The hard road was from $0.20 to $1.

The easy road is from $1 to $5.

Time to full send $ENA above a dollar

- Fed rate cuts = higher funding rates

- Funding rates improving creates a loop of Ethena assets: people going to Aave and borrowing stables at 4/5% & supplying sUSDe and Ethena PT tokens at >10% APY

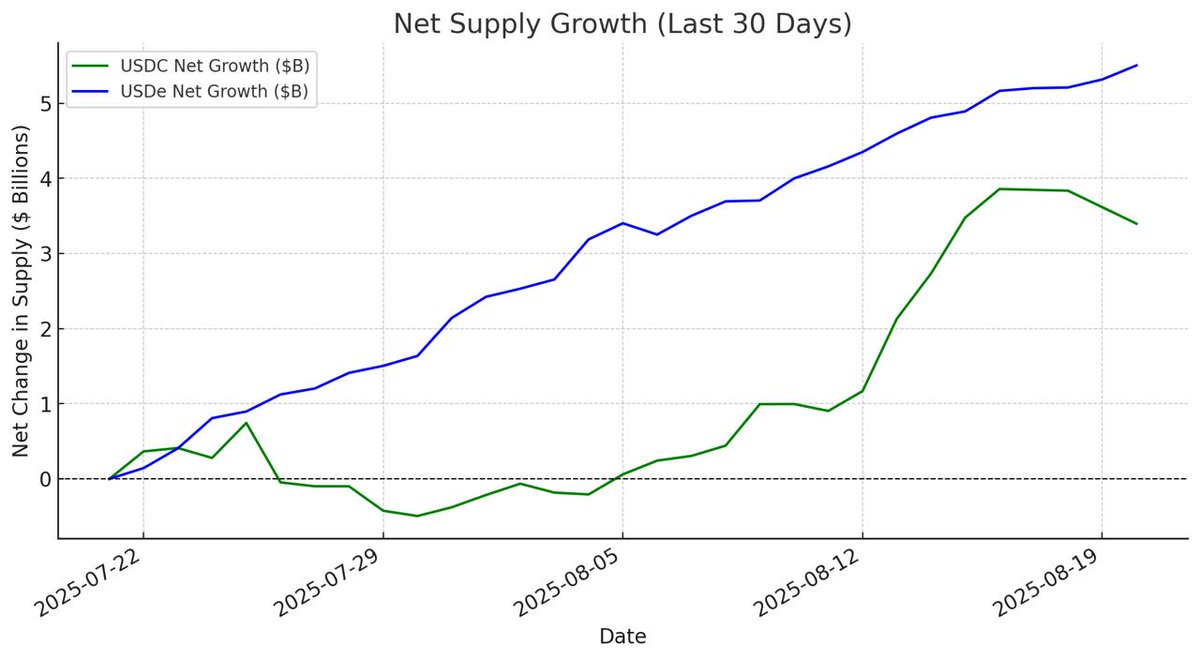

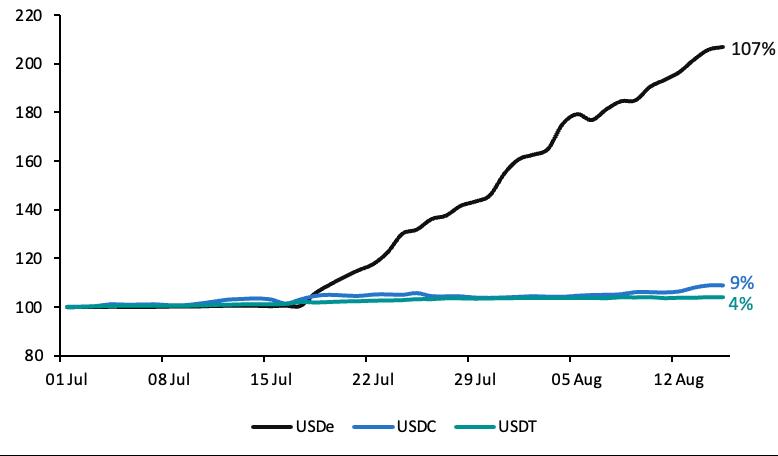

- This explains the growth of USDe TVL

- Circle revenue diminishing vs Ethena revenue

- USDe has been outperforming USDC by a major margin in terms of net supply growth. Especially these last 2 months.

Whether you like it or not, the 'yield' use case is outperforming the 'savings' use case of stablecoins in general. We have seen it with Luna (not executed properly) and now with $ENA.

We had a small correction after the big surge of $ENA price last month. I believe $ENA is one of the few assets worth bidding in the long run outside of the established coins like eth/sol.

Luna without a crash 러그없는 루나

28.64K

318

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.