Many DeFi projects have TVL (total value locked) in ETH.

So when the price of ETH rises -> TVL increases, but it doesn't necessarily mean the amount of ETH being staked increases and the project operates more effectively.

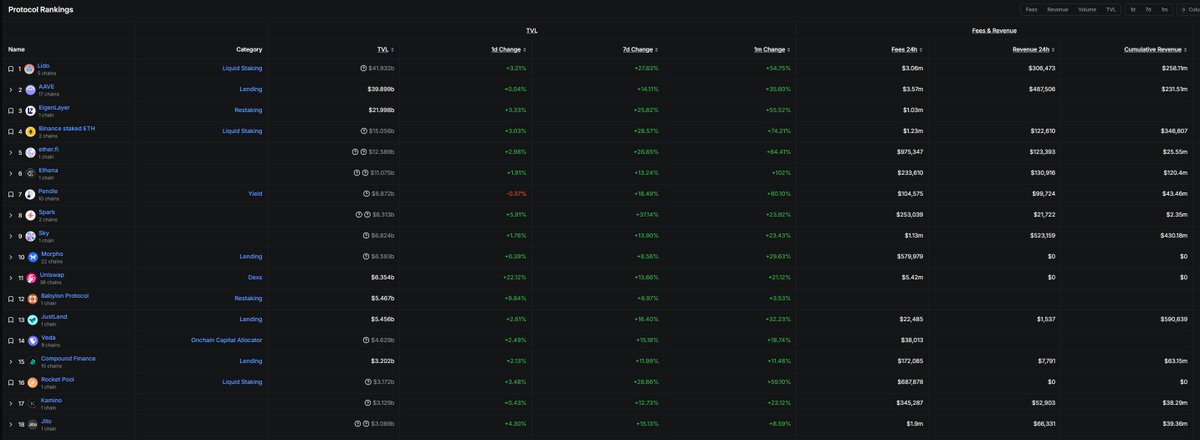

You should also consider the 24h Fee (transaction fee) and Revenue.

The prices of tokens like $LDO, $AAVE, $ENA, $EIGEN, $PEPE... may continue to rise due to the following reasons:

+ First is the cash flow; after ETH rises sharply, investors may look for asset layers below Layer2, Staking, Restaking, Lending....

-> to hunt within the ETH ecosystem, just play with the leading trends.

+ Another important factor is that these are all projects that have raised a lot of funds and have stable revenue. In short, if there is money and waves, then push, ride the "rain."

Show original

83.61K

54

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.