Concerned about the low APY from your delta-neutral strategy on @HyperliquidX? @pendle_fi has you covered.

Let's discover the performance boost of Pendle-neutral compared to a standard delta-neutral strategy, leveraging Pendle's familiar features.

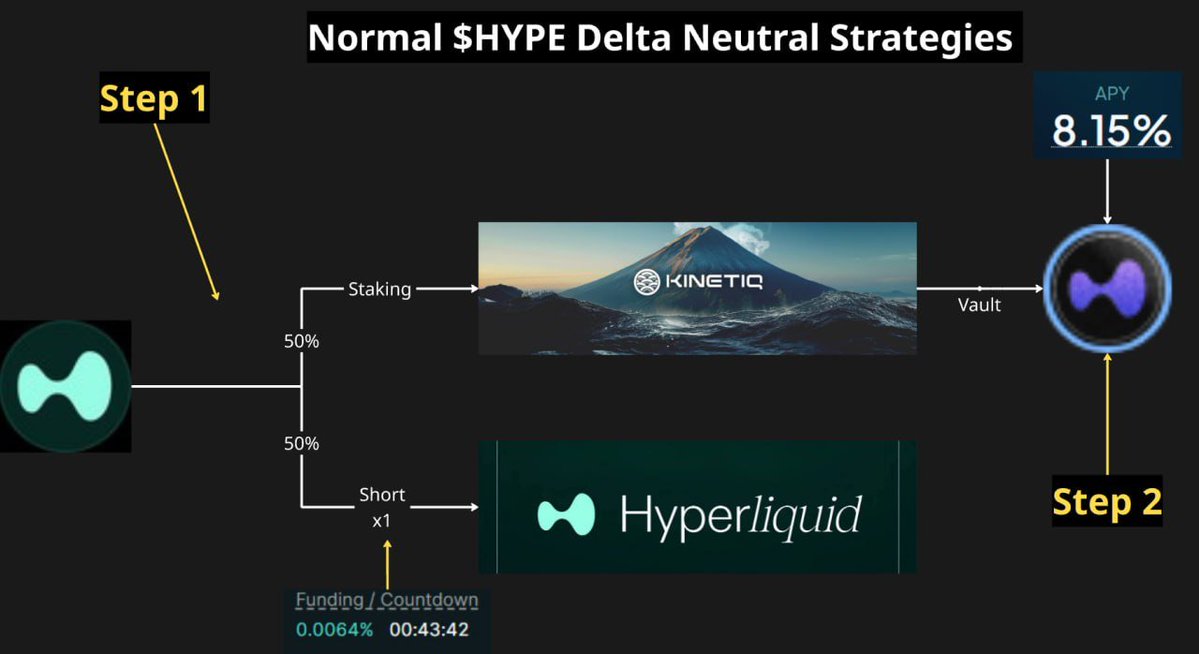

1⃣The standard delta-neutral approach is the classic method we are all familiar with, similar to how @ethena_labs operates with USDe.

Likewise, $HYPE's standard delta-neutral strategy enables you to earn:

🔹50% to Kinetiq Earn 8.15% APY, plus Kinetiq points

🔹50% shorting, yielding 56% APR from funding rate (~75% APY)

🔹Return: ~41.6%APY + points

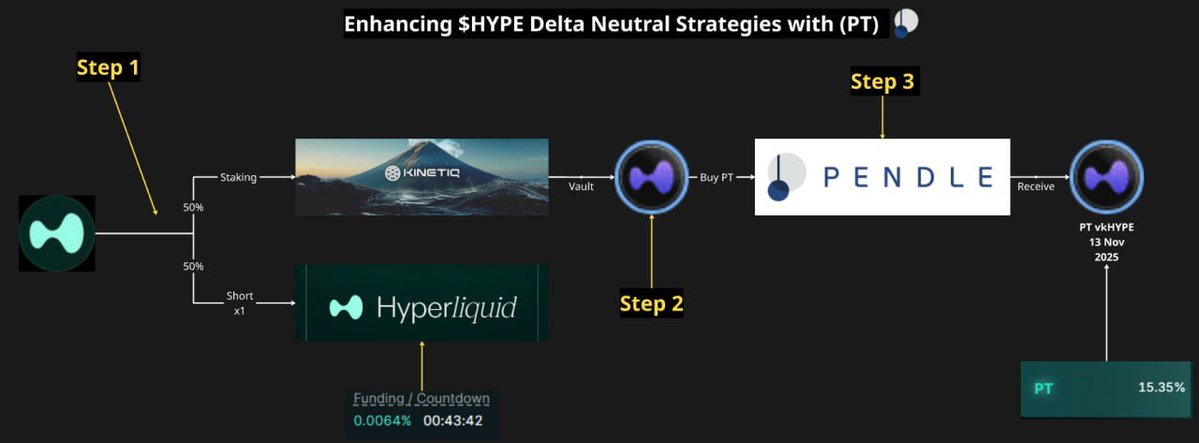

2⃣What if we tweak things a bit with Pendle and call it Pendle-neutral? As before, the breakdown would be:

🔹50% allocated for shorting, yielding ~75% APY

🔹50% allocated to PT-vkHYPE with a fixed APY of 15.35%

🔹Return: ~45.2% APY

This approach combines high-yield potential with strategic balance to achieve optimal returns.

3⃣While Pendle-neutral yields a higher return than standard Delta neutral, boosting APY by an additional 8.64%, it doesn't earn @kinetiq_xyz points.

Pendle-neutral with LP, however, achieves this. Specifically:

🔹50% shorting, yielding ~75% APY.

🔹50% LP-vkHYPE for 21.29% APY, plus Kinetiq point

🔹Return: 48.15% APY + point

Pendle not only enables users to trade yield but also allows integration with Pendle to customize strategies for optimized yield generation.

With Pendle, you can achieve an impressive 48.15% APY, surpassing standard Delta-neutral by 6.58%, while still earning points from Kinetiq.

However, there is another factor to consider. It's the fluctuation of the funding rate.

But once @boros_fi begins to expand its support for $HYPE, we could potentially increase the yield to triple digits by optimizing the yield from the funding rate.

Show original

2.71K

43

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.