The two scenarios I envision for $ETH

1. Bullish Scenario

- The inflow from ETFs continues to be steady.

- The aggressive accumulation of Ethereum by Bitmain and Sharplink is also ongoing.

- The current price level is likely to have very thin sell walls (for KRW, it's only new entrants, and in USD, it's well above the peak after Trump's election in 2024).

- There are still more than a day left in the Nasdaq trading days. This means there is still capital to be procured through the ATMs of SERs, which translates to purchasing power for Ethereum.

2. Bearish Scenario

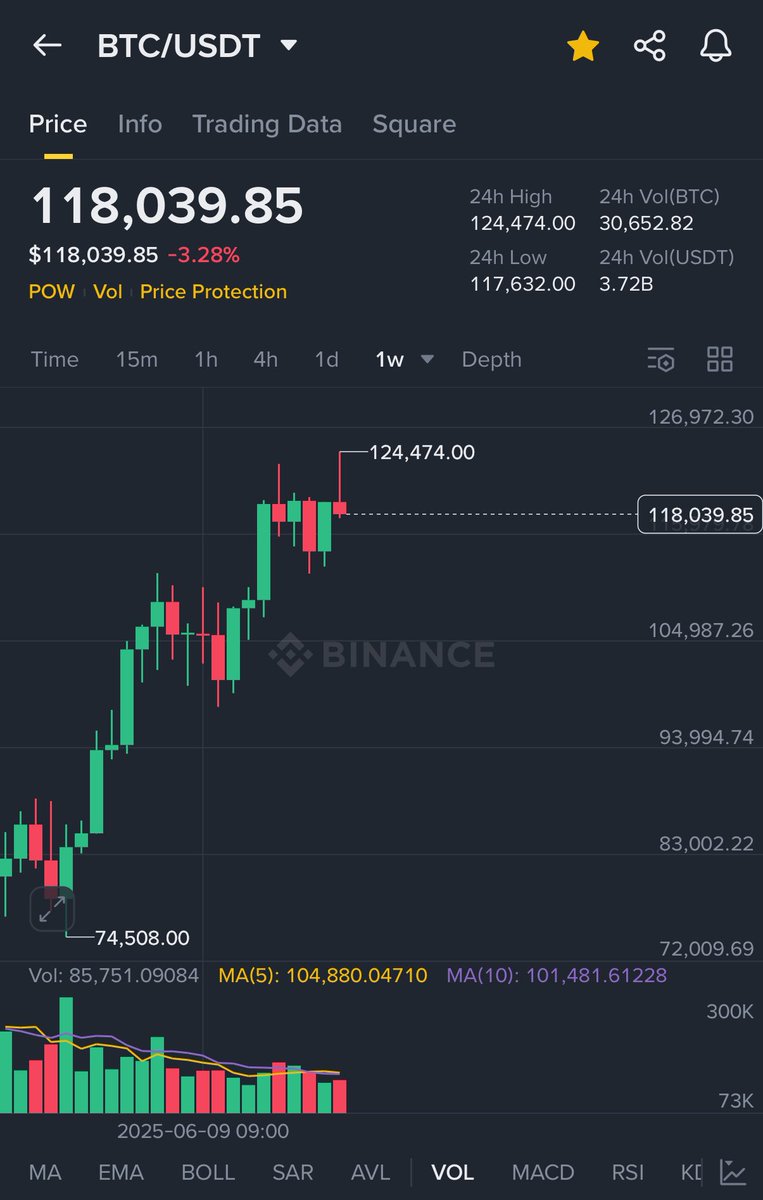

- Both Bitcoin and Ethereum have their weekly high this week ending in .00. Trusting in the weekly integer theory, if the weekly close (Monday at 9 AM) ends up like this, the possibility of a correction next week is very high.

- On 7/28, a new weekly high of 3941.00 was set, and the data shows a drop of about -15% over the next six days until Sunday.

- After the Ethereum staking exit queue hit an all-time high on 7/26, the market correction began on 7/28, and it has returned to that level (same signal).

I believe both scenarios are possible. Therefore, I think the conclusion is to wait for the weekly close and then make a judgment. In past corrections, the rebounds starting from Monday may have been due to the buying pressure from SER as the Nasdaq opened. So, while a rebound is possible at any time now with aggressive ATM funding, if we cannot surpass the peak before the weekly close, I think a correction next week is inevitable.

And right now, it's Ethereum season. Even when Bitcoin was rising, I suggest not to invest in beta but just invest in alpha.

In the case of Bitcoin, there is little ETF inflow and MSTR / Metaplanet is not making aggressive purchases, but for Ethereum, I believe there is still a huge buying pressure due to the enormous ETF inflow every day, the cash accumulated by Sharplink, and the cash generated by Bitmain's $20B super ATM project.

So, depending on how many SER stocks are traded during the Nasdaq opening hours today/tomorrow, I think the rise of Ethereum is at stake, and I believe it is possible to update the peak since there are not enough sell orders.

However, currently, both Bitcoin and Ethereum have their weekly peak at an integer level. Therefore, according to the weekly integer theory, if the peak is not updated by 9 AM next Monday, I think it is right to reduce the risk unconditionally. Looking at how Ethereum dropped to the $3300 range from $3941.00.

In summary, while Bitcoin may not, there is a possibility that Ethereum will update its peak within this week, but if the weekly peak is not updated by 9 AM next Monday, reduce the risk unconditionally.

3.36K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.