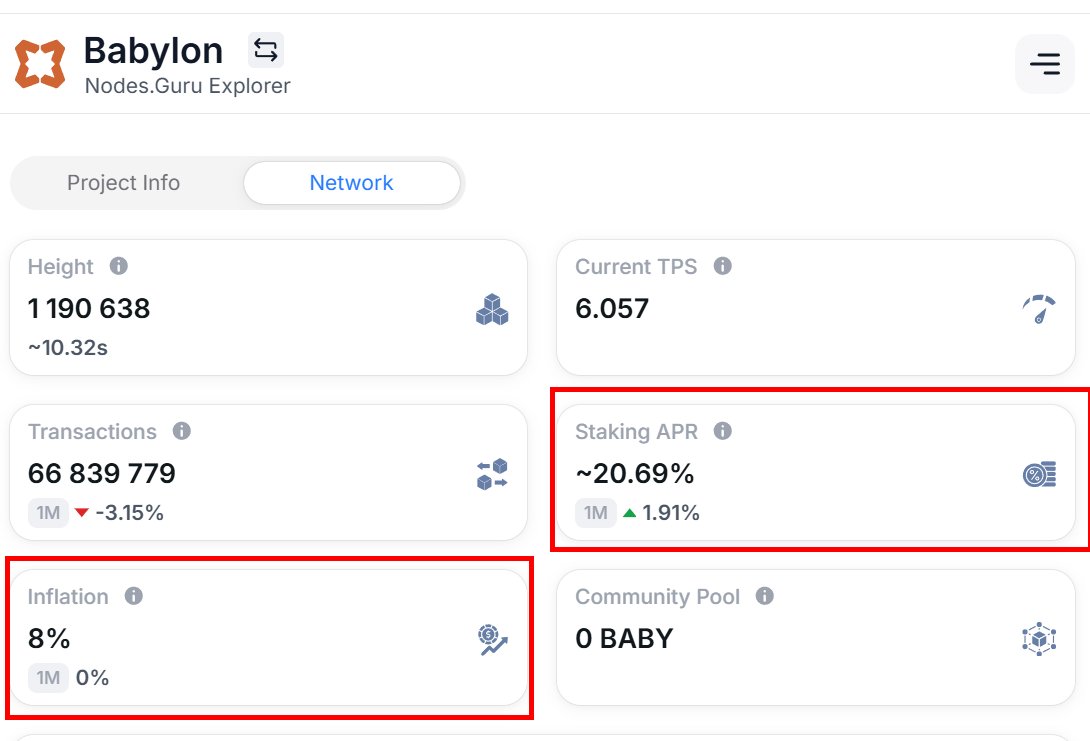

On top of that, $BABY Babylon’s native token has been tanking for multiple reasons. With an annual 8% inflation rate being distributed to both validators and stakers, the sell pressure is only accelerating the price decline. As a result, falling $BABY prices give BTC holders even less reason to take on staking risk, which will likely lead to declining TVL.

This also weakens validator rewards in real terms, making it harder to maintain network security. That, in turn, lowers the cost of potential attacks and increases systemic risk across the Babylon network.

And because Lombard’s LBTC-BTC peg ultimately depends on Babylon’s security, these risks spill over into Lombard itself and by extension, the entire DeFi ecosystem being built on top of it.

As things stand right now, Lombard’s LST ecosystem looks risky on multiple fronts.

Show original

10.76K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.