After reviewing the operations of this main upward wave since 2023, one regret is that the allocation of mainstream coins $BTC $ETH $SOL $BNB in my asset portfolio is too small.

This bull market is essentially a bull market for mainstream coins, with major mainstream coins taking turns to reach new highs, while altcoins have become more like derivatives of mainstream coins. For example, through Pendle YT, various DeFi, mining, and yield farming operations allow you to leverage your ETH and USDT to earn $ENA $SPARK and other altcoins. Of course, experienced on-chain players can also exchange their SOL, BNB, and ETH for various early potential meme coins waiting for appreciation.

Moreover, mainstream coins have a significant advantage as they can be used as collateral to borrow USDT, and the collateral ratio is quite high. This way, during the bull market, you can benefit from the price increase of B E S while still using USDT for various transactions and mining.

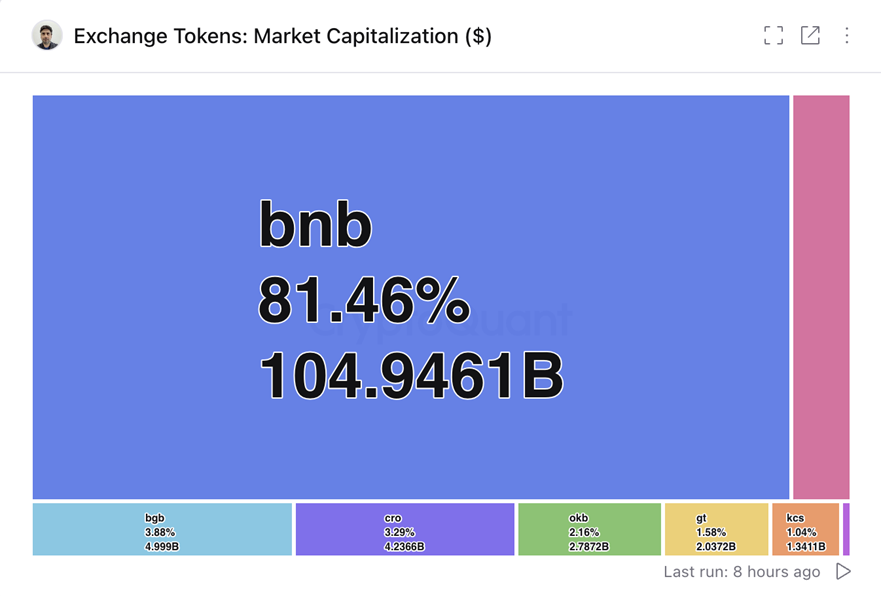

Here, I would like to particularly recommend $BNB. After looking at the platform tokens of various exchanges, I found that the most stable one is still $BNB.

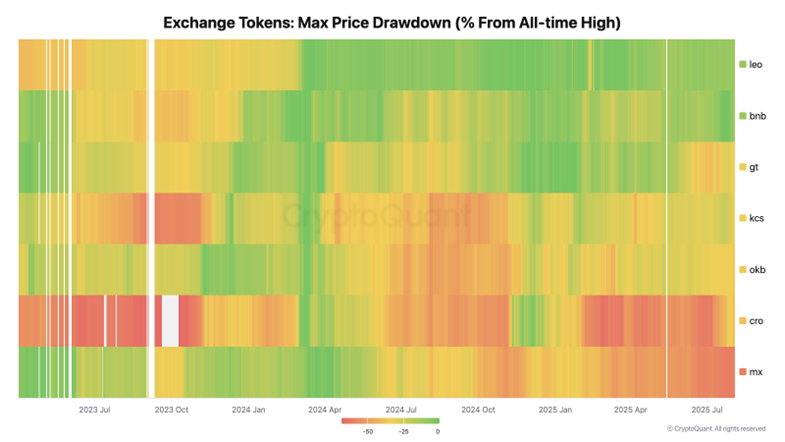

It holds an 81.46% market share among all platform tokens, meaning that the total of all others combined is still not enough to match $BNB. Moreover, compared to other platform tokens, $BNB is not just an exchange token; it can also be used on the BNB chain for various projects and participate in various DeFi activities. For instance, this year's investment project $SKYAI was subscribed through $BNB. Additionally, while other platform tokens often see a 10-20% pullback, $BNB's pullback is quite small, only 6% after reaching a new high.

In the next bear market, I plan to buy 500-1000 $BNB as a bull market asset package to hold. First, it allows me to upgrade to VIP status and reduce transaction fees; second, it can be used to participate in various pools and hodler financial products; third, it can be used for various on-chain operations.

Show original

99.67K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.