Crypto Trends Chart Book: Understand What is Moving in the Market and Why

Signals That Move Markets

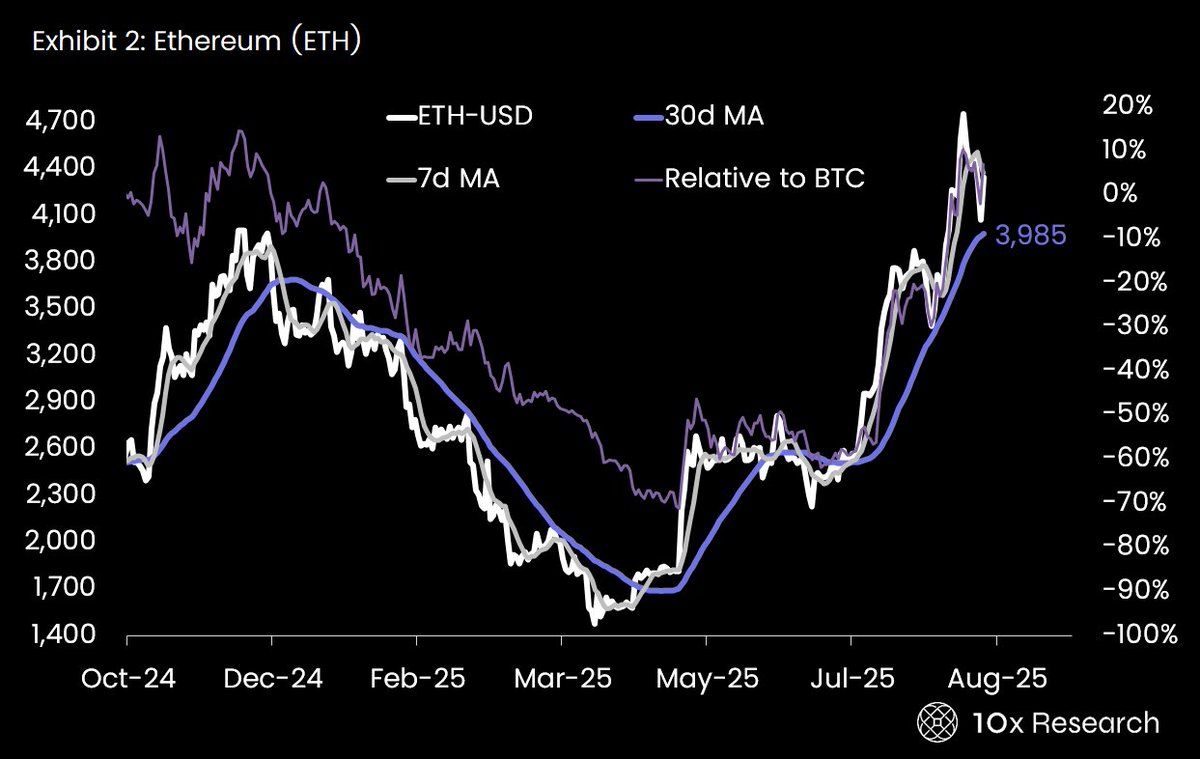

Bitcoin trades below its 30-day average, Ethereum above, while Solana and Ripple have broken lower.

Bitcoin has pulled back from record highs on profit-taking, macro concerns, and exchange inflows from short-term holders.

Ethereum faces selling pressure from unstaking and ETF outflows despite large institutional accumulation.

Solana dropped sharply on inflation data and heavy whale activity driving volatility.

Ripple rallied on SEC settlement optimism but faced profit-taking and cooling derivatives demand.

BNB Chain gained momentum on new wallet support, integrations, and growing institutional reserves.

Cardano surged on whale accumulation and rising futures activity boosting confidence.

Tron advanced on record earnings, a $1 billion buyback, and strong ecosystem growth.

Avalanche strengthened as SkyBridge planned $300 million in asset tokenization, driving on-chain demand.

Ton gained traction from institutional backing, new staking options, and growing utility.

Stellar rallied on its upcoming Protocol 23 upgrade and RWA tokenization partnerships.

Ethena cooled after profit-taking, with declining derivatives interest despite growing DeFi presence.

Jupiter weakened as 1inch launched rival Solana swaps, raising competition concerns.

Jito gained attention from a governance proposal and regulatory clarity on liquid staking.

Aptos benefited from a Bitso partnership but saw pressure from token unlocks.

Kaspa faced concerns over PoW vulnerabilities but optimism around its Caravel testnet.

Chainlink rose to a six-month high on an ICE partnership and growing secured value.

Polkadot declined on ecosystem funding worries but retained long-term optimism around JAM upgrade and ETF hopes.

Sign up for our email reports and read the full report here:

Show original

32.01K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.