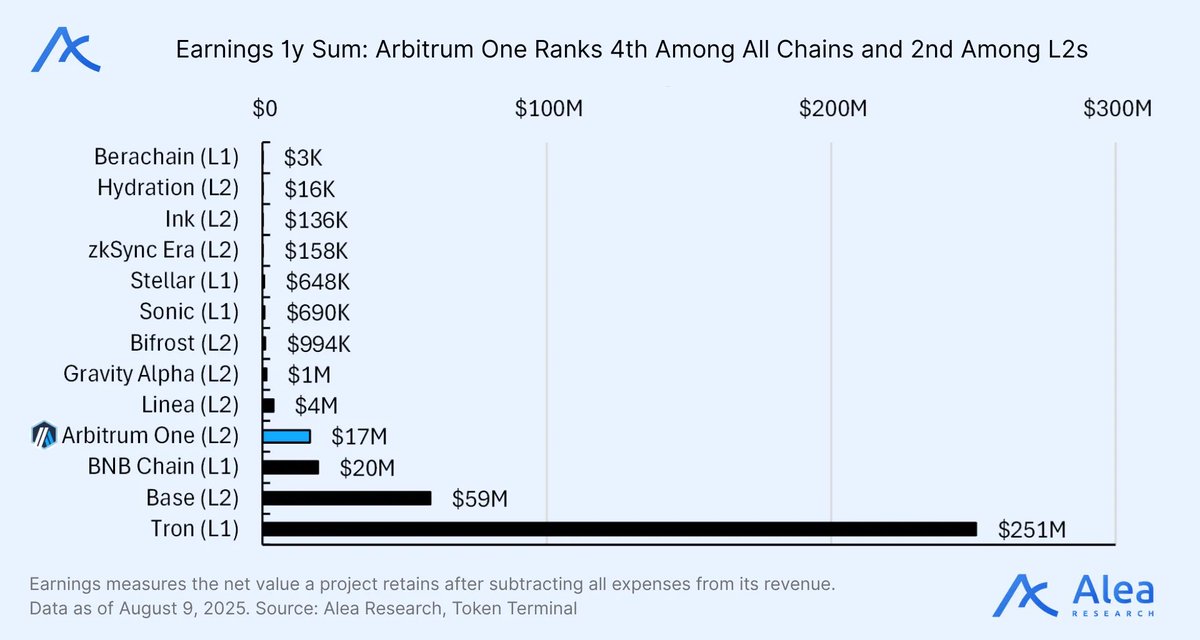

Profitability is rare in this space, only 14 chains consistently earn more than they spend. @arbitrum sits near the top of that list, ranking 4th overall and 2nd among L2s.

But what stands out isn’t just revenue.

It’s the flexibility of how that revenue gets used.

Instead of routing profits straight to holders, the DAO has kept them in the treasury funding incentives, grants, and strategic bets that strengthen the ecosystem long-term. In my view, that optionality is more valuable right now than a short-term burn.

At the same time, Arbitrum isn’t standing still, the stack is expanding in ways that go beyond just another L2 and while others sit passively on treasuries, the Arbitrum DAO is one of the few actively managing capital positioning itself to recycle yield back into the ecosystem.

That’s why I think @arbitrum remains underrated at this stage of the cycle.

Another angle:

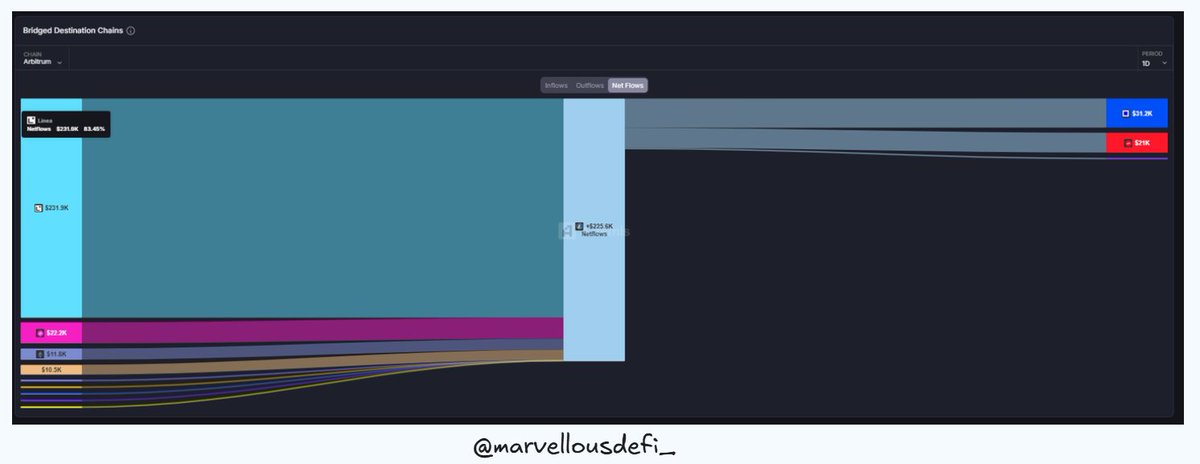

Most times, TVL efficiency could be tied into composability.

I think @arbitrum is seeing liquidity loop across LSTs, RWAs, and AI-finance sector seamlessly, and that interconnection is what makes the liquidity "sticky"

If you ask me, "liquidity depth + utility" in most cases are what separates ecosystems that attract mercenary flows vs ones that retain sticky builders.

More reason why I believe @arbitrum's trajectory at this point is super underrated.

The L2 is in top 10 chains by fees generated in the last 24hrs ($72k+) coupled with a net flow of $214.8k

S/F @artemis

8.38K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.