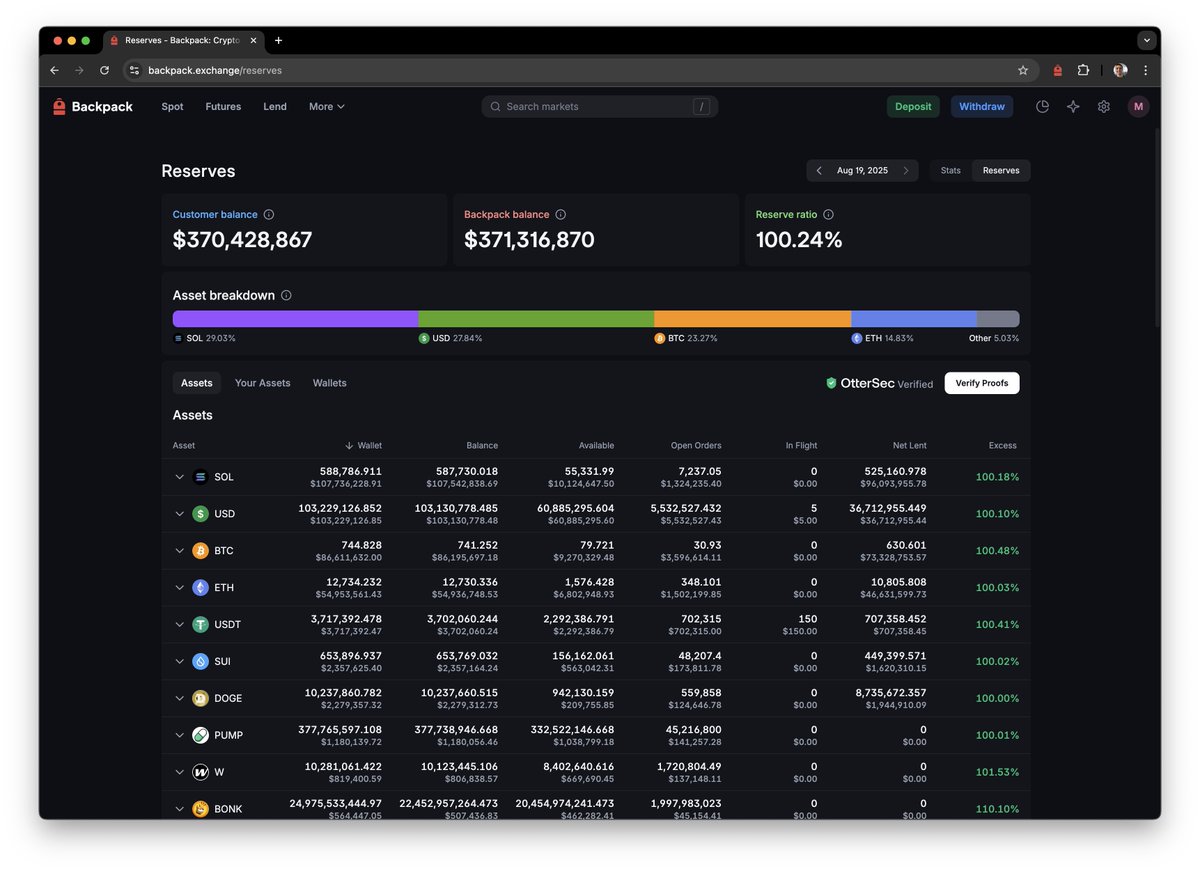

ICYMI, we have a full reserves transparency page where you can dive into our wallets, see the breakdown, and verify your own balances via an inclusion proof, published everyday.

Proof of Reserves

Today, we stand on the shoulders of the exchanges that came before us. Over a decade of pioneering. Over a decade of booms. Over a decade of busts. Over a decade of hard lessons learned. And if there's one lesson to learn, it's that the future of finance is onchain.

Today, we inch forward with our own contribution, committing to a daily proof of reserves, and we're not stopping there.

When we set out to build Backpack Exchange, we asked whether we wanted to build a CEX or a DEX, and we concluded, why not both? TradFi isn't going anywhere, and over time it'll evolve to become more and more like crypto. The centralized exchanges of the future will remain compliant--but they will be verifiable, distributed, and look and feel much like today's decentralized exchanges. In the end, it'll be hard to tell the difference. The CEX's will be compliant. The DEX's will be censorship resistant. Both will be onchain.

The next step for Backpack's ongoing journey to trust minimize: state integrity attestations.

(Honestly, I'm reluctant to even say this, because words and technical definitions have become so distorted this cycle as to almost become meaningless. Nevertheless, it's pretty interesting and gives insight into where we are and where we're going, so here we go.)

Few understand that Backpack is already onchain. The entire exchange ledger itself is built off a global linear log of authenticated transactions played over a deterministic state machine. Every order placement, every cancel, every liquidation, every deposit, every withdrawal--everything--is a signed transaction. Through one lens, classical state machine replication with some crypto on top. Through another lens, a permissioned blockchain of sorts.

