$HYPE: Ecosystem Expansion Defies Market Slowdown

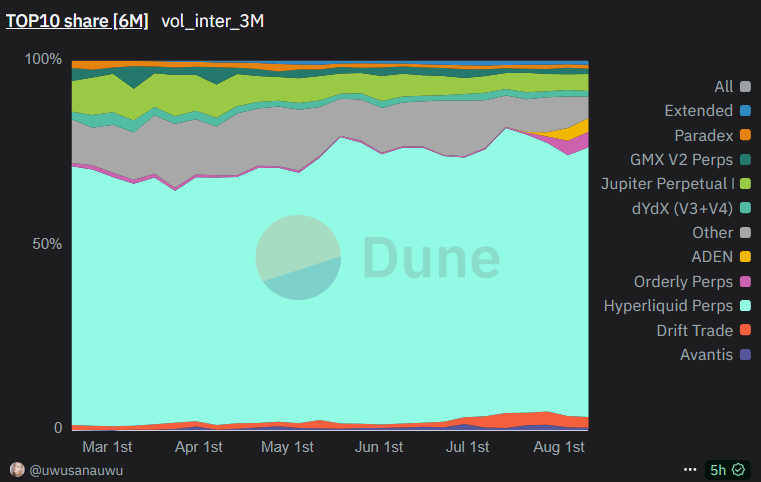

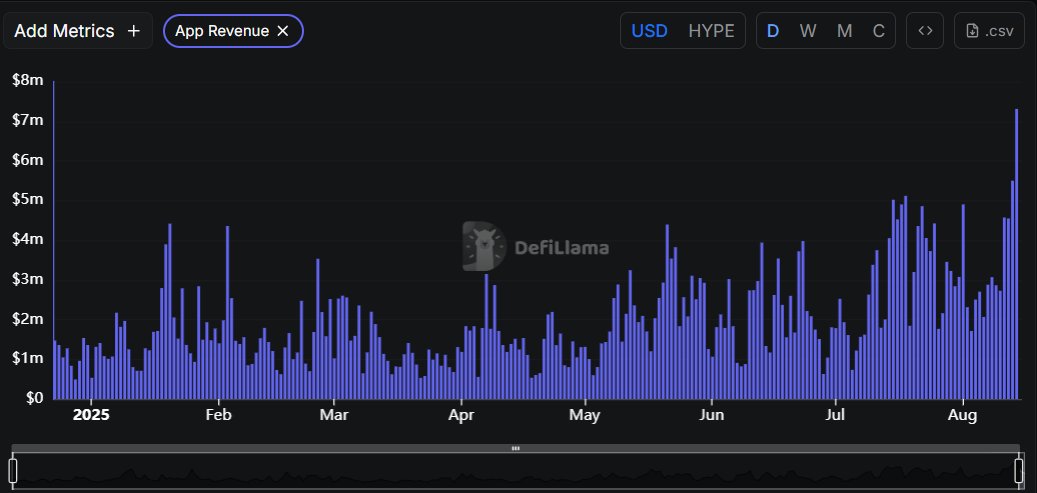

- Trading near ATHs with FDV $46.7B, +73% in 90D; 30d fees ~$94.5M → ~$1.15B annualized; FDV/fee multiple ~40.6×. Perps dominate 63-77% of DeFi volumes over the period. Hits ATHs: $29B in 24H volume, $7.7M 24H fees.

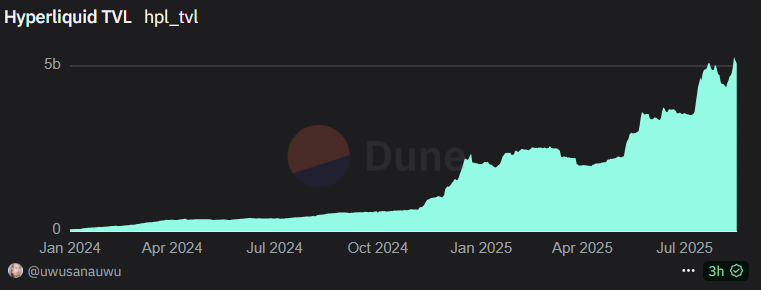

- TVL up +80% in 3M from $2.9B → $5.3B; @kinetiq_xyz #1 on HyperEVM at $1.37B TVL, @pendle_fi #3 >$500M, @MorphoLabs #5 $425M.

- kinetiq leads liquid staking, connecting native HYPE staking on HyperCore with DeFi composability. HIP3 exotic perps infrastructure requires $48.5M staked per market; Kinetiq to enable builders to rent stake, lowering capital barriers.

- @Anchorage adds institutional custody for HYPE; @circle to launch native USDC + CCTP V2 on Hyperliquid, enabling regulated stablecoin on/offramps and crosschain liquidity.

- Forward: HIP3 pricing model, Pendle pool expansions, Circle on/offramps, and EaaS rollout underpin next leg of growth.

@HyperliquidX x @chameleon_jeff

Show original

11.28K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.