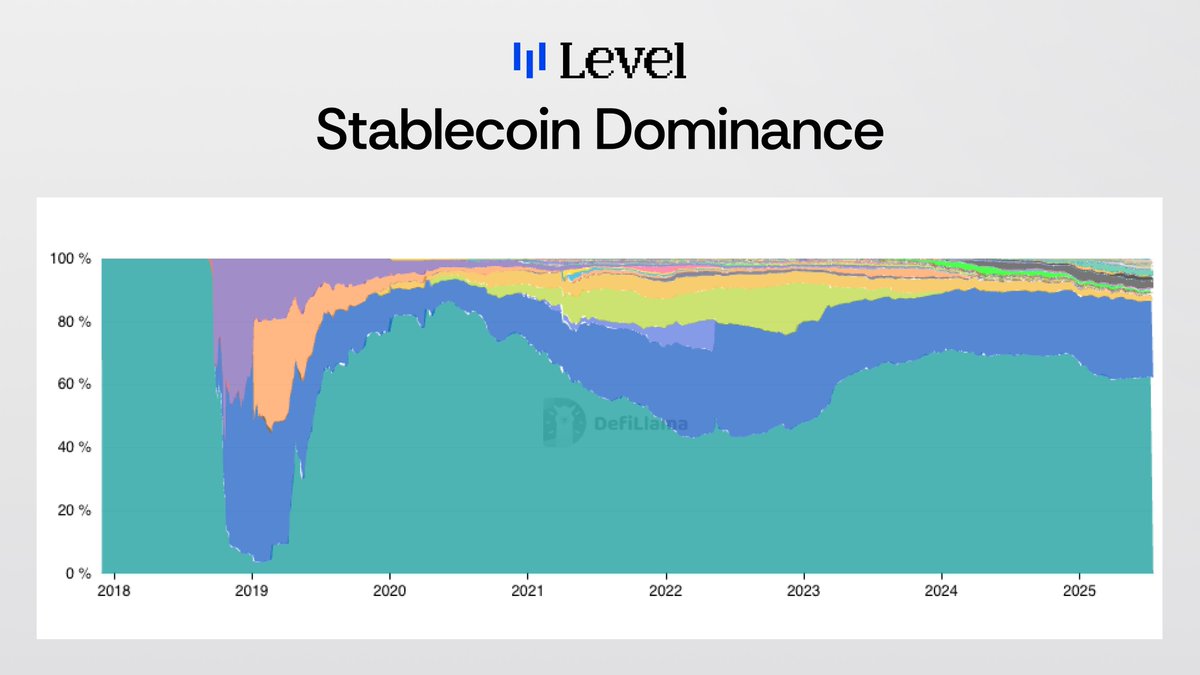

USDC is quietly taking share

Over the last twelve months, USDC from @circle has added roughly five percentage points of stablecoin market share.

That shift shows up both at the network level and inside money markets. Circulating supply has climbed from about 34B to around 68B.

On @aave, USDC supplied rose from roughly 1.5B to about 5.2B while borrow pricing stayed broadly stable near the mid-4 percent range, aside from the late-year stress spike.

In other words, more USDC is being used as productive collateral and credit fuel without a reset in baseline funding costs.

USDT from @Tether_to still dominates by absolute size and its Aave market has heated up this summer, with supply APR printing near 7% as utilization tightened.

Yet the share gains for USDC suggest a growing preference for assets that slot cleanly into compliance-heavy integrations, fiat on and off ramps, and institutional workflows.

Show original

3.97K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.