Proof of reserves takes the large and critical step of anchoring our ledger to public chains, but how do you know that ledger was computed correctly? You need to not only see the code to ensure there's no foul play, but you also need to replay every transaction--as is done with today's blockchains--or encode that state transition function into a zero knowledge circuit--as is done with the bleeding edge of ZK VMs. In either case, the outcome is the same: verifiability of the ledger.

Today, Backpack is fully verifiable. Every state transition from the beginning of time up until now can be executed and matched against our publicly attested to ledger. Pair this ledger with a proof of reserves, and you have full end to end anchoring of a centralized exchange to a public blockchain. To start, we're committing to daily proofs, but in practice, we run our balance reconciliation in real time and generate the proofs every 10 minutes. To be honest, I expect some challenges with generating proofs too frequently due to some upcoming fiat-related regulatory requirements, so we'll stick with once a day for now. But as we get more and more comfortable with the system, we'll aim to bring proof times down from daily to, I hope, closer and closer to real time.

There's just one problem with all of this: we don't publish the code or the data publicly, and so although much of the hard technical work of achieving verifiability is done, in practice, it's still very much in the category of "trust me bro". (To be fair to ourselves, almost everything in crypto is still very much in the category of trust me bro, but we do our best to be sincere about our limitations.) In any case, this is the next critical step we must take to empower our proof of reserves with end to end guarantees over user balances on the platform.

Slowly but surely, we put one foot in front of the other.

This was an important step for us, but there are many, many--many--more areas to bring genuine trust minimization to every level of the centralized exchange stack. Custodians, margin risk management, self custody--all topics warranting their own deep dive, their own product, and their own announcement. There is much work to reimagine and rebuild the centralized exchange from the ground up, and, as corny and uncreative as it is to say. This is just the beginning.

🧱

---------------------

PS. Some interesting details:

- The proof covers all "physical" balances on the exchange. I like saying physical because it implies you can touch the coins--as opposed to synthetic concepts that can't be externally enforced by an L1 like open interest, unrealized pnl, or open borrows. In the nomenclature of Backpack's system, this means all funds in available balances (i.e. tokens sitting in your portfolio), open orders (i.e. tokens sitting in the order book), and unborrowed lends (i.e. tokens that have been lent but not borrowed) are encapsulated by the Proof of Reserves. These last two points are extremely subtle but extremely important, so I'll touch on them next.

- Surprisingly, some exchanges allow trading with a TradFi concept called "net settlement", where one can provide liquidity with more than the assets they have on the platform, e.g. because they're a trusted market participant staying neutral. On Backpack, all balances in the order book are physical. I.e. they map directly to balances sitting in our wallets on chain, and because the balances in the order book are physical, it ensures the liquidity you see is always real and anchored by the public chain via the PoR. (There are also other interesting ways to test whether liquidity is real, e.g., build a taker bot and check your fill rate. Such an experiment has frequently been used by crypto HFTs to test the integrity of various exchange order books over the years.)

- In Backpack or any borrow-lend system for that matter, one could deposit USD and use that as collateral to borrow and withdraw BTC. This creates a legitimate hole in the system where that hole is fully and over 100% collateralized by the assets backing the borrow. Nevertheless it is a hole. The lent asset is *correctly* no longer sitting in the wallet if the borrower withdraws. As a result, a comprehensive analysis of reserves ought to be paired with a robust margin risk analysis. One must answer the question: does the collateral hold up and can it be liquidated in a worst case market movement? Naturally, risk management is just as important as custody, but that's a conversation for another day.

- Because Perpetual Futures on Backpack realize PnL in real time, marking to market positions and exchanging physical cash between all winners and losers continuously, it means that all open PnL in positions is accounted for in the proof of reserves, a nice win that falls out of our risk engine design for free.

- Ironically, fiat sitting in banks, which the rest of the non-crypto native world views as more secure, throws a wrench into Proof of Reserves. As implied above, there are some regulatory requirements in some parts of the world where stablecoins aren't allowed. In these regions, we'll be forced to use good old cash in the bank. However, our system knows nothing other than tokens. To address this, we'll need to mint a "deposit token" (like a stablecoin but representing bank deposits). Currently, we use 100% stable coins, but I suspect deposit tokens will become more of a thing over time, as we recently saw JP Morgan team up with Coinbase to pioneer this concept.

- If you haven't already, see our Proof of Reserves page. We host one ourselves where you can download and run all the proofs. Both in aggregate across the entire exchange and also inclusion proofs for your specific account. A second page with the same data and proofs is externally hosted and validated by Ottsersec (see the quoted tweet for details and links).

- For completeness, I should mention all the ZK proof code is public for the world to see, clone, and run oneself.

-----------------------

PS. If you think any of this is interesting, we're hiring. DMs are open.

45.54K

191

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.