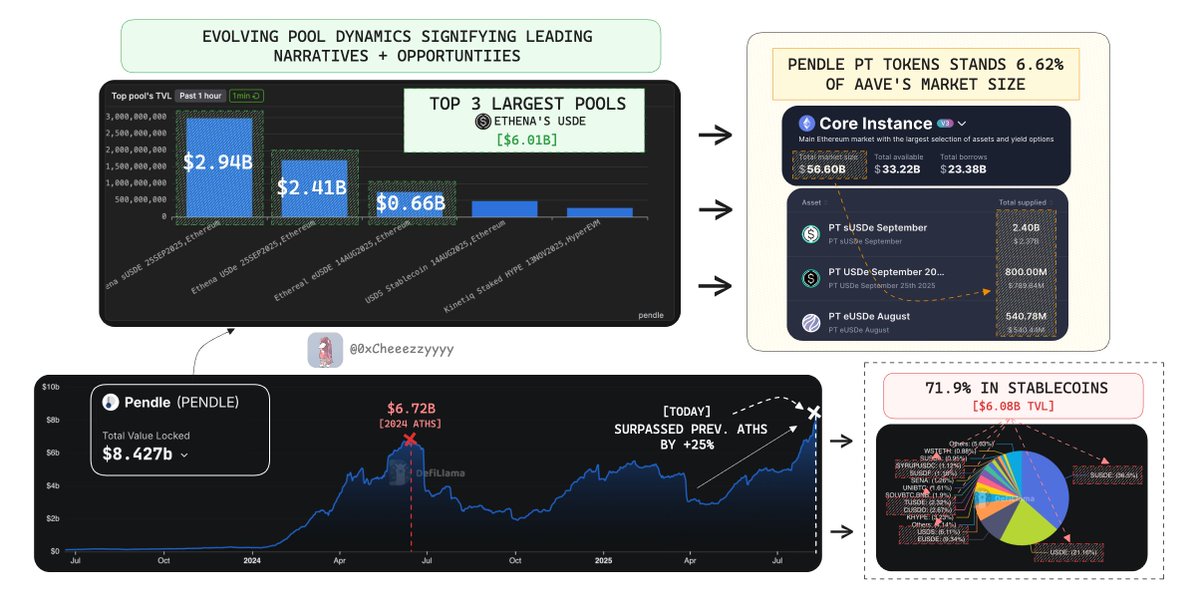

.@pendle_fi TVL has soared to a new ATH of $8.42B, up 25% from its previous $6.72B record.

This isn’t your typical 'price pump → TVL up' phenomenon; it's fundamentally driven by solid stablecoin inflows.

If you look closely:

🔸71.9% TVL ($6.08B) sits in the largest stablecoins

🔸Among the top 3 pools, it's @ethena_labs's $USDe which drives $6.01B here (~60% of USDe supply)

That's huge as it reflects the exceptional significance Pendle plays in one of the fastest-growing DeFi segments: Yield-bearing Stablecoins (YBS)

The value proposition of 'tokenizing yields' doesn't stop here.

The open composability it offers is equally insane: ~$3.74B worth of PTs are collateralized on @aave which makes ~6.62% of Aave’s market size

And this is cap limited by the way.

Demand is so strong that caps fill almost instantly & it's only a matter of time once risk assessment expands them, expect another leg up.

Not gonna lie, it doesn't get more promising than this.

Pendle

h/t @DefiLlama @sentioxyz for the data insights

Show original

16.88K

102

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.