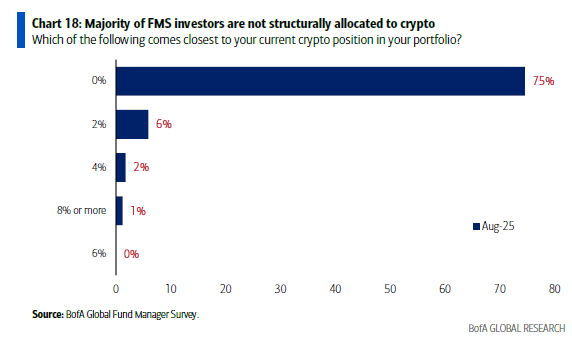

75% of fund managers hold zero crypto; avg fund manager crypto allocation = 0.3%

inevitably all fund managers will want $link exposure, still have opportunity to front-run them

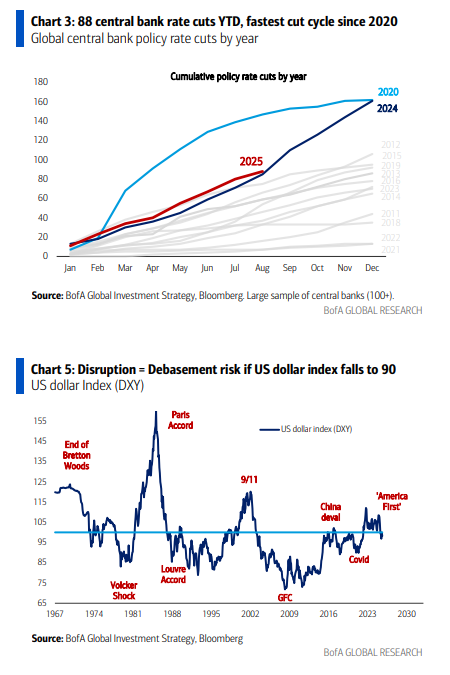

BoA's Hartnett says to sell the $USD and buy "gold, crypto and EM...in second half of 2020s":

88 central bank rate cuts YTD, fastest cut cycle since ‘20 (Chart 3); stocks/credit anticipate Fed joining party; but new debates on Fed independence, higher Fed inflation target, sectoral price controls, gold revaluation, YCC mean “disruption = debasement”, policy disruption to drive US$ bear (DXY below 90 – Chart 5), in turn driving higher allocations to gold, crypto, EM higher in second half of 2020s.

9.47K

96

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